Related Research Articles

Michael Robert Milken is an American convicted felon, financier and philanthropist. He is noted for his role in the development of the market for high-yield bonds, and his conviction and sentence following a guilty plea on felony charges for violating U.S. securities laws. Since his release from prison, he has also become known for his charitable giving. Milken was pardoned by President Donald Trump on February 18, 2020.

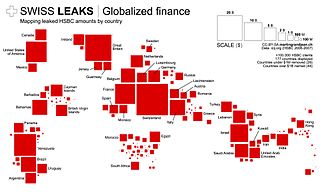

HSBC Holdings plc is a British multinational investment bank and financial services holding company. It is the second largest bank in Europe, with total assets of US$2.984 trillion. HSBC traces its origin to a hong in British Hong Kong, and its present form was established in London by the Hongkong and Shanghai Banking Corporation to act as a new group holding company in 1991; its name derives from that company's initials. The Hongkong and Shanghai Banking Corporation opened branches in Shanghai in 1865 and was first formally incorporated in 1866.

An offshore bank is a bank regulated under international banking license, which usually prohibits the bank from establishing any business activities in the jurisdiction of establishment. Due to less regulation and transparency, accounts with offshore banks were often used to hide undeclared income. Since the 1980s, jurisdictions that provide financial services to nonresidents on a big scale, can be referred to as offshore financial centres. OFCs often also levy little or no corporation tax and/or personal income and high direct taxes such as duty, making the cost of living high.

Wilbert Joseph Tauzin II is an American lobbyist and politician. He was President and CEO of PhRMA, a pharmaceutical company lobby group. Tauzin was also a member of the United States House of Representatives from 1980 to 2005, representing Louisiana's 3rd congressional district.

Viktor Kožený is a Czech-born fugitive financier. According to Bloomberg News, he graduated from Harvard in 1989 with a bachelor's degree in economics. However, he can not be located in the Harvard Alumni directory as of 2015. Viktor Kožený is an Irish citizen imprisoned in the Bahamas in 2005 but released in 2007. He currently lives in a gated community in the Bahamas. Efforts to bring him to justice stem from both the Czech Republic and the USA. An international warrant has been issued for Kožený, who in the early 1990s ran one of the great scams of the post-Communist era. By the media he is often called "the pirate of Prague".

Offshore investment is the keeping of money in a jurisdiction other than one's country of residence. Offshore jurisdictions are used to pay less tax in many countries by large and small-scale investors. Poorly regulated offshore domiciles have served historically as havens for tax evasion, money laundering, or to conceal or protect illegally acquired money from law enforcement in the investor's country. However, the modern, well-regulated offshore centres allow legitimate investors to take advantage of higher rates of return or lower rates of tax on that return offered by operating via such domiciles. The advantage to offshore investment is that such operations are both legal and less costly than those offered in the investor's country—or "onshore".

Eddie Ray Kahn is an American tax protester. Kahn is currently in prison for tax crimes, with a tentative release date of 2026. Kahn founded the group American Rights Litigators and ran the for-profit businesses "Guiding Light of God Ministries" and "Eddie Kahn and Associates." According to the U.S. Justice Department, all three organizations are or were illegal tax evasion operations.

Robert Allen Stanford, known primarily by his middle name, is an American convicted financial fraudster and former financier and was also a sponsor of professional sports. He is currently serving a 110-year federal prison sentence, having been convicted in 2012 of charges that his investment company was a massive Ponzi scheme and fraud.

The redemption movement is a debt-resistance movement and fraud scheme active primarily in the United States and Canada. Participants allege that a secret fund is created for everyone at birth, and that a procedure exists to "redeem" or reclaim this fund to pay bills. Common redemption schemes include acceptance for value (A4V), Treasury Direct Accounts (TDA) and secured party creditor kits.

Marc Stuart Dreier is a former American lawyer who was sentenced to 20 years in federal prison in 2009 for committing investment fraud using a Ponzi scheme. He is scheduled to be released from FCI Sandstone on October 26, 2026. On May 11, 2009, he pleaded guilty in the United States District Court for the Southern District of New York to eight charges of fraud, which included one count of conspiracy to commit securities fraud and wire fraud, one count of money laundering, one count of securities fraud, and five counts of wire fraud in a scheme to sell more than $950 million in fictitious promissory notes. Civil charges, filed in December 2008 by the U.S. Securities and Exchange Commission, are pending. The 2011 documentary Unraveled states that "Drier stole over $740 million from 4 clients, 4 individuals, and 13 hedge funds".

