Board games are tabletop games that typically use pieces. These pieces are moved or placed on a pre-marked game board and often include elements of table, card, role-playing, and miniatures games as well.

Capitalism is an economic system based on the private ownership of the means of production and their operation for profit. The defining characteristics of capitalism include private property, capital accumulation, competitive markets, price systems, recognition of property rights, self-interest, economic freedom, meritocracy, work ethic, consumer sovereignty, economic efficiency, decentralized decision-making, profit motive, a financial infrastructure of money and investment that makes possible credit and debt, entrepreneurship, commodification, voluntary exchange, wage labor, production of commodities and services, and a strong emphasis on innovation and economic growth. In a market economy, decision-making and investments are determined by owners of wealth, property, or ability to maneuver capital or production ability in capital and financial markets—whereas prices and the distribution of goods and services are mainly determined by competition in goods and services markets.

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities.

Oxford University Press (OUP) is the publishing house of the University of Oxford. It is the largest university press in the world. Its first book was printed in Oxford in 1478, with the Press officially granted the legal right to print books by decree in 1586. It is the second-oldest university press after Cambridge University Press, which was founded in 1534.

A market economy is an economic system in which the decisions regarding investment, production, and distribution to the consumers are guided by the price signals created by the forces of supply and demand. The major characteristic of a market economy is the existence of factor markets that play a dominant role in the allocation of capital and the factors of production.

Joseph Eugene Stiglitz is an American New Keynesian economist, a public policy analyst, political activist, and a professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2001) and the John Bates Clark Medal (1979). He is a former senior vice president and chief economist of the World Bank. He is also a former member and chairman of the US Council of Economic Advisers. He is known for his support for the Georgist public finance theory and for his critical view of the management of globalization, of laissez-faire economists, and of international institutions such as the International Monetary Fund and the World Bank.

Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: asset pricing and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance.

Publishing is the activity of making information, literature, music, software, and other content available to the public for sale or free of charge. Traditionally, the term refers to the creation and distribution of printed works, such as books, comic books, newspapers, and magazines. With the advent of digital information systems, the scope has expanded to include digital publishing such as e-books, digital magazines, websites, social media, music, and video game publishing.

Print on demand (POD) is a printing technology and business process in which book copies are not printed until the company receives an order, allowing prints in single or small quantities. While other industries established the build-to-order business model, POD could only develop after the beginning of digital printing because it was not economical to print single copies using traditional printing technologies such as letterpress and offset printing.

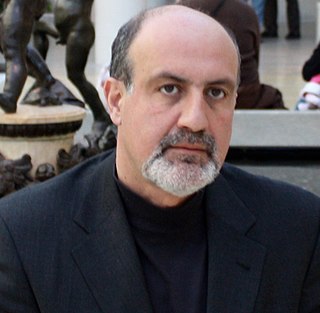

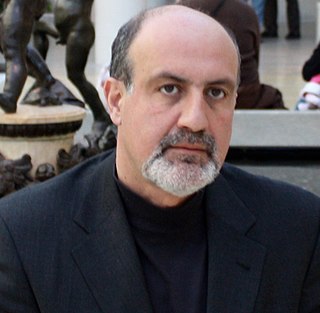

Nassim Nicholas Taleb is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist. His work concerns problems of randomness, probability, complexity, and uncertainty.

"This Little Pig Went to Market" is an English-language nursery rhyme and fingerplay. It has a Roud Folk Song Index number of 19297.

Donald Angus MacKenzie is a Professor of Sociology at the University of Edinburgh, Scotland. His work constitutes a crucial contribution to the field of science and technology studies. He has also developed research in the field of social studies of finance. He has undertaken widely cited work on the history of statistics, eugenics, nuclear weapons, computing and finance, among other things.

Market microstructure is a branch of finance concerned with the details of how exchange occurs in markets. While the theory of market microstructure applies to the exchange of real or financial assets, more evidence is available on the microstructure in the financial field due to the availability of transactions data from them. The major thrust of market microstructure research examines the ways in which the working processes of a market affect determinants of transaction costs, prices, quotes, volume, and trading behavior. In the twenty-first century, innovations have allowed an expansion into the study of the impact of market microstructure on the incidence of market abuse, such as insider trading, market manipulation and broker-client conflict.

In epidemiology, the relative risk reduction (RRR) or efficacy is the relative decrease in the risk of an adverse event in the exposed group compared to an unexposed group. It is computed as , where is the incidence in the exposed group, and is the incidence in the unexposed group. If the risk of an adverse event is increased by the exposure rather than decreased, the term relative risk increase (RRI) is used, and it is computed as . If the direction of risk change is not assumed, the term relative effect is used, and it is computed in the same way as relative risk increase.

Robert James Shiller is an American economist, academic, and author. As of 2022, he served as a Sterling Professor of Economics at Yale University and is a fellow at the Yale School of Management's International Center for Finance. Shiller has been a research associate of the National Bureau of Economic Research (NBER) since 1980, was vice president of the American Economic Association in 2005, its president-elect for 2016, and president of the Eastern Economic Association for 2006–2007. He is also the co‑founder and chief economist of the investment management firm MacroMarkets LLC.

David Michael Garrood Newbery, CBE, FBA, is a British economist who has been Professor of Applied Economics at the University of Cambridge since 1988. He specialises in the field of energy economics, and he writes on the regulation of electricity markets. His interests also include climate change mitigation and environmental policy, privatisation, and risk.

Anilingus is an oral and anal sex act in which one person stimulates the anus of another by using their tongue or lips.

Stephany Griffith-Jones is an economist specializing in international finance and development. Her expertise lies in the reform of the international financial system, particularly in financial regulation, global governance, and international capital flows. Currently, she serves as a member of the Governor Board at the Central Bank of Chile. She has held various positions throughout her career, including financial markets director at the Initiative for Policy Dialogue based at Columbia University, associate fellow at the Overseas Development Institute, and professorial fellow at the Institute of Development Studies at Sussex University.

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field.

Kristin Shrader-Frechette is O'Neill Family Professor, Department of Biological Sciences and Department of Philosophy, at the University of Notre Dame. She has previously held senior professorships at the University of California and the University of Florida. Most of Shrader-Frechette's research work analyzes the ethical problems in risk assessment, public health, or environmental justice - especially those related to radiological, ecological, and energy-related risks.