A monopoly, as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterised by a lack of economic competition to produce the good or service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb monopolise or monopolize refers to the process by which a company gains the ability to raise prices or exclude competitors. In economics, a monopoly is a single seller. In law, a monopoly is a business entity that has significant market power, that is, the power to charge overly high prices, which is associated with a decrease in social surplus. Although monopolies may be big businesses, size is not a characteristic of a monopoly. A small business may still have the power to raise prices in a small industry.

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In theoretical models where conditions of perfect competition hold, it has been demonstrated that a market will reach an equilibrium in which the quantity supplied for every product or service, including labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum.

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit. In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a "rational agent" which wants to maximize its total profit, which is the difference between its total revenue and its total cost.

The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. The WACC is commonly referred to as the firm's cost of capital. Importantly, it is dictated by the external market and not by management. The WACC represents the minimum return that a company must earn on an existing asset base to satisfy its creditors, owners, and other providers of capital, or they will invest elsewhere.

An expense is an item requiring an outflow of money, or any form of fortune in general, to another person or group as payment for an item, service, or other category of costs. For a tenant, rent is an expense. For students or parents, tuition is an expense. Buying food, clothing, furniture, or an automobile is often referred to as an expense. An expense is a cost that is "paid" or "remitted", usually in exchange for something of value. Something that seems to cost a great deal is "expensive". Something that seems to cost little is "inexpensive". "Expenses of the table" are expenses for dining, refreshments, a feast, etc.

The break-even point (BEP) in economics, business—and specifically cost accounting—is the point at which total cost and total revenue are equal, i.e. "even". There is no net loss or gain, and one has "broken even", though opportunity costs have been paid and capital has received the risk-adjusted, expected return. In short, all costs that must be paid are paid, and there is neither profit nor loss. The break-even analysis was developed by Karl Bücher and Johann Friedrich Schär.

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is increased, i.e. the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced.

In economics and finance, the profit rate is the relative profitability of an investment project, a capitalist enterprise or a whole capitalist economy. It is similar to the concept of rate of return on investment.

Throughput accounting (TA) is a principle-based and simplified management accounting approach that provides managers with decision support information for enterprise profitability improvement. TA is relatively new in management accounting. It is an approach that identifies factors that limit an organization from reaching its goal, and then focuses on simple measures that drive behavior in key areas towards reaching organizational goals. TA was proposed by Eliyahu M. Goldratt as an alternative to traditional cost accounting. As such, Throughput Accounting is neither cost accounting nor costing because it is cash focused and does not allocate all costs to products and services sold or provided by an enterprise. Considering the laws of variation, only costs that vary totally with units of output e.g. raw materials, are allocated to products and services which are deducted from sales to determine Throughput. Throughput Accounting is a management accounting technique used as the performance measure in the Theory of Constraints (TOC). It is the business intelligence used for maximizing profits, however, unlike cost accounting that primarily focuses on 'cutting costs' and reducing expenses to make a profit, Throughput Accounting primarily focuses on generating more throughput. Conceptually, Throughput Accounting seeks to increase the speed or rate at which throughput is generated by products and services with respect to an organization's constraint, whether the constraint is internal or external to the organization. Throughput Accounting is the only management accounting methodology that considers constraints as factors limiting the performance of organizations.

Project accounting is a type of managerial accounting oriented toward the goals of project management and delivery. It involves tracking, reporting, and analyzing financial results and implications, and sometimes the creation of financial reports designed to track the financial progress of projects; the information generated by this analysis is used to aid project management.

A cost centre is a department within a business to which costs can be allocated. The term includes departments which do not produce directly but they incur costs to the business, when the manager and employees of the cost centre are not accountable for the profitability and investment decisions of the business but they are responsible for some of its costs.

In finance, leverage, also known as gearing, is any technique involving borrowing funds to buy an investment.

Contribution margin (CM), or dollar contribution per unit, is the selling price per unit minus the variable cost per unit. "Contribution" represents the portion of sales revenue that is not consumed by variable costs and so contributes to the coverage of fixed costs. This concept is one of the key building blocks of break-even analysis.

A profit center is a part of a business which is expected to make an identifiable contribution to the organization's profits.

In economics, profit is the difference between revenue that an economic entity has received from its outputs and total costs of its inputs, also known as surplus value. It is equal to total revenue minus total cost, including both explicit and implicit costs.

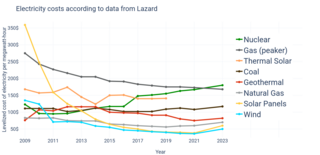

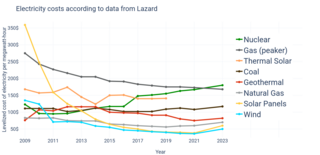

The levelized cost of electricity (LCOE) is a measure of the average net present cost of electricity generation for a generator over its lifetime. It is used for investment planning and to compare different methods of electricity generation on a consistent basis.

A responsibility center is an organizational unit headed by a manager, who is responsible for its activities and results. In responsibility accounting, revenues and cost information are collected and reported on by responsibility centers.

In business, a revenue center is a division that gains revenue from product sales or service provided. The manager in a revenue center is accountable for revenue only.

Utility ratemaking is the formal regulatory process in the United States by which public utilities set the prices they will charge consumers. Ratemaking, typically carried out through "rate cases" before a public utilities commission, serves as one of the primary instruments of government regulation of public utilities.