Telstra Group Limited is an Australian telecommunications company that builds and operates telecommunications networks and markets related products and services. It is a member of the S&P/ASX 20 and Australia's largest telecommunications company by market share.

The World Game was an Australian football (soccer) television show broadcast on the SBS network, as well as a dedicated associated website. The show debuted in 2001 and was the only Australian TV programme dedicated to both football news and issues within Australia as well as around the world. Its popularity led to the launch of an associated website the following year. The TV show was dropped in 2019, whilst the website closed in 2021, and merged with the core SBS Sport website.

Travel insurance is an insurance product for covering unforeseen losses incurred while travelling, either internationally or domestically. Basic policies generally only cover emergency medical expenses while overseas, while comprehensive policies typically include coverage for trip cancellation, lost luggage, flight delays, public liability, and other expenses.

An insurance broker is an intermediary who sells, solicits, or negotiates insurance on behalf of a client for compensation. An insurance broker is distinct from an insurance agent in that a broker typically acts on behalf of a client by negotiating with multiple insurers, while an agent represents one or more specific insurers under a contract.

Facebook is an online social media and social networking service owned by American technology giant Meta Platforms. Created in 2004 by Mark Zuckerberg with four other Harvard College students and roommates Eduardo Saverin, Andrew McCollum, Dustin Moskovitz, and Chris Hughes, its name derives from the face book directories often given to American university students. Membership was initially limited to Harvard students, gradually expanding to other North American universities. Since 2006, Facebook allows everyone to register from 13 years old, except in the case of a handful of nations, where the age limit is 14 years. As of December 2022, Facebook claimed 3 billion monthly active users. As of October 2023 Facebook ranked as the 3rd most visited website in the world with 22.56% of its traffic coming from the United States. It was the most downloaded mobile app of the 2010s.

Hollard Group is a privately owned insurance group based in South Africa that operates under two insurance licences: short term and life. The company was established in 1980 by Robert Enthoven, and the Enthoven family retains the majority share, locally through The Enthoven Family Trust (EFT) and internationally through Capricorn Ventures International (CVI).

The Australian and New Zealand Institute of Insurance and Finance (ANZIIF), also known as the Institute, is a professional association and education provider for the insurance and financial services industry in the Asia-Pacific region. ANZIIF was founded in 1884, making it one of the oldest professional associations in the region.

PanARMENIAN.Net is the first Armenian online news agency, an internet portal based in Yerevan, Armenia. The PanARMENIAN.Net information-analytical portal is one of the projects of the "PanArmenian Network" NGO. It was launched on April 2, 2000. PanARMENIAN.Net provides information and analysis about the main events in the social and political life of Armenia, as well as events taking place all over the world that are connected with Armenia directly or indirectly. Topics covered: Politics, Armenia and World, Society, Economics, Region, Sport, Culture, IT & Telecommunications.

CoreLogic, Inc. is an Irvine, CA-based corporation providing financial, property, and consumer information, analytics, and business intelligence. The company analyzes information assets and data to provide clients with analytics and customized data services. The company also develops proprietary research, and tracks current and historical trends in a number of categories, including consumer credit, capital markets, real estate, fraud, regulatory compliance, natural hazards, and disaster projections. The company reported full 2020 revenue of $1.6 billion. As of 2021, CoreLogic is a Fortune 1000 company.

The United Nations Office for Disaster Risk Reduction (UNDRR) was created in December 1999 to ensure the implementation of the International Strategy for Disaster Reduction.

Tower is a New Zealand-based insurance company that provides car, home, contents, business, boat, pet, travel and other general insurance.

CurrencyFair was an online peer-to-peer currency exchange marketplace but now offers only the opportunity to exchange at the current rate. CurrencyFair is headquartered in Ireland and also has employees in the UK, Australia, Greece, Hong Kong, Poland and Singapore.

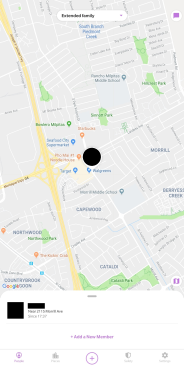

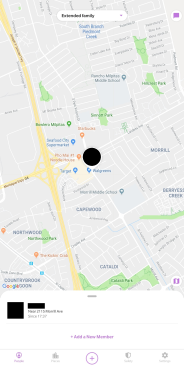

Life360 Inc. is a San Francisco, California–based American information technology company that provides location-based services, including sharing and notifications, to consumers globally. Its main service is called Life360, a family social networking app released in 2008. It is a location-based service designed primarily to enable friends and family members to share their location with each other.

AJ+ is a social media publisher owned by Al Jazeera Media Network which focuses on news and current affairs. AJ+ content exists in English, Arabic, French, and Spanish. It is available on its website, YouTube, Facebook, Instagram, and X, with written content on Medium.

David Riker is the co-founder of BlueLine Grid, operator of a critical communication platform for enterprise security and public safety.

Optus Sport is an Australian group of sports channels, owned by Optus launched on 13 July 2016. The network was launched after Optus outbid the incumbent Foxtel.

Merchantrade Asia (Merchantrade) is a Money Services Business (MSB), Digital Payment Service and Mobile Virtual Network operator (MVNO) provider based in Malaysia.

Vodafone Australia is an Australian telecommunications brand providing mobile and fixed broadband services. Vodafone’s mobile network covers more than 23 million Australians, and Vodafone has commenced the rollout of its 5G mobile network. Vodafone NBN fixed broadband services are available in capital cities and selected regional centres. Vodafone is the third-largest wireless carrier in Australia, with 5.8 million subscribers as of 2020.

Climate risk insurance is a type of insurance designed to mitigate the financial and other risk associated with climate change, especially phenomena like extreme weather. The insurance is often treated as a type of insurance needed for improving the climate resilience of poor and developing communities. It provides post-disaster liquidity for relief and reconstruction measures while also preparing for the future measures in order to reduce climate change vulnerability. Insurance is considered an important climate change adaptation measure.