Accounting, also known as accountancy, is the process of recording and processing information about economic entities, such as businesses and corporations. Accounting measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and "financial reporting" are often used interchangeably.

International Financial Reporting Standards, commonly called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB). They constitute a standardised way of describing the company's financial performance and position so that company financial statements are understandable and comparable across international boundaries. They are particularly relevant for companies with shares or securities publicly listed.

The Financial Accounting Standards Board (FASB) is a private standard-setting body whose primary purpose is to establish and improve Generally Accepted Accounting Principles (GAAP) within the United States in the public's interest. The Securities and Exchange Commission (SEC) designated the FASB as the organization responsible for setting accounting standards for public companies in the U.S. The FASB replaced the American Institute of Certified Public Accountants' (AICPA) Accounting Principles Board (APB) on July 1, 1973. The FASB is run by the nonprofit Financial Accounting Foundation.

The Governmental Accounting Standards Board (GASB) is the source of generally accepted accounting principles (GAAP) used by state and local governments in the United States. As with most of the entities involved in creating GAAP in the United States, it is a private, non-governmental organization.

Generally Accepted Accounting Principles (GAAP or U.S. GAAP or GAAP (USA), pronounced like "gap") is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC) and is the default accounting standard used by companies based in the United States.

Chinese accounting standards are the accounting rules used in mainland China. As of February 2010, the Chinese accounting standard systems is composed of Basic Standard, 38 specific standards and application guidance.

In financial accounting, a cash flow statement, also known as statement of cash flows, is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities. Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. As an analytical tool, the statement of cash flows is useful in determining the short-term viability of a company, particularly its ability to pay bills. International Accounting Standard 7 is the International Accounting Standard that deals with cash flow statements.

An auditor's report is a formal opinion, or disclaimer thereof, issued by either an internal auditor or an independent external auditor as a result of an internal or external audit, as an assurance service in order for the user to make decisions based on the results of the audit.

GASB 34 is a financial accounting standard issued by the Governmental Accounting Standards Board in the United States

In the United States, a permanent fund is one of the five governmental fund types established by GAAP. It is classified as a restricted true endowment fund for governments and non-profit organizations. Put simply, a permanent fund may be used to generate and disburse money to those entitled to receive payments by qualification or agreement, as in the case of Alaska citizens or residents that satisfy the rules for payment from their permanent fund from State oil revenues. It was first introduced through GASB Statement 34. The name of the fund comes from the purpose of the fund: a sum of equity used to permanently generate payments to maintain some financial obligation. Also, a fund can only be classified as a permanent fund if the money is used to report the status of a restricted financial resource. The resource is restricted in the sense that only earnings from the resource are used and not the principal. For example, a fund can be classified as a permanent fund if it is being used to pay for accounting services for a perpetual endowment of a government-run cemetery or financial endowments towards a government-run library.

Accounting for leases in the United States is regulated by the Financial Accounting Standards Board (FASB) by the Financial Accounting Standards Number 13, now known as Accounting Standards Codification Topic 840. These standards were effective as of January 1, 1977. The FASB completed in February 2016 a revision of the lease accounting standard, referred to as ASC 842.

Government financial statements are annual financial statements or reports for the year. The financial statements, in contrast to budget, present the revenue collected and amounts spent. The government financial statements usually include a statement of activities, a balance sheet and often some type of reconciliation. Cash flow statements are often included to show the sources of the revenue and the destination of the expenses.

The Federal Accounting Standards Advisory Board (FASAB) is a United States federal advisory committee whose mission is to improve federal financial reporting through issuing federal financial accounting standards and providing guidance after considering the needs of external and internal users of federal financial information. FASAB is designated as the body that sets U.S. generally accepted accounting principles (GAAP) for the United States Government and its component entities, referred to as federal financial reporting entities. The AICPA Council designated FASAB as the body that establishes GAAP for federal entities in 1999.

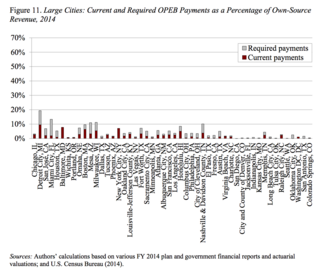

Other postemployment benefits is a term used in the United States to describe the benefits that an employee begins to receive at the start of their retirement. These benefits do not include the pension paid to the retired employee. "Other postemployment benefits" were originally intended to be an important source of supplemental coverage for people on Medicare. Typically this means that if employees retire before the age of 65 they can remain on their employer's health plan. Upon turning 65 they leave their employers plan for Medicare but still receive additional benefits from their employer. These benefits may include health insurance and dental, vision, prescription, or other healthcare benefits provided to eligible retirees and their beneficiaries. They also may include life insurance, disability insurance, long-term care insurance, and other benefits.

GASB 45, or GASB Statement 45, is an accounting and financial reporting provision requiring government employers to measure and report the liabilities associated with postemployment benefits. Reported OPEBs may include post-retirement medical, pharmacy, dental, vision, life, long-term disability and long-term care benefits that are not associated with a pension plan. Government employers required to comply with GASB 45 include all states, towns, education boards, water districts, mosquito districts, public schools, and all other government entities that offer OPEB and report under GASB.

An Annual Comprehensive Financial Report, formerly called Comprehensive Annual Financial Report (CAFR)) is a set of U.S. government financial statements comprising the financial report of a state, municipal or other governmental entity that complies with the accounting requirements promulgated by the Governmental Accounting Standards Board (GASB). GASB provides standards for the content of a Comprehensive Annual Financial Report in its annually updated publication Codification of Governmental Accounting and Financial Reporting Standards. The U.S. Federal Government adheres to standards determined by the Federal Accounting Standards Advisory Board (FASAB).

The Financial Accounting Foundation (FAF) is located in Norwalk, Connecticut, United States. It was organized in 1972 as a non-stock, Delaware Corporation. It is an independent organization in the private sector, operating with the goal of ensuring objectivity and integrity in financial reporting standards. FAF operates four branches in its organization: the Financial Accounting Standards Board (FASB), the Governmental Accounting Standards Board (GASB), the Financial Accounting Standards Advisory Council (FASAC), and the Governmental Accounting Standards Advisory Council (GASAC).

The convergence of accounting standards refers to the goal of establishing a single set of accounting standards that will be used internationally. Convergence in some form has been taking place for several decades, and efforts today include projects that aim to reduce the differences between accounting standards.

International Financial Reporting Standard 1: First-time Adoption of International Financial Reporting Standards or IFRS 1 is an international financial reporting standard issued by the International Accounting Standards Board (IASB). It sets out requirements on the preparation and presentation of financial statements and interim financial reports by entities that are adopting the IFRS for the first time, to ensure that they contain high-quality information.