Balance of trade can be measured in terms of commercial balance, or net exports. Balance of trade is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balance of trade for goods versus one for services. The balance of trade measures a flow variable of exports and imports over a given period of time. The notion of the balance of trade does not mean that exports and imports are "in balance" with each other.

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro.

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic action that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government revenues and spending. For a government that uses accrual accounting the budget balance is calculated using only spending on current operations, with expenditure on new capital assets excluded. A positive balance is called a government budget surplus, and a negative balance is a government budget deficit. A government budget presents the government's proposed revenues and spending for a financial year.

In international economics, the balance of payments of a country is the difference between all money flowing into the country in a particular period of time and the outflow of money to the rest of the world. In other words, it is economic transactions between countries during a period of time. These financial transactions are made by individuals, firms and government bodies to compare receipts and payments arising out of trade of goods and services.

In macroeconomics and international finance, a country's current account records the value of exports and imports of both goods and services and international transfers of capital. It is one of the two components of the balance of payments, the other being the capital account. Current account measures the nation's earnings and spendings abroad and it consists of the balance of trade, net primary income or factor income and net unilateral transfers, that have taken place over a given period of time. The current account balance is one of two major measures of a country's foreign trade. A current account surplus indicates that the value of a country's net foreign assets grew over the period in question, and a current account deficit indicates that it shrank. Both government and private payments are included in the calculation. It is called the current account because goods and services are generally consumed in the current period.

The Bretton Woods system of monetary management established the rules for commercial relations among the United States, Canada, Western European countries, and Australia as well as 44 other countries after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold. It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits.

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national currency in relation to a foreign reference currency or currency basket. The opposite of devaluation, a change in the exchange rate making the domestic currency more expensive, is called a revaluation. A monetary authority maintains a fixed value of its currency by being ready to buy or sell foreign currency with the domestic currency at a stated rate; a devaluation is an indication that the monetary authority will buy and sell foreign currency at a lower rate.

Foreign exchange reserves are cash and other reserve assets such as gold and silver held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and to maintain confidence in financial markets. Reserves are held in one or more reserve currencies, nowadays mostly the United States dollar and to a lesser extent the euro.

The Marshall–Lerner condition is satisfied if the absolute sum of a country's export and import demand elasticities is greater than one. If it is satisfied, then if a country begins with a zero trade deficit then when the country's currency depreciates, its balance of trade will improve. The country's imports become more expensive and exports become cheaper due to the change in relative prices, and the Marshall-Lerner condition implies that the indirect effect on the quantity of trade will exceed the direct effect of the country having to pay a higher price for its imports and receive a lower price for its exports.

The Mundell–Fleming model, also known as the IS-LM-BoP model, is an economic model first set forth (independently) by Robert Mundell and Marcus Fleming. The model is an extension of the IS–LM model. Whereas the traditional IS-LM model deals with economy under autarky, the Mundell–Fleming model describes a small open economy.

Foreign trade of Argentina includes economic activities both within and outside Argentina especially with regards to merchandise exports and imports, as well as trade in services.

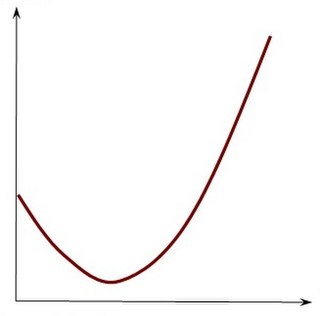

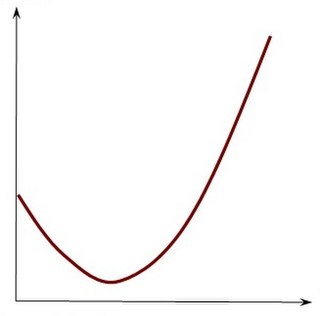

A J curve is any of a variety of J-shaped diagrams where a curve initially falls, then steeply rises above the starting point.

In its balance of payments accounts, Japan has traditionally run a deficit in services. Trade in services includes transportation, insurance, travel expenditures, royalties, licensing fees, and income from investments. The deficit in services rose steadily from US$99 million in 1960, to nearly US$1.8 billion in 1970 and to more than US$11.3 billion in 1980 which can be attributed to rising royalty and licensing payments for Japan's acquisition of technology from other industrial countries and to rising deficits in the trade-related services of transportation and insurance. The transportation deficit rose after the 1960s, as rapidly climbing labor costs made Japanese-flag vessels less competitive, leading to greater use of foreign-flag carriers.

The visible trade balance is that part of the balance of trade figures that refers to international trade in physical goods, but not trade in services; it thus contrasts with the invisible balance.

The 1991 Indian economic crisis was an economic crisis in India resulting from a balance of payments deficit due to excess reliance on imports and other external factors. India's economic problems started worsening in 1985 as imports swelled, leaving the country in a twin deficit: the Indian trade balance was in deficit at a time when the government was running on a huge fiscal deficit.

Foreign trade of the United States comprises the international imports and exports of the United States. The country is among the top three global importers and exporters.

In macroeconomics, sterilization is action taken by a country's central bank to counter the effects on the money supply caused by a balance of payments surplus or deficit. This can involve open market operations undertaken by the central bank whose aim is to neutralize the impact of associated foreign exchange operations. The opposite is unsterilized intervention, where monetary authorities have not insulated their country's domestic money supply and internal balance against foreign exchange intervention.

Sudan's exports in 2008 amounted to US$12.4 billion, and its imports totaled US$8.9 billion. Agricultural products dominated Sudanese exports until Sudan began to export petroleum and petroleum products. By 2000 the value of petroleum-based products surpassed the total of all other exports combined. By 2008, they had reached US$11.6 billion and have accounted for 80 to 94 percent of all export revenue since 2000, the result of expanded oil production, as well as higher oil prices. Because oil provides such a large proportion of export earnings, Sudan is now vulnerable to the volatility of the international price of oil.

Since becoming an independent country, Ivory Coast has transitioned from an economy dominated by agriculture—coffee and cocoa in particular—to a diversified economy with a large service sector. From 1960 to 1976, government policy focused on investing revenues from agricultural export into infrastructure. From 1976 to 1980, factors such as a boom-bust in coffee and cocoa prices, over-investment funded by foreign debt, and a devaluation of the US Dollar led Ivory Coast to the brink of financial crisis. Decreased revenues from coffee and cocoa exports continued into the 80's and early 90's, increasing the burden of foreign debt and eventually requiring lender negotiation. This resulted in the privatization of many state-owned enterprises with mixed levels of success. In 1994, the economy began a comeback due to devaluation of the CFA franc, increased export revenues, financial reforms, and debt rescheduling. Since then the economy has been impacted by and rebounded from political crises such as the 1999 coup d'état and the 2011 election crisis.