The Commissioner of Internal Revenue is the head of the Internal Revenue Service (IRS), an agency within the United States Department of the Treasury.

Lynda Paige Marvel is an American lawyer who serves as a senior judge of the United States Tax Court.

Villanova University's Charles Widger School of Law is the law school of Villanova University, a private Roman Catholic research university in Villanova, Pennsylvania. It was opened in 1953 and is approved by the American Bar Association (ABA) and a member of the Association of American Law Schools (AALS). Approximately 720 students study full-time in the J.D. program which offers more than 100 offerings including foundation courses, specialty offerings, drafting courses, clinical experiences, seminars, simulation courses and externships.

Mortimer Maxwell Caplin was an American lawyer and educator, and the founding member of Caplin & Drysdale, Chartered.

Renunciation of citizenship is the voluntary loss of citizenship. It is the opposite of naturalization, whereby a person voluntarily obtains citizenship. It is distinct from denaturalization, where citizenship is revoked by the state.

Harvey Sheldon Rosen is an American economist and academic. Prior to his retirement and subsequent appointment as Emeritus Professor in 2019, Rosen was the John L. Weinberg Professor of Economics and Business Policy at Princeton University, and former chairperson of the Council of Economic Advisers. His research focuses on public finance. Harvard University economist and former Council of Economic Advisers chairman Greg Mankiw credits Rosen as one of four mentors who taught him how to practice economics, along with Alan Blinder, Larry Summers, and Stanley Fischer.

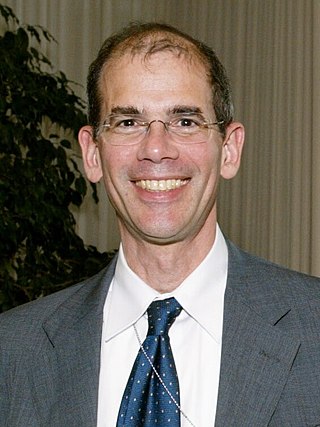

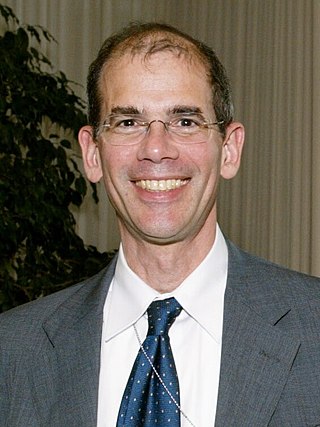

Douglas H. "Doug" Shulman is president and chief executive officer of OneMain Financial. Shulman is a former U.S. commissioner of Internal Revenue.

A tax protester is someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. Tax protesters are different from tax resisters, who refuse to pay taxes as a protest against a government or its policies, or a moral opposition to taxation in general, not out of a belief that the tax law itself is invalid. The United States has a large and organized culture of people who espouse such theories. Tax protesters also exist in other countries.

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act.

Goodwin Hon Liu is an American lawyer who serves as an associate justice of the Supreme Court of California. Before his appointment by California Governor Jerry Brown, Liu was Associate Dean and Professor of Law at the University of California, Berkeley School of Law. Liu has been recognized for his writing on constitutional law, education policy, civil rights, and the Supreme Court.

The Treasury Inspector General for Tax Administration (TIGTA) is an office in the United States Federal government. It was established in January 1999 in accordance with the Internal Revenue Service Restructuring and Reform Act of 1998 (RRA 98) to provide independent oversight of Internal Revenue Service (IRS) activities. As mandated by RRA 98, TIGTA assumed most of the responsibilities of the IRS' former Inspection Service.

The Foreign Account Tax Compliance Act (FATCA) is a 2010 U.S. federal law requiring all non-U.S. foreign financial institutions (FFIs) to search their records for customers with indicia of a connection to the U.S., including indications in records of birth or prior residency in the U.S., or the like, and to report such assets and identities of such persons to the United States Department of the Treasury. FATCA also requires such persons to report their non-U.S. financial assets annually to the Internal Revenue Service (IRS) on form 8938, which is in addition to the older and further redundant requirement to report them annually to the Financial Crimes Enforcement Network (FinCEN) on form 114. Like U.S. income tax law, FATCA applies to U.S. residents and also to U.S. citizens and green card holders residing in other countries.

In 2013, the United States Internal Revenue Service (IRS), under the Obama administration, revealed that it had selected political groups applying for tax-exempt status for intensive scrutiny based on their names or political themes. This led to wide condemnation of the agency and triggered several investigations, including a Federal Bureau of Investigation (FBI) criminal probe ordered by United States Attorney General Eric Holder. Conservatives claimed that they were specifically targeted by the IRS, but an exhaustive report released by the Treasury Department's Inspector General in 2017 found that from 2004 to 2013, the IRS used both conservative and liberal keywords to choose targets for further scrutiny.

Jerome Kurtz was an American tax lawyer who served as the Commissioner of Internal Revenue from 1977 to 1980 during the Carter administration. He left the IRS in 1980 to return to private practice.

Charles Paul Rettig is an American attorney who served as the United States Commissioner of Internal Revenue, the head of the U.S. Internal Revenue Service (IRS). On September 12, 2018, the United States Senate confirmed Rettig's nomination to be Commissioner for the term expiring November 12, 2022. Rettig was sworn in on October 1, 2018.

Michael J. Desmond is an American tax attorney and former federal government official. He previously served as the 48th Chief Counsel of the U.S. Internal Revenue Service (IRS) and Assistant General Counsel in the Department of the Treasury. He was confirmed by the Senate on February 27, 2019 and began serving as Chief Counsel on March 4, 2019. Shortly before the Inauguration of Joe Biden, Desmond resigned from his position as Chief Counsel effective January 20, 2021, succeeded by Acting Chief Counsel William M. Paul.

Richard Pilger is an American attorney and retired government official who served as the Director of the Election Crimes Branch at the Criminal Division of the United States Department of Justice from March 2010 to November 2020, returning to the civil service position in February 2021 through his retirement in July 2022. He is currently an unaffiliated private attorney.

Donald Cyril Lubick was an American attorney and tax policy expert. He served every Democratic President—from John F. Kennedy to Barack Obama—and was the Assistant Secretary for Tax Policy at the Department of the Treasury under both President Carter and President Clinton.

Lily Lawrence Batchelder is the Robert C. Kopple Family Professor of Taxation at New York University and Assistant Secretary of the Treasury for tax policy since September 2021. She was the former chief tax counsel to the U.S. Senate Finance Committee under the Obama administration and appointed to head Joe Biden’s IRS transition team.

The IRS Oversight Board is a nine-member board established by the Internal Revenue Service Restructuring and Reform Act of 1998 to oversee the Internal Revenue Service. It usually meets four times a year.