Citigroup Inc. or Citi is an American multinational investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking giant Citicorp and financial conglomerate Travelers Group in 1998; Travelers was subsequently spun off from the company in 2002. Citigroup owns Citicorp, the holding company for Citibank, as well as several international subsidiaries. Citi is incorporated in NY.

Washington Mutual, Inc—abbreviated to WaMu—was a savings bank holding company and the former owner of WaMu Bank, which was the United States' largest savings and loan association until its collapse in 2008.

Citibank is the consumer division of financial services multinational Citigroup. Citibank was founded in 1812 as the City Bank of New York, and later became First National City Bank of New York. The bank has 2,649 branches in 19 countries, including 723 branches in the United States and 1,494 branches in Mexico operated by its subsidiary Banamex. The U.S. branches are concentrated in six metropolitan areas: New York City, Chicago, Los Angeles, San Francisco, Washington, D.C., and Miami. In 2016, the United States accounted for 70% of revenue and Mexico accounted for 13% of revenue. Aside from the U.S. and Mexico, most of the company's branches are in Poland, Russia, India and the United Arab Emirates.

Bank One Corporation was the sixth-largest bank in the United States. It traded on the New York Stock Exchange under the stock symbol ONE. The company merged with JPMorgan Chase & Co. on July 1, 2004. The company had its headquarters in the Bank One Plaza in the Chicago Loop in Chicago, Illinois, now the headquarters of Chase's retail banking division.

U.S. Bancorp is an American bank holding company based in Minneapolis, Minnesota, and incorporated in Delaware. It is the parent company of U.S. Bank National Association, and is on the list of largest banks in the United States. The company provides banking, investment, mortgage, trust, and payment services products to individuals, businesses, governmental entities, and other financial institutions. It has 3,106 branches and 4,842 ATMs, primarily in the Western and Midwestern United States. It is ranked 117th on the Fortune 500. The company also owns Elavon, a processor of credit card transactions for merchants and Elan Financial Services, a credit card issuer that issue credit card products to US Bank and other financial institutions.

Citizens Financial Group, Inc. is an American bank headquartered in Providence, Rhode Island, which operates in the states of Connecticut, Delaware, Maine, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Ohio, South Carolina, Pennsylvania, Rhode Island and Vermont.

M&T Bank Corporation is an American bank holding company headquartered in Buffalo, New York. It operates 780 branches in New York, New Jersey, Pennsylvania, Maryland, Delaware, Virginia, West Virginia, Washington, D.C., and Connecticut. M&T is ranked 462nd on the Fortune 500. Until May 1998, it was named First Empire State Corporation.

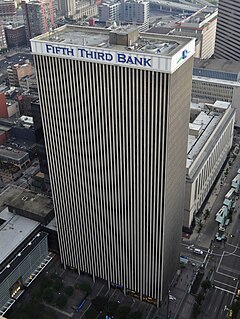

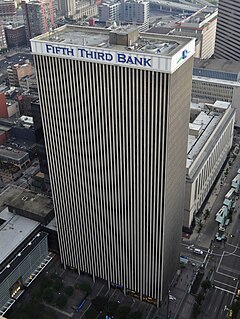

Fifth Third Bank is a bank headquartered in Cincinnati, Ohio, at Fifth Third Center. It is the principal subsidiary of Fifth Third Bancorp, a bank holding company. One of the largest consumer banks in the Midwestern United States, it operates 1,154 branches and 2,469 automated teller machines in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Georgia, and North Carolina. Fifth Third Bank is incorporated in Ohio. It was state-chartered until late 2019, when it obtained a national charter.

PNC Financial Services Group, Inc. is an American bank holding company and financial services corporation based in Pittsburgh, Pennsylvania. Its banking subsidiary, PNC Bank, operates in 19 states and the District of Columbia with 2,459 branches and 9,051 ATMs. The company also provides financial services such as asset management, wealth management, estate planning, loan servicing, and information processing.

SunTrust Banks, Inc. is an American bank holding company with SunTrust Bank as its largest subsidiary and assets of US$199 billion as of March 31, 2018. The bank's most direct corporate parent was established in 1891 in Atlanta, where it was headquartered.

National City Corporation was a regional bank holding company based in Cleveland, Ohio, USA, founded in 1845; it was once one of the ten largest banks in America in terms of deposits, mortgages and home equity lines of credit. Subsidiary National City Mortgage is credited for doing the first mortgage in America. The company operated through an extensive banking network primarily in Ohio, Illinois, Indiana, Kentucky, Michigan, Missouri, Pennsylvania, Florida, and Wisconsin, and also served customers in selected markets nationally. Its core businesses included commercial and retail banking, mortgage financing and servicing, consumer finance, and asset management. The bank reached out to customers primarily through mass advertising and offered comprehensive banking services online. In its last years, the company was commonly known in the media by the abbreviated NatCity, with its investment banking arm even bearing the official name NatCity Investments.

Truist Financial Corp. is an American bank holding company headquartered in Charlotte, North Carolina. The company was formed in December 2019 as the result of the merger of BB&T and SunTrust Banks. Its bank operates 2,049 branches in 15 states and Washington, D.C., and offers consumer and commercial banking, securities brokerage, asset management, mortgage, and insurance products and services. It is on the list of largest banks in the United States by assets. Its subsidiary, McGriff Insurance Services, was one of the largest insurance brokers in the world. In its history, it has made 106 mergers and acquisitions. Since it took over Southern National Bank in 1995, it has made 43 deals.

The National Bank of Detroit (NBD), later renamed NBD Bank, was a bank that operated mostly in the Midwestern United States. Following its merger with First National Bank of Chicago, the bank was ultimately acquired and merged into Bank One, at which point the NBD name was discontinued. Today, what was once NBD is owned by JPMorgan Chase & Co.

Regions Financial Corporation is a bank holding company headquartered in the Regions Center in Birmingham, Alabama. The company provides retail banking and commercial banking, trust, stockbrokerage, and mortgage services. Its banking subsidiary, Regions Bank, operates 1,952 automated teller machines and 1,454 branches in 16 states in the Southern United States and Midwestern United States.

NetBank, formerly named Atlanta Internet Bank (1996) and Net.B@nk (1998), was a direct bank.

Huntington Bancshares Incorporated is a bank holding company headquartered in Columbus, Ohio. The company is ranked 610th on the Fortune 500, and is among the largest banks in the United States.

WesBanco, Inc., is a bank holding company headquartered in Wheeling, West Virginia. It has 236 branches in West Virginia, Ohio, Western Pennsylvania, Kentucky, Maryland and Southern Indiana.

First Guaranty Bank (FGB) is a bank based in Hammond, Louisiana. It is the primary subsidiary of First Guaranty Bancshares, Inc., a bank holding company. The bank operates 21 branches.

Star Banc Corporation was a Cincinnati, Ohio-based regional bank holding company that became Firstar in 1998 and eventually became U.S. Bancorp in 2001. The company can trace its origins back to 1863 when it was first founded as the First National Bank of Cincinnati.

TCF Financial Corporation is a bank holding company based in Detroit, Michigan. The current incarnation of the company was formed by a 2019 merger between the former TCF, which was established in 1923 in Wayzata, Minnesota, and the Michigan-based Chemical Financial Corporation.