Related Research Articles

An affidavit is a written statement voluntarily made by an affiant or deponent under an oath or affirmation which is administered by a person who is authorized to do so by law. Such a statement is witnessed as to the authenticity of the affiant's signature by a taker of oaths, such as a notary public or commissioner of oaths. An affidavit is a type of verified statement or showing, or in other words, it contains a verification, which means that it is made under oath on penalty of perjury, and this serves as evidence for its veracity and is required in court proceedings.

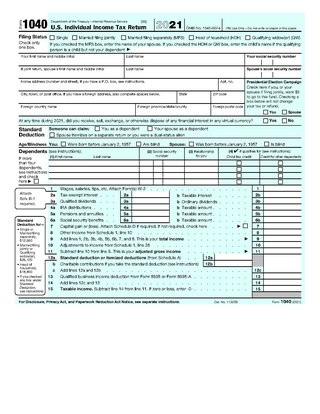

Form 1040, officially, the U.S. Individual Income Tax Return, is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government.

A notary public of the common law is a public officer constituted by law to serve the public in non-contentious matters usually concerned with general financial transactions, estates, deeds, powers-of-attorney, and foreign and international business. A notary's main functions are to validate the signature of a person ; administer oaths and affirmations; take affidavits and statutory declarations, including from witnesses; authenticate the execution of certain classes of documents; take acknowledgments ; provide notice of foreign drafts; provide exemplifications and notarial copies; and, to perform certain other official acts depending on the jurisdiction. Such transactions are known as notarial acts, or more commonly, notarizations. The term notary public only refers to common-law notaries and should not be confused with civil-law notaries.

The United States has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

A summons is a legal document issued by a court or by an administrative agency of government for various purposes.

Traditionally an oath is either a statement of fact or a promise taken by a sacrality as a sign of verity. A common legal substitute for those who conscientiously object to making sacred oaths is to give an affirmation instead. Nowadays, even when there is no notion of sanctity involved, certain promises said out loud in ceremonial or juridical purpose are referred to as oaths. "To swear" is a verb used to describe the taking of an oath, to making a solemn vow.

Tax returns in the United States are reports filed with the Internal Revenue Service (IRS) or with the state or local tax collection agency containing information used to calculate income tax or other taxes. Tax returns are generally prepared using forms prescribed by the IRS or other applicable taxing authority.

Form 1099 is one of several IRS tax forms used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips. The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds of returns.

A sworn declaration is a document that recites facts pertinent to a legal proceeding. It is very similar to an affidavit but is not witnessed and sealed by an official such as a notary public. Instead, the person making the declaration signs a separate endorsement paragraph at the end of the document, stating that the declaration is made under penalty of perjury.

The Internal Revenue Service Restructuring and Reform Act of 1998, also known as Taxpayer Bill of Rights III, resulted from hearings held by the United States Congress in 1996 and 1997. The Act included numerous amendments to the Internal Revenue Code of 1986. The bill was passed in the Senate unanimously, and was seen as a major reform of the Internal Revenue Service.

Tax preparation is the process of preparing tax returns, often income tax returns, often for a person other than the taxpayer, and generally for compensation. Tax preparation may be done by the taxpayer with or without the help of tax preparation software and online services. Tax preparation may also be done by a licensed professional such as an attorney, certified public accountant or enrolled agent, or by an unlicensed tax preparation business. Because United States income tax laws are considered to be complicated, many taxpayers seek outside assistance with taxes.

Tax protesters in the United States have advanced a number of arguments asserting that the assessment and collection of the federal income tax violates statutes enacted by the United States Congress and signed into law by the President. Such arguments generally claim that certain statutes fail to create a duty to pay taxes, that such statutes do not impose the income tax on wages or other types of income claimed by the tax protesters, or that provisions within a given statute exempt the tax protesters from a duty to pay.

A statutory declaration is a legal document defined under the law of certain Commonwealth nations and in the United States. It is similar to a statement made under oath, but it is not sworn.

An eschatocol, or closing protocol, is the final section of a legal or public document, which may include a formulaic sentence of appreciation; the attestation of those responsible for the document, which may be the author, writer, countersigner, principal parties involved, and witnesses to the enactment or the subscription; or both. It also expresses the context of the documentation of the action described therein, i. e., enunciation of the means of validation and indication of who is responsible to document the act; and the final formulae.

Notaries public in New York are commissioned by the Secretary of State of New York after passing a short examination in law and procedure and submitting an application for appointment accompanied by the proper fees. A notary's commission is received from and kept on file with the county clerk of the county in which they reside or do business, but notaries are empowered to actually perform their duties anywhere in the state.

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act.

A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for taxes.

In the United States, an income tax audit is the examination of a business or individual tax return by the Internal Revenue Service (IRS) or state tax authority. The IRS and various state revenue departments use the terms audit, examination, review, and notice to describe various aspects of enforcement and administration of the tax laws.

In the United States, a notary public is a person appointed by a state government, e.g., the governor, lieutenant governor, secretary of state, or in some cases the state legislature, and whose primary role is to serve the public as an impartial witness when important documents are signed. Since the notary is a state officer, a notary's duties may vary widely from state to state and in most cases, a notary is barred from acting outside his or her home state unless they have a commission there as well.

References

- 1 2 Burrill, Alexander Mansfield (1867). "jurat". A Law Dictionary and Glossary (2nd ed.). New York: Baker, Voorhis. p. 110.

- ↑ Piombino, Alfred (1996). Notary Public Handbook: A Guide for Vermont Notaries, Commissioners & Justices of the Peace. East Coast Publishing. pp. 65–66. ISBN 0-944560-97-0.

- ↑ "Internal Revenue Bulletin: 2005-14". Internal Revenue Service. April 4, 2005.