Related Research Articles

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price or delivery price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

The Chicago Mercantile Exchange (CME) is a global derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board, an agricultural commodities exchange. For most of its history, the exchange was in the then common form of a non-profit organization, owned by members of the exchange. The Merc demutualized in November 2000, went public in December 2002, and merged with the Chicago Board of Trade in July 2007 to become a designated contract market of the CME Group Inc., which operates both markets. The chairman and chief executive officer of CME Group is Terrence A. Duffy, Bryan Durkin is president. On August 18, 2008, shareholders approved a merger with the New York Mercantile Exchange (NYMEX) and COMEX. CME, CBOT, NYMEX, and COMEX are now markets owned by CME Group. After the merger, the value of the CME quadrupled in a two-year span, with a market cap of over $25 billion.

A commodity price index is a fixed-weight index or (weighted) average of selected commodity prices, which may be based on spot or futures prices. It is designed to be representative of the broad commodity asset class or a specific subset of commodities, such as energy or metals. It is an index that tracks a basket of commodities to measure their performance. These indexes are often traded on exchanges, allowing investors to gain easier access to commodities without having to enter the futures market. The value of these indexes fluctuates based on their underlying commodities, and this value can be traded on an exchange in much the same way as stock index futures.

West Texas Intermediate (WTI) is a grade or mix of crude oil; the term is also used to refer to the spot price, the futures price, or assessed price for that oil. In colloquial usage, WTI usually refers to the WTI Crude Oil futures contract traded on the New York Mercantile Exchange (NYMEX). The WTI oil grade is also known as Texas light sweet. Oil produced from any location can be considered WTI if the oil meets the required qualifications. Spot and futures prices of WTI are used as a benchmark in oil pricing. This grade is described as light crude oil because of its low density and sweet because of its low sulfur content.

A currency future, also known as an FX future or a foreign exchange future, is a futures contract to exchange one currency for another at a specified date in the future at a price that is fixed on the purchase date; see Foreign exchange derivative. Typically, one of the currencies is the US dollar. The price of a future is then in terms of US dollars per unit of other currency. This can be different from the standard way of quoting in the spot foreign exchange markets. The trade unit of each contract is then a certain amount of other currency, for instance €125,000. Most contracts have physical delivery, so for those held at the end of the last trading day, actual payments are made in each currency. However, most contracts are closed out before that. Investors can close out the contract at any time prior to the contract's delivery date.

An interest rate future is a financial derivative with an interest-bearing instrument as the underlying asset. It is a particular type of interest rate derivative.

The Chicago Butter and Egg Board, founded in 1898, was a spin-off entity of the Chicago Produce Exchange. In the year 1919, it was re-organized as the Chicago Mercantile Exchange (CME). Roots of the Chicago Butter and Egg Board are traceable to the 19th century.

The Kansas City Board of Trade (KCBT), was an American commodity futures and options exchange regulated by the Commodity Futures Trading Commission. Specializing in the hard-red winter wheat contract, it was located at 4800 Main Street in Kansas City, Missouri.

Futures exchanges establish a minimum amount that the price of a commodity can fluctuate upward or downward. This minimum fluctuation is known as a tick or commodity tick. Hence, a tick is any fluctuation in the price of a security.

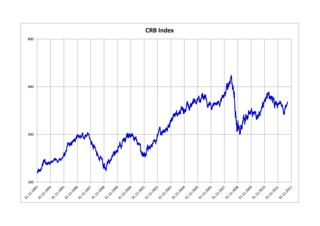

The FTSE/CoreCommodity CRB Index is a commodity futures price index. It was first calculated by Commodity Research Bureau, Inc. in 1957 and made its inaugural appearance in the 1958 CRB Commodity Year Book.

S&P Dow Jones Indices LLC is a joint venture between S&P Global, the CME Group, and News Corp that was announced in 2011 and later launched in 2012. It produces, maintains, licenses, and markets stock market indices as benchmarks and as the basis of investable products, such as exchange-traded funds (ETFs), mutual funds, and structured products. The company currently has employees in 15 cities worldwide, including New York, London, Frankfurt, Singapore, Hong Kong, Sydney, Beijing, and Dubai.

NASDAQ futures are financial futures which launched on June 21, 1999. It is the financial contract futures that allow an investor to hedge with or speculate on the future value of various components of the NASDAQ market index.

