Unisys Corporation is an American multinational information technology (IT) services and consulting company founded in 1986 and headquartered in Blue Bell, Pennsylvania. The company provides digital workplace, cloud applications & infrastructure, enterprise computing, business process, AI technology and data analytics services.

The Depository Trust & Clearing Corporation (DTCC) is an American post-trade financial services company providing clearing and settlement services to the financial markets. It performs the exchange of securities on behalf of buyers and sellers and functions as a central securities depository by providing central custody of securities.

SunGard was an American multinational company based in Wayne, Pennsylvania, which provided software and services to education, financial services, and public sector organizations. It was formed in 1983, as a spin-off of the computer services division of Sun Oil Company. The name of the company originally was an acronym which stood for Sun Guaranteed Access to Recovered Data, a reference to the disaster recovery business it helped pioneer. SunGard was ranked at 480th in the U.S. Fortune 500 list in the year 2012.

Euroclear is a Belgium-based financial services company that specialises in the settlement of securities transactions, as well as the safekeeping and asset servicing of these securities. It was founded in 1968 as part of J.P. Morgan & Co. to settle trades on the then developing eurobond market. It is one of two European international central securities depositories.

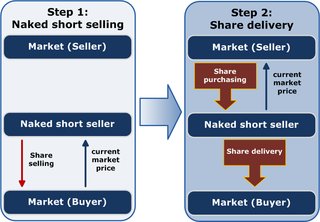

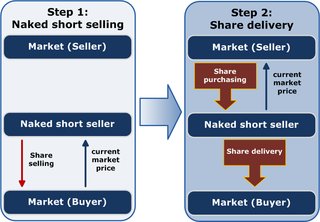

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the asset from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deliver it to the buyer within the required time frame, the result is known as a "failure to deliver" (FTD). The transaction generally remains open until the asset is acquired and delivered by the seller, or the seller's broker settles the trade on their behalf.

Depository Trust Company (DTC), founded in 1973, is a New York corporation that performs the functions of a central securities depository as part of the US National Market System. DTC annually settles transactions worth hundreds of trillions of dollars, processes hundreds of millions of book-entry deliveries, and custodies millions of securities issues worth tens of trillions of dollars issued in the United States and over 100 other countries. Since 1999 it has been a subsidiary of the Depository Trust & Clearing Corporation, a securities holding company.

Fidelity National Information Services, Inc. (FIS) is an American multinational corporation which offers a wide range of financial products and services. FIS is most known for its development of Financial Technology, or FinTech, and as of Q2 2020 it offers its solutions in three primary segments: Merchant Solutions, Banking Solutions, and Capital Market Solutions. Annually, FIS facilitates the movement of roughly $9 trillion through the processing of approximately 75 billion transactions in service to more than 20,000 clients around the globe.

The Bank of New York Mellon Corporation, commonly known as BNY Mellon, is an American banking and financial services corporation headquartered in New York City. The bank offers investment management, investment services, and wealth management services. BNY Mellon was formed from the merger of The Bank of New York and the Mellon Financial Corporation in 2007. It is the world's largest custodian bank and securities services company, with $1.8 trillion in assets under management and $45.7 trillion in assets under custody as of 2023. It is considered a systemically important bank by the Financial Stability Board.

Markit was a British financial information and services company with over 4,000 employees, founded in 2003 as an independent source of credit derivative pricing. The company provides independent data, trade processing of derivatives, foreign exchange and loans, customised technology platforms and managed services. The company aims to enhance transparency, reduce financial risk and improve operational efficiency. Its client base includes institutional participants in the financial marketplace. On 12 July 2016, Markit and IHS Inc. merged in an all-stock merger of equals to form IHS Markit. IHS Markit later merged with S&P Global on 28 February 2022.

Betterment is an American financial advisory company which provides digital investment, retirement and cash management services.

Eagle Investment Systems is an American global provider of financial services technology and a subsidiary of BNY Mellon. Founded in 1989 and based in Wellesley, Massachusetts, Eagle has 15 offices internationally, including offices in Beijing, Chennai, Dubai, London, Montreal, New York City, Pune, San Francisco, Singapore, Sydney and Toronto.

MillenniumIT ESP is a Sri Lankan information technology company that provides enterprise solutions with a portfolio that includes stock exchange systems, infrastructure platforms, cyber security systems, managed services, automation, and cloud services. Headquartered in Colombo, Sri Lanka, MIT ESP also offers industry-specific solutions tailored for banking and finance, telecommunications, government, manufacturing and retail, and commercial sectors.

Quadriserv was a US-based electronic trading platform that helped clients lend and borrow stock for settlement of short sales and other purposes. It was headquartered in New York and was the holding company for its subsidiary, Automated Equity Finance Markets (AQS).

Paysafe Limited is a multinational online payments company. Paysafe offers payment processing, digital wallet and online cash solutions to businesses and consumers, with particular experience of serving the global entertainment sectors. The group offers services both under the Paysafe brand and subsidiary brands that have become part of the group through several mergers and acquisitions, most notably Neteller, Skrill, SafetyPay, PagoEfectivo, Paysafecash and paysafecard.

Synechron Inc. is a New York-based information technology and consulting company focused on the financial services industry including capital markets, insurance, banking, cards & payments and digital.

Thomas W. Farley is an American banker. He serves as the CEO of Far Point Acquisition Corp. He previously served as the president of the NYSE Group, including the New York Stock Exchange.

Murex is a financial services company based in Paris (France), that provides financial software for trading, treasury, risk, and post-trade operations in financial markets.

The ATM Industry Association (ATMIA), originally the ATM Owners Association, was established in 1997 in the United States as a global nonprofit trade association to service an industry that built around the global growth of the ATM.

Securities market participants in the United States include corporations and governments issuing securities, persons and corporations buying and selling a security, the broker-dealers and exchanges which facilitate such trading, banks which safe keep assets, and regulators who monitor the markets' activities. Investors buy and sell through broker-dealers and have their assets retained by either their executing broker-dealer, a custodian bank or a prime broker. These transactions take place in the environment of equity and equity options exchanges, regulated by the U.S. Securities and Exchange Commission (SEC), or derivative exchanges, regulated by the Commodity Futures Trading Commission (CFTC). For transactions involving stocks and bonds, transfer agents assure that the ownership in each transaction is properly assigned to and held on behalf of each investor.

Mark P. Wetjen is an American lawyer. In 2011, he was nominated by Barack Obama to serve a five-year term as a Commissioner of the Commodity Futures Trading Commission (CFTC). He also served for five months as acting chairman of the CFTC upon the departure of his predecessor, Gary Gensler.