The Madoff investment scandal was a major case of stock and securities fraud discovered in late 2008. In December of that year, Bernie Madoff, the former NASDAQ chairman and founder of the Wall Street firm Bernard L. Madoff Investment Securities LLC, admitted that the wealth management arm of his business was an elaborate multi-billion-dollar Ponzi scheme.

Bradley Charles Birkenfeld is an American private banker, convicted felon, and whistleblower. During the mid- to late-2000s, he made a series of disclosures about UBS Group AG clients, in violation of Swiss banking secrecy laws, to the U.S. government alleging possible tax evasion. Known as the 2007 "Birkenfeld Disclosure", the U.S. Department of Justice (DOJ) announced it had reached a deferred prosecution agreement with UBS that resulted in a US$780 million fine and the release of previously privileged information on American tax evaders.

Hervé Daniel Marcel Falciani is a French-Italian systems engineer and whistleblower who is credited with "the biggest banking leak in history." In 2008, Falciani began collaborating with numerous European nations by providing allegedly illegal stolen information relating to more than 130,000 suspected tax evaders with Swiss bank accounts – specifically those with accounts in HSBC's Swiss subsidiary HSBC Private Bank.

Igor Olenicoff is an American billionaire and real estate developer. In 2007, he was convicted of tax evasion stemming from his use of off-shore companies and Swiss banks to hide his financial assets.

The Swiss investment bank and financial services company, UBS Group AG, has been at the center of numerous tax evasion and avoidance investigations undertaken by U.S., French, German, Israeli, and Belgian tax authorities as a consequence of their strict banking secrecy practices.

Swiss Leaks is the name of a journalistic investigation, released in February 2015, of a giant tax evasion scheme allegedly operated with the knowledge and encouragement of the British multinational bank HSBC via its Swiss subsidiary, HSBC Private Bank (Suisse). Triggered by leaked information from French computer analyst Hervé Falciani on accounts held by over 100,000 clients and 20,000 offshore companies with HSBC in Geneva, the disclosed information has been called "the biggest leak in Swiss banking history".

Adam Aristotle Starchild, born Malcolm Willis McConahy, was a financial consultant, convicted fraudster, key figure in the "perpetual traveler" movement, and prolific author of books relating to investment, taxation, and the "offshore" world.

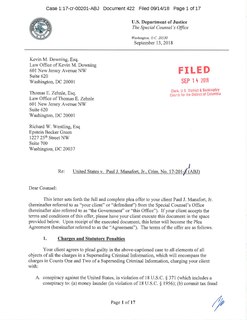

Richard William Gates III is an American former political consultant and lobbyist who pleaded guilty to conspiracy against the United States and making false statements in the investigation into Russian interference in the 2016 United States elections. He is a longtime business associate of Paul Manafort and served as deputy to Manafort when the latter was campaign manager of the Donald Trump presidential campaign in 2016, and after under Kellyanne Conway.

The two criminal trials of Paul Manafort were the first cases brought to trial by the special counsel's investigation into Russian interference in the 2016 presidential election. Manafort served as campaign chair for the Donald Trump 2016 presidential campaign from June 20 to August 19, 2016. In July 2017, the FBI conducted a raid of Manafort's home, authorized by search warrant under charges of interference in the 2016 election. Manafort and his business assistant Rick Gates were both indicted and arrested in October 2017 for charges of conspiracy against the United States, making false statements, money laundering, and failing to register as foreign agents for Ukraine. Gates entered a plea bargain in February 2018.

The Panama Papers are 11.5 million leaked documents that detail financial and attorney–client information for more than 214,488 offshore entities. The documents, some dating back to the 1970s, were created by, and taken from, Panamanian law firm and corporate service provider Mossack Fonseca, and were leaked in 2015 by an anonymous source.

References

- ↑ "Storm Survivors". The Economist. February 16, 2013. Retrieved 21 February 2013.

- ↑ DeGeorge, Gail. "Psst, Wanna Buy A Bank? How About A Few Dozen?" Businessweek. September 22, 1991. Retrieved 21 February, 2013.

- ↑ Johnston, David Cay. "Pioneer of Sham Tax Havens Sits Down for Pre-Jail Chat". New York Times. November 18, 2004. Retrieved 21 February 2013.

- ↑ Ross, Brian. "Confessions of a Tax Scammer". ABC News. December 10, 2004. Retrieved 21 February 2013.

- ↑ "'Hiding Your Money' author indicted". USA Today. December 22, 2002. Retrieved 21 February 2013.

- ↑ Johnston, David Cay. "Man Sentenced in Tax Schemes Also Releases Data on Lawyers". New York Times. December 7, 2004. Retrieved 21 February 2013.