Related Research Articles

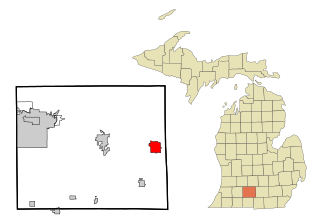

Albion is a city in Calhoun County in the south central region of the Lower Peninsula of the U.S. state of Michigan. The population was 7,700 at the 2020 census and is part of the Battle Creek Metropolitan Statistical Area.

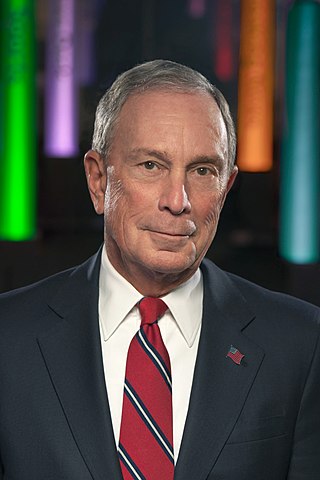

Michael Rubens Bloomberg is an American businessman, politician, philanthropist, and author. He is the majority owner and co-founder of Bloomberg L.P., and was its CEO from 2014 until 2023. He served as the mayor of New York City for three terms from 2002 to 2013 and was a candidate for the 2020 Democratic nomination for president of the United States. He has served as chair of the Defense Innovation Board, an independent advisory board that provides recommendations on artificial intelligence, software, data and digital modernization to the United States Department of Defense, since June 2022.

Kalamazoo is a city in the southwest region of the U.S. state of Michigan. It is the county seat of Kalamazoo County. At the 2020 census, Kalamazoo had a population of 73,598. Kalamazoo is the major city of the Kalamazoo-Portage Metropolitan Statistical Area, which had a population of 261,670 in 2020.

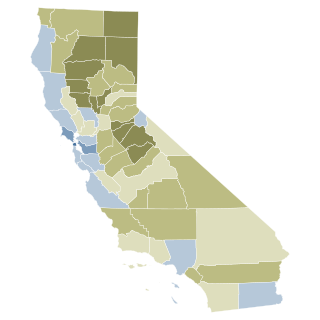

Proposition 13 is an amendment of the Constitution of California enacted during 1978, by means of the initiative process. The initiative was approved by California voters on June 6, 1978. It was upheld as constitutional by the United States Supreme Court in the case of Nordlinger v. Hahn, 505 U.S. 1 (1992). Proposition 13 is embodied in Article XIII A of the Constitution of the State of California.

In addition to federal income tax collected by the United States, most individual U.S. states collect a state income tax. Some local governments also impose an income tax, often based on state income tax calculations. Forty-two states and many localities in the United States impose an income tax on individuals. Eight states impose no state income tax, and a ninth, New Hampshire, imposes an individual income tax on dividends and interest income but not other forms of income. Forty-seven states and many localities impose a tax on the income of corporations.

Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United States. Sales tax is governed at the state level and no national general sales tax exists. 45 states, the District of Columbia, the territories of Puerto Rico, and Guam impose general sales taxes that apply to the sale or lease of most goods and some services, and states also may levy selective sales taxes on the sale or lease of particular goods or services. States may grant local governments the authority to impose additional general or selective sales taxes.

Stephen Michael Ross is an American real estate developer, philanthropist, and sports team owner. Ross is the chairman and majority owner of The Related Companies, a global real estate development firm he founded in 1972. Related is best known for developing the Deutsche Bank Center, where Ross lives and works, as well as the Hudson Yards Redevelopment Project. Ross has a net worth of $7.7 billion in 2020, ranking him 185 on Forbes Billionaires List in 2020. He is still featured on the list as of 2023. Having doubled his net worth since 2008, he paid no income taxes in the next decade utilizing the losses on the properties he owned. Ross is also the principal owner of the Miami Dolphins and Hard Rock Stadium.

The Kalamazoo Promise is a pledge by a group of anonymous donors to pay up to 100 percent of tuition at many Michigan colleges and universities for graduates of the Kalamazoo Public Schools school district of Kalamazoo, Michigan. The Kalamazoo Promise applies to all of Michigan's state colleges and universities, as well as the 15 private colleges of the Michigan College Alliance and several apprenticeships and skilled trade programs. To receive the minimum 65% benefit, students must have lived within the Kalamazoo School District, attended public high school there for four years, and graduated. To receive a full scholarship, students must have attended Kalamazoo public schools since kindergarten.

Robert B. Jones was an American politician from the state of Michigan. He served four consecutive terms as the Mayor of Kalamazoo from 1997 to 2005. A Democrat, he was elected to the Michigan State House of Representatives in 2006 and 2008, representing the 60th District in Kalamazoo County, which includes the City of Kalamazoo, Cooper Township and part of Kalamazoo Township. He was the Democratic nominee for the Michigan Senate's 20th district in the November 2, 2010 election, until his death just 16 days before.