Feeder cattle, in some countries or regions called store cattle, are young cattle mature enough either to undergo backgrounding or to be fattened in preparation for slaughter. They may be steers or heifers. The term often implicitly reflects an intent to sell to other owners for fattening (finishing). Backgrounding occurs at backgrounding operations, and fattening occurs at a feedlot. Feeder calves are less than 1 year old; feeder yearlings are between 1 and 2 years old. Both types are often produced in a cow-calf operation. After attaining a desirable weight, feeder cattle become finished cattle that are sold to a packer. Packers slaughter the cattle and sell the meat in carcass boxed form.

Live cattle is a type of futures contract that can be used to hedge and to speculate on fed cattle prices. Cattle producers, feedlot operators, and merchant exporters can hedge future selling prices for cattle through trading live cattle futures, and such trading is a common part of a producer's price risk management program. Conversely, meat packers, and merchant importers can hedge future buying prices for cattle. Producers and buyers of live cattle can also enter into production and marketing contracts for delivering live cattle in cash or spot markets that include futures prices as part of a reference price formula. Businesses that purchase beef as an input could also hedge beef price risk by purchasing live cattle futures contracts.

LME Aluminium stands for a group of spot, forward, and futures contracts, trading on the London Metal Exchange (LME), for delivery of primary Aluminium that can be used for price hedging, physical delivery of sales or purchases, investment, and speculation. Producers, semi-fabricators, consumers, recyclers, and merchants can use Aluminium futures contracts to hedge Aluminium price risks and to reference prices. Notable companies that use LME Aluminium contracts to hedge Aluminium prices include General Motors, Boeing, and Alcoa.

LME Copper stands for a group of spot, forward, and futures contracts, trading on the London Metal Exchange (LME), for delivery of Copper, that can be used for price hedging, physical delivery of sales or purchases, investment, and speculation.

LME Nickel stands for a group of spot, forward, and futures contracts, trading on the London Metal Exchange (LME), for delivery of primary Nickel that can be used for price hedging, physical delivery of sales or purchases, investment, and speculation. Producers, semi-fabricators, consumers, recyclers, and merchants can use Nickel futures contracts to hedge Nickel price risks and to reference prices. As of December 31, 2019, LME Nickel is associated with 153,318 tonnes of physical Nickel stored in 500 LME approved warehouses around the world. This is 5.67% of the 2019 global estimated mined Nickel production of 2.7 million tonnes. Despite the low share of physical Nickel associated with LME Nickel contracts, global physical Nickel transactions are usually based on LME Nickel prices. This practice began in the 1970s to 1982, when producer Nickel prices, especially Canadian producer prices collapsed, and the industry switched to LME prices.

LME Zinc stands for a group of spot, forward, and futures contracts traded on the London Metal Exchange (LME), for delivery of special high-grade Zinc with a 99.995% purity minimum that can be used for price hedging, physical delivery of sales or purchases, investment, and speculation. Producers, semi-fabricators, consumers, recyclers, and merchants can use Zinc futures contracts to hedge Zinc price risks and to reference prices.

References

- ↑ "Livestock Risk Management" . Retrieved 2020-05-06.

- ↑ "CME Lean Hog contract specifications" . Retrieved 2020-05-06.

- ↑ "Historical Intraday Lean Hogs Futures Data (HE/LH/LHA)". PortaraCQG. Retrieved 2022-04-26.

- ↑ Lawrence, John D.; Grimes, Glenn (2007). "Production and marketing characteristics of U.S. pork producers, 2006". Economics Working Papers (2002–2016). Retrieved 2020-05-06.

- ↑ Economic Research Service, USDA. "Hedging in Futures" (PDF). Retrieved 2020-05-06.

- ↑ Mattos, Fabio (2016-02-10). "Commodity Indices and Futures Markets". Cornhusker Economics. Retrieved 2020-05-06.

- ↑ Purcell, Wayne D.; Hudson, Michael A. (1985), "The Economic Roles and Implications of Trade in Livestock Futures" (PDF), in Peck, Anne E. (ed.), Futures Markets: Regulatory Issues, Washington D.C.: American Enterprise Institute for Public Policy Research, pp. 329–376

- ↑ Mattos, Fabio (2016-02-10). "Commodity Indices and Futures Markets". Cornhusker Economics. Retrieved 2020-05-06.