Related Research Articles

A hedge fund is a pooled investment fund that holds liquid assets and that makes use of complex trading and risk management techniques to improve investment performance and insulate returns from market risk. Among these portfolio techniques are short selling and the use of leverage and derivative instruments. In the United States, financial regulations require that hedge funds be marketed only to institutional investors and high-net-worth individuals.

Passive management is an investing strategy that tracks a market-weighted index or portfolio. Passive management is most common on the equity market, where index funds track a stock market index, but it is becoming more common in other investment types, including bonds, commodities and hedge funds.

A mutual fund is an investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe, and the open-ended investment company (OEIC) in the UK.

Stanley Freeman Druckenmiller is an American billionaire investor, philanthropist and former hedge fund manager. He is the former chairman and president of Duquesne Capital, which he founded in 1981. He closed the fund in August 2010, at which time it had over $12 billion in assets. From 1988 to 2000, he managed money for George Soros as the lead portfolio manager for Quantum Fund. He is reported to have made $260 million in 2008.

Soros Fund Management, LLC is a privately held American investment management firm. It is currently structured as a family office, but formerly as a hedge fund. The firm was founded in 1970 by George Soros and, in 2010, was reported to be one of the most profitable firms in the hedge fund industry, averaging a 20% annual rate of return over four decades. It is headquartered at 250 West 55th Street in New York. As of 2023, Soros Fund Management, LLC had $25 billion in AUM.

Long/short equity is an investment strategy generally associated with hedge funds. It involves buying equities that are expected to increase in value and selling short equities that are expected to decrease in value. This is different from the risk reversal strategies where investors will simultaneously buy a call option and sell a put option to simulate being long in a stock.

A "fund of funds" (FOF) is an investment strategy of holding a portfolio of other investment funds rather than investing directly in stocks, bonds or other securities. This type of investing is often referred to as multi-manager investment. A fund of funds may be "fettered", meaning that it invests only in funds managed by the same investment company, or "unfettered", meaning that it can invest in external funds run by other managers.

Tiger Management Corp. is an American hedge fund and family office founded by Julian Robertson. The fund began investing in 1980 and wound down in March 2000-01. It continues to operate in direct public equity investments and seeding new investment funds. It is colloquially known as the "Tiger Fund", with its alumni commonly referred to as "tiger cubs".

A stock fund, or equity fund, is a fund that invests in stocks, also called equity securities. Stock funds can be contrasted with bond funds and money funds. Fund assets are typically mainly in stock, with some amount of cash, which is generally quite small, as opposed to bonds, notes, or other securities. This may be a mutual fund or exchange-traded fund. The objective of an equity fund is long-term growth through capital gains, although historically dividends have also been an important source of total return. Specific equity funds may focus on a certain sector of the market or may be geared toward a certain level of risk.

An investment strategy or portfolio is considered market-neutral if it seeks to avoid some form of market risk entirely, typically by hedging. To evaluate market neutrality requires specifying the risk to avoid. For example, convertible arbitrage attempts to fully hedge fluctuations in the price of the underlying common stock. A portfolio is truly market-neutral if it exhibits zero correlation with the unwanted source of risk. Market neutrality is an ideal, which is seldom possible in practice. A portfolio that appears market-neutral may exhibit unexpected correlations as market conditions change. The risk of this occurring is called basis risk.

Martin Edward Zweig was an American stock investor, investment adviser, and financial analyst.

The absolute return or simply return is a measure of the gain or loss on an investment portfolio expressed as a percentage of invested capital. The adjective "absolute" is used to stress the distinction with the relative return measures that are based on comparison to a benchmark.

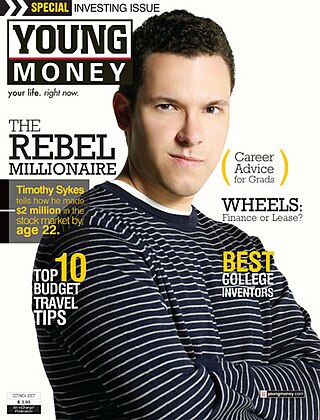

Timothy Sykes is a penny stock trader who claims to have earned $1.65 million from a $12,415 Bar mitzvah gift through day trading while in college.

TrimTabs Investment Research, Inc. is a leading independent institutional research firm focused on equity market liquidity based in Sausalito, California.

A 130–30 fund or a ratio up to 150/50 is a type of collective investment vehicle, often a type of specialty mutual fund, but which allows the fund manager simultaneously to hold both long and short positions on different equities in the fund. Traditionally, mutual funds were long-only investments. 130–30 funds are a fast-growing segment of the financial industry; they should be available both as traditional mutual funds, and as exchange-traded funds (ETFs). While this type of investment has existed for a while in the hedge fund industry, its availability for retail investors is relatively new.

Seth Andrew Klarman is an American billionaire investor, hedge fund manager, and author. He is a proponent of value investing. He is the chief executive and portfolio manager of the Baupost Group, a Boston-based private investment partnership he founded in 1982.

Greenlight Capital is an American hedge fund founded in 1996 by David Einhorn. Greenlight invests primarily in publicly traded North American corporate debt offerings and equities. Greenlight is most notable for its short selling of Lehman stock prior to Lehman Brothers' collapse in 2008 and the $11 million fine they received in January 2012 for insider trading in the UK. Einhorn remains the fund's manager.

Appaloosa Management is an American hedge fund founded in 1993 by David Tepper and Jack Walton specializing in distressed debt. Appaloosa Management invests in public equity and fixed income markets around the world.

Clifford Scott Asness is an American hedge fund manager and the co-founder of AQR Capital Management. As of July 2024, Forbes estimated his net worth at US$2.0 billion.

Ted Weschler is an American hedge fund manager who is the current investment manager at Berkshire Hathaway. Alongside Todd Combs, he is frequently cited as a potential future Chief Investment Officer of Berkshire.

References

- ↑ "Fairfield University Alumni Celebrate Diversity and Raise $1.4M for the Multicultural Scholarship Fund". PRWeb. Archived from the original on May 2, 2010. Retrieved 2015-11-18.

- ↑ "Hedge fund industry snapshot: $2.6 trillion in 11,000 funds". CNBC . 31 August 2014.

- ↑ The Stock Whiz You Never Heard Of Archived 2011-04-11 at the Wayback Machine

- ↑ 2007 Absolute Return Awards: Joseph DiMenna

- ↑ Euromoney Conferences | Home

- ↑ ^ Jump up to: a b Alpha's Top Moneymakers: No. 13 Joseph DiMenna

- ↑ Panache Privee: Joe DiMenna Archived 2011-07-15 at the Wayback Machine

- ↑ New-York Historical Society Announces $5 Million Donation from Joseph DiMenna to Create an Interactive Children’s History Museum

- ↑ "Board of Trustees". The Gilder Lehrman Institute of American History . Retrieved 8 July 2021.

- ↑ Hedge-Fund Manager Helps Nomadic Orchestra Buy Permanent Home

- ↑ "Meet Joe DiMenna: The Hedge Fund Manager That If You Don't Know, You Should". Business Insider. Business Insider. Retrieved 17 October 2015.

- ↑ "John List Back of Claudia Drury Clients In An Updated Story After the Larry Ray Trial". www.innercitypress.com. Retrieved 2024-08-21.