Related Research Articles

A hedge fund is a pooled investment fund that holds liquid assets and that makes use of complex trading and risk management techniques to improve investment performance and insulate returns from market risk. Among these portfolio techniques are short selling and the use of leverage and derivative instruments. In the United States, financial regulations require that hedge funds be marketed only to institutional investors and high-net-worth individuals.

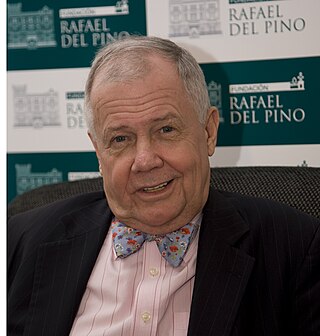

James Beeland Rogers Jr. is an American investor and financial commentator based in Singapore. Rogers is the chairman of Beeland Interests, Inc. He was the co-founder of the Quantum Fund and Soros Fund Management. He was also the creator of the Rogers International Commodities Index (RICI).

Edward Arthur Seykota is a commodities trader, who earned B.S. degrees in Electrical Engineering from MIT and Management from the MIT Sloan School of Management, both in 1969. In 1970, Seykota pioneered systems trading by using early punched card computers to test market trading ideas. Seykota resided in Incline Village, Nevada, on the north shore of Lake Tahoe, but moved to Texas.

Monroe Trout Jr. is a retired financial speculator and hedge fund manager profiled in the book New Market Wizards by Jack D. Schwager. Trout's expertise is in quantitative analysis, with pattern recognition backed by statistical analysis. He subscribes to Ayn Rand's Objectivism. He has traded stocks, stock index futures, commodity futures, and options on all these, both for his own account and as an advisor for others.

Charles Faulkner is an American practitioner of neuro-linguistic programming (NLP), life coach, motivational speaker, trader and author. He has written several books and audio tapes on NLP, which is largely considered a pseudoscience.

Michael Phillips Marcus was a commodities trader who, in less than 20 years, is reputed to have turned his initial $30,000 into $80 million.

Commodities Corporation was a financial services company, based in Princeton, New Jersey, that traded actively across various commodities. The firm was noted as one of the leading commodity and futures trading firms. CC is credited for launching the careers of many notable hedge fund investors and for its influence on global macro investing.

Lawrence D. Hite is a hedge fund manager who, along with Ed Seykota, is one of the forefathers of system trading. He is the author of the book, The Rule: How I Beat the Odds in the Markets and in Life—and How You Can Too, which was named a Wall Street Journal, LA Times, and Porchlight Books bestseller.

Linda Bradford Raschke (/'ræʃki/) is an American financier, operating mostly as a commodities and futures trader.

Thomas F. Basso is an American hedge fund manager. He was president and founder of Trendstat Capital Management. He is the author of two books, Panic-Proof Investing and the self-published The Frustrated Investor. In 1998, he was elected to the board of the National Futures Association.

Lucian Thomas Baldwin III is a bond trader investor and founder of the Baldwin Group of companies. He was described by the Wall Street Journal as a trader who can singlehandedly move the Treasury bond market. He often trades the 30-year bond in the pits of the Chicago Board of Trade.

Gil Blake is a speculator investor and fund manager who devised an investment strategy known as mutual fund market timing. This method of investing is based on the historic pricing patterns of mutual funds.

Reminiscences of a Stock Operator is a 1923 roman à clef by American author Edwin Lefèvre. It is told in the first person by a character inspired by the life of stock trader Jesse Livermore up to that point.

A portfolio manager (PM) is a professional responsible for making investment decisions and carrying out investment activities on behalf of vested individuals or institutions. Clients invest their money into the PM's investment policy for future growth, such as a retirement fund, endowment fund, or education fund. PMs work with a team of analysts and researchers and are responsible for establishing an investment strategy, selecting appropriate investments, and allocating each investment properly towards an investment fund or asset management vehicle.

Cornwall Capital is a New York City-based private financial investment corporation. It is best known as one of the few investors to foresee and profit from the subprime mortgage crisis of 2007, as described in the book The Big Short by Michael Lewis.

Perry J. Kaufman is an American systematic trader, rocket scientist, index developer, and quantitative financial theorist. He is considered a leading expert in the development of fully algorithmic trading programs.

Peter F. Borish is chairman and CEO of Computer Trading Corporation (CTC), an investment and advisory firm. Borish sits on the board of CIBC Bank USA. He is also a Partner of Quantrarian Asset Management and sits on the board of Laconic, a carbon data and management platform.

Michael Dever is an American businessman, futures trader, and author. Dever is the founder and CEO of Brandywine Asset Management, Inc., an investment management firm founded in 1982, and he is the author of the investment book "Jackass Investing: Don't do it. Profit from it."

Steven Edward Drobny is an American hedge fund advisor and published author. He is the founder of Clocktower Group, a consulting and investment advisory business focused on fundamental discretionary global macro and commodity hedge fund strategies. Drobny is the author of The Invisible Hands: Top Hedge Funds on Bubbles, Crashes and Rethinking Real Money and Inside the House of Money: Top Hedge Fund Traders on Profiting in the Global Markets

Martin Taylor is a British investor and hedge fund manager. He has run several billion dollar funds, focusing on emerging markets. He is also a significant political donor to the Labour Party.

References

- 1 2 "Schwager, Jack D. 1948- | Encyclopedia.com". www.encyclopedia.com. Retrieved 2023-08-08.

- 1 2 "Jack D. Schwager". www.goodreads.com. Retrieved 2023-08-08.

- ↑ "Schwager, Jack D. 1948-". Encyclopedia.com. Retrieved 2020-01-20.

- ↑ Schwager, Jack D.; Seykota, Ed (2012-04-25). Hedge Fund Market Wizards: How Winning Traders Win (1st ed.). Wiley.

- ↑ "Harriman House". harriman-house.com. Retrieved 2023-08-18.

- ↑ Elearnmarkets. "Hedge Fund Market Wizard by Jack Schwager : Book Summary". Elearnmarkets. Retrieved 2023-08-19.

- ↑ "Jack Schwager - Investor Profile • World Top Investors". World Top Investors. 2018-01-15. Retrieved 2023-08-29.

- ↑ Schwager, Jack D. (2016-05-04). Market Wizards: Interviews with Top Traders. John Wiley & Sons. ISBN 978-1-118-53871-5.

- ↑ "Jack Schwager" (PDF).

- ↑ "About JS – Jack Schwager" . Retrieved 2023-09-02.

- ↑ "Hedge Fund Market Wizards: How Winning Traders Win (a review)". Financial Analysts Journal . doi:10.2469/br.v8.n1.10 (inactive 2024-09-12).

{{cite journal}}: CS1 maint: DOI inactive as of September 2024 (link) - ↑ DL, Dr Vikas Shah MBE (2012-06-01). "The Secrets of The World's Greatest Traders". Thought Economics. Retrieved 2023-09-10.

- ↑ "Jack Schwager – HarperCollins".