Related Research Articles

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs).

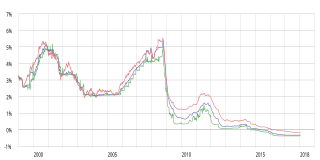

The London Inter-Bank Offered Rate was an interest rate average calculated from estimates submitted by the leading banks in London. Each bank estimated what it would be charged were it to borrow from other banks. It was the primary benchmark, along with the Euribor, for short-term interest rates around the world. Libor was phased out at the end of 2021, with market participants encouraged to transition to risk-free interest rates such as SOFR and SARON.

In finance, a forward rate agreement (FRA) is an interest rate derivative (IRD). In particular it is a linear IRD with strong associations with interest rate swaps (IRSs).

A reference rate is a rate that determines pay-offs in a financial contract and that is outside the control of the parties to the contract. It is often some form of LIBOR rate, but it can take many forms, such as a consumer price index, a house price index or an unemployment rate. Parties to the contract choose a reference rate that neither party has power to manipulate.

In finance, a swap is an agreement between two counterparties to exchange financial instruments, cashflows, or payments for a certain time. The instruments can be almost anything but most swaps involve cash based on a notional principal amount.

National Stock Exchange of India Limited (NSE) is one of the leading stock exchanges in India, based in Mumbai. NSE is under the ownership of various financial institutions such as banks and insurance companies. It is the world's largest derivatives exchange by number of contracts traded for the fifth consecutive year and the third largest in cash equities by number of trades for the calendar year 2023 It is the 7th largest stock exchange in the world by total market capitalization, exceeding $5 trillion on May 23, 2024. NSE's flagship index, the NIFTY 50, is a 50 stock index that is used extensively by investors in India and around the world as a barometer of the Indian capital market. The NIFTY 50 index was launched in 1996 by NSE.

The Euro Interbank Offered Rate (Euribor) is a daily reference rate, published by the European Money Markets Institute, based on the averaged interest rates at which Eurozone banks borrow unsecured funds from counterparties in the euro wholesale money market. Prior to 2015, the rate was published by the European Banking Federation.

Eonia was computed as a weighted average of all overnight unsecured lending transactions in the interbank market, undertaken in the European Union and European Free Trade Association (EFTA) countries by a Panel of banks subject to the Eonia Code of Conduct.

SIBOR stands for Singapore Interbank Offered Rate and is a daily reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks in the Singapore wholesale money market. It is similar to the widely used LIBOR, and Euribor. Using SIBOR is more common in the Asian region and set by the Association of Banks in Singapore (ABS).

An interest rate future is a futures contract with an interest-bearing instrument as the underlying asset. It is a particular type of interest rate derivative. Examples include Treasury-bill futures, Treasury-bond futures and Eurodollar futures.

A term loan is a monetary loan that is repaid in regular payments over a set period of time. Term loans usually last between one and ten years, but may last as long as 30 years. A term loan involves paying interest with the interest amount being added to the amount that needs to be repaid. The interest rate which could fixed or floating is often based on the borrower's credit rating and when floating is often based on a benchmark rate such as EURIBOR, SOFR or a similar benchmark rate.

SONIA is the effective reference for overnight indexed swaps for unsecured transactions in the Sterling market. SONIA is a risk-free rate.

In finance, a currency swap is an interest rate derivative (IRD). In particular it is a linear IRD, and one of the most liquid benchmark products spanning multiple currencies simultaneously. It has pricing associations with interest rate swaps (IRSs), foreign exchange (FX) rates, and FX swaps (FXSs).

The interbank lending market is a market in which banks lend funds to one another for a specified term. Most interbank loans are for maturities of one week or less, the majority being overnight. Such loans are made at the interbank rate. A sharp decline in transaction volume in this market was a major contributing factor to the collapse of several financial institutions during the financial crisis of 2007–2008.

Ashishkumar Chauhan is an Indian business executive and administrator who is currently the Managing Director (MD) and Chief Executive Officer (CEO) of the National Stock Exchange of India (NSE). A technocrat from IIT Bombay and IIM Calcutta, Ashish was a founding member of NSE. Prior to joining NSE back in 2022, he was the Managing Director and Chief Executive Officer of the Bombay Stock Exchange (BSE) for 10 years. Ashish is a member of the University Grants Commission and is the Chancellor of University of Allahabad. He also serves as a member of Governing Council of one of the premier B-Schools in India - IIM Calcutta. Ashish is best known as the father of modern financial derivatives in India, and is considered one of the foremost experts in financial market policies, Information technology, organized retail, telecommunications, cricket and Indian social issues. Ashish has been awarded Lifetime Achievement Award by Global Custodian

SARON stands for Swiss Average Rate Overnight and is a measurement of the overnight interest rate of the secured funding market denominated in Swiss Franc (CHF). It is based on transactions and quotes posted in the Swiss repo market, and is administered by SIX.

The Prague Inter Bank Offered Rate (PRIBOR) is the average rate at which banks are willing to lend liquidity on the Czech interbank money market and as such, reflects the price of money on the market.

The Karachi Interbank Offered Rate (KIBOR) is a daily reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks in the Karachi wholesale money market. The banks used it as a benchmark in their lending to corporate sector.

SOFR Academy, Inc. is a U.S.-based economic education and market information provider. In connection with global reference rate reform and the transition away from the London Interbank Offered Rate (LIBOR), the firm operationalized benchmark credit spreads US-dollar Across-the-curve credit spread indices (AXI) that can be referenced in lending products in conjunction with the Secured Overnight Financing Rate (SOFR) to mitigate mismatches for financial institutions between their assets and liabilities in times of market stress thereby promoting their ability to provide credit.

References

- ↑ "MIBOR (Mumbai Inter-Bank Offered Rate)". Corporate Finance Institute . Retrieved May 18, 2024.

- 1 2 "RBI announces Revised Methodology for Overnight MIBID/MIBOR from July 22, 2015". Reserve Bank of India. July 2, 2015.

- ↑ "Mumbai Inter-Bank Offer Rate (MIBOR)". IndianEconomy.net. November 4, 2017.