Mark Hamilton Schauer is an American politician who served as a U.S. representative for Michigan's 7th congressional district from 2009 to 2011.

In the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax bracket and the amount of time the investment was held. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-term capital gains, on dispositions of assets held for more than one year, are taxed at a lower rate.

The Kalamazoo Gazette is the daily newspaper in Kalamazoo, Michigan, and is part of MLive Media Group, Michigan's largest local media organization. The Gazette publishes seven days a week. Papers are available for home delivery on Thursday and Sunday.

Jon Lloyd Stryker is an American architect, philanthropist, and billionaire heir to the Stryker Corporation medical technology company fortune.

James "Jase" Bolger served as the 71st Speaker of the Michigan House of Representatives from January 12, 2011 to the end of 2014 session. Bolger is a member of the Republican Party, and represented Michigan's 63rd house district from 2009 to 2014. After being term limited out, he founded a consulting firm, Tusker Strategies. Bolger was also appointed by former Governor Rick Snyder on December 29, 2016 to the Michigan Civil Service Commission and was elected chair on April 27, 2023.

Bloomberg Philanthropies is a philanthropic organization that encompasses all of the charitable giving of founder Michael R. Bloomberg. Headquartered in New York City, Bloomberg Philanthropies focuses its resources on five areas: the environment, public health, the arts, government innovation and education. According to the Foundation Center, Bloomberg Philanthropies was the 10th largest foundation in the United States in 2015, the last year for which data was available. Bloomberg has pledged to donate the majority of his wealth, currently estimated at more than $54 billion. Patti Harris is the CEO of Bloomberg Philanthropies.

The Illinois Fair Tax was a proposed amendment to the Illinois state constitution that would have effectively changed the state income tax system from a flat tax to a graduated income tax. The proposal, formally titled the "Allow for Graduated Income Tax Amendment", appeared on the ballot in the November 3, 2020 election in Illinois as a legislatively referred constitutional amendment striking language from the Constitution of Illinois requiring a flat state income tax. Concurrent with the proposed constitutional amendment, the Illinois legislature passed legislation setting a new set of graduated income tax rates that would have taken effect had the amendment been approved by voters.

2015 Michigan Proposal 1, also known as the Michigan Sales Tax Increase for Transportation Amendment, was a referendum held on May 5, 2015, concerning a legislatively-referred ballot measure. The measure's approval would have caused one constitutional amendment and 10 statutes to go into effect. It is estimated that Proposal 1 would raise state revenues from sales and use taxes by $1.427 billion, fuel taxes by $463 million, truck registration fees by $50 million, and vehicle registration fees by $10.1 million in the first year. If approved, the proposal was estimated by the Associated Press to result in an average tax increase of $545 per household in 2016.

Karen Weaver is an American psychologist and politician who was the mayor of Flint, Michigan, from 2015 to 2019. She was the first female mayor of the city and the 5th African-American to hold the office.

Sheldon A. Neeley is an American politician, currently serving as the Mayor of Flint, Michigan. He was elected as Flint’s mayor in 2019 and served an abbreviated three-year term before being re-elected in 2022. Neeley is a registered Democrat and a former state representative in Michigan's 34th House district. He served two complete terms and one partial term in the Michigan House of Representatives between 2015 and 2019. He resigned from his position in the House when he was elected as the Mayor of Flint in 2019. Neeley's wife, Cynthia, was elected to his former seat on March 10, 2020. Neeley served two complete terms and one partial term on the Flint City Council between 2005 and 2014, prior to his tenure as Michigan Representative and was the Council's first African-American member to have come from Flint's Sixth Ward.

California Proposition 15 was a failed citizen-initiated proposition on the November 3, 2020, ballot. It would have provided $6.5 billion to $11.5 billion in new funding for public schools, community colleges, and local government services by creating a "split roll" system that increased taxes on large commercial properties by assessing them at market value, without changing property taxes for small business owners or residential properties for homeowners or renters. The measure failed by a small margin of about four percentage points.

References

- ↑ AP (2016-07-29). "$70M for foundation to help Kalamazoo fix budget, cut taxes". The Washington Times. Retrieved 2016-10-10.

- ↑ Barrett, Malachi (2016-09-01). "Details of Foundation for Excellence organization beginning to take shape". MLive.com. Retrieved 2016-10-10.

- ↑ staff (2016-07-29). "New donor-backed foundation to help fund Kalamazoo". WOODTV.com. Retrieved 2016-10-10.

- 1 2 Albright, Amanda (2016-09-15). "Billionaire Rescues Michigan City With Cash to End Fiscal Plight". Bloomberg.com. Retrieved 2016-10-10.

- ↑ "Kalamazoo votes 5-2 to create $500M Foundation for Excellence". MLive.com. Retrieved 2017-08-28.

- ↑ Friess, Steve (2016-09-29). "Kalamazoo Is Asking the Rich for Donations Instead of Hiking Taxes". Bloomberg.com. Retrieved 2016-10-10.