Related Research Articles

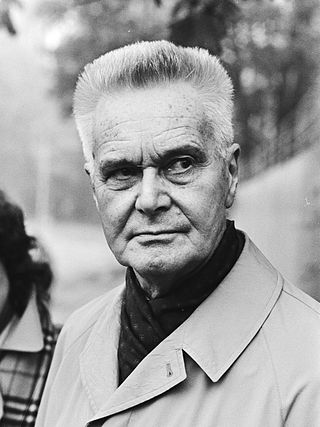

Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference". An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships". Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today.

Jan Tinbergen was a Dutch economist who was awarded the first Nobel Memorial Prize in Economic Sciences in 1969, which he shared with Ragnar Frisch for having developed and applied dynamic models for the analysis of economic processes. He is widely considered to be one of the most influential economists of the 20th century and one of the founding fathers of econometrics.

Sir Clive William John Granger was a British econometrician known for his contributions to nonlinear time series analysis. He taught in Britain, at the University of Nottingham and in the United States, at the University of California, San Diego. Granger was awarded the Nobel Memorial Prize in Economic Sciences in 2003 in recognition of the contributions that he and his co-winner, Robert F. Engle, had made to the analysis of time series data. This work fundamentally changed the way in which economists analyse financial and macroeconomic data.

Cointegration is a statistical property of a collection (X1, X2, ..., Xk) of time series variables. First, all of the series must be integrated of order d (see Order of integration). Next, if a linear combination of this collection is integrated of order less than d, then the collection is said to be co-integrated. Formally, if (X,Y,Z) are each integrated of order d, and there exist coefficients a,b,c such that aX + bY + cZ is integrated of order less than d, then X, Y, and Z are cointegrated. Cointegration has become an important property in contemporary time series analysis. Time series often have trends—either deterministic or stochastic. In an influential paper, Charles Nelson and Charles Plosser (1982) provided statistical evidence that many US macroeconomic time series (like GNP, wages, employment, etc.) have stochastic trends.

William Arnold Barnett is an American economist, whose current work is in the fields of chaos, bifurcation, and nonlinear dynamics in socioeconomic contexts, econometric modeling of consumption and production, and the study of the aggregation problem and the challenges of measurement in economics.

Sir David Forbes Hendry, FBA CStat is a British econometrician, currently a professor of economics and from 2001 to 2007 was head of the Economics Department at the University of Oxford. He is also a professorial fellow at Nuffield College, Oxford.

Neil Shephard, FBA, is an econometrician, currently Frank B. Baird Jr., Professor of Science in the Department of Economics and the Department of Statistics at Harvard University.

Eric Ghysels is a Belgian-American economist with interest in finance and time series econometrics, and in particular the fields of financial econometrics and financial technology. He is the Edward M. Bernstein Distinguished Professor of Economics at the University of North Carolina and a Professor of Finance at the Kenan-Flagler Business School. He is also the Faculty Research Director of the Rethinc.Labs at the Frank Hawkins Kenan Institute of Private Enterprise.

Joshua David Angrist is an Israeli-American economist and Ford Professor of Economics at the Massachusetts Institute of Technology. Angrist, together with Guido Imbens, was awarded the Nobel Memorial Prize in Economics in 2021 "for their methodological contributions to the analysis of causal relationships".

Anil K. Bera is an Indian-American econometrician. He is Professor of Economics at University of Illinois at Urbana–Champaign's Department of Economics. He is most noted for his work with Carlos Jarque on the Jarque–Bera test.

Kenneth David West is the John D. MacArthur and Ragnar Frisch Professor of Economics in the Department of Economics at the University of Wisconsin. He is currently co-editor of the Journal of Money, Credit and Banking, and has previously served as co-editor of the American Economic Review. He has published widely in the fields of macroeconomics, finance, international economics and econometrics. Among his honors are the John M. Stauffer National Fellowship in Public Policy at the Hoover Institution, Alfred P. Sloan Research Fellowship, Fellow of the Econometric Society, and Abe Fellowship. He has been a research associate at the NBER since 1985.

Herman Koene van Dijk is a Dutch economist Consultant at the Research Department of Norges Bank and Professor Emeritus at the Econometric Institute of the Erasmus University Rotterdam, known for his contributions in the field of Bayesian analysis.

Philippus Henricus Benedictus Franciscus "Philip Hans" Franses is a Dutch economist and Professor of Applied Econometrics and Marketing Research at the Erasmus University Rotterdam, and dean of the Erasmus School of Economics, especially known for his 1998 work on "Nonlinear Time Series Models in Empirical Finance."

Apostolos Serletis is a Greek economist who is a Professor of Economics at the University of Calgary.

Christiaan Heij is a Dutch mathematician, Assistant Professor in statistics and econometrics at the Econometric Institute at the Erasmus University Rotterdam, known for his work in the field of mathematical systems theory, and econometrics.

Thomas Lemieux is a Canadian economist and professor at the University of British Columbia.

Douglas W. "Doug" Mitchell was an American economist and polymath who made significant contributions in a wide variety of areas in economics and finance as well as in statistics and mathematics.

Nicole M. Fortin is a Professor in the Vancouver School of Economics (VSE) at University of British Columbia, where she obtained her Ph.D. in Economics. Before moving to Vancouver, B.C. in 1999, Fortin taught at Université de Montréal for ten years in her hometown. She was the President of the Canadian Women Economic Network (CWEN) in 2013–2014. Her research focus is placed on three main themes, including the linkage between labour market institutions and wage inequality, issues related to the economic progress of gender equality, as well as contributions to decomposition methods. Notably, Fortin contributed to the ground-breaking research presented in the 2015 World Happiness Report by examining how various factors impact feelings of happiness for individuals, and societal well-being overall, across the globe.

Xiaohong Chen is a Chinese economist who currently serves as the Malcolm K. Brachman Professor of Economics at Yale University. She is a fellow of the Econometric Society and a laureate of the China Economics Prize. As one of the leading experts in econometrics, her research focuses on econometric theory, Semi/nonparametric estimation and inference methods, Sieve methods, Nonlinear time series, and Semi/nonparametric models. She was elected to the American Academy of Arts and Sciences in 2019.

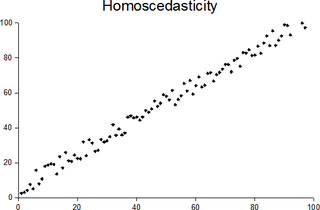

In statistics, a sequence of random variables is homoscedastic if all its random variables have the same finite variance; this is also known as homogeneity of variance. The complementary notion is called heteroscedasticity, also known as heterogeneity of variance. The spellings homoskedasticity and heteroskedasticity are also frequently used. Assuming a variable is homoscedastic when in reality it is heteroscedastic results in unbiased but inefficient point estimates and in biased estimates of standard errors, and may result in overestimating the goodness of fit as measured by the Pearson coefficient.