Related Research Articles

Berkshire Hathaway Inc. is an American multinational conglomerate holding company headquartered in Omaha, Nebraska. Founded in 1839 as a textile manufacturer, it transitioned into a major conglomerate starting in 1965 under the management of chairman and CEO Warren Buffett and vice chairman Charlie Munger.

Carlos Slim Helú is a Mexican business magnate, investor, and philanthropist. From 2010 to 2013, Slim was ranked as the richest person in the world by Forbes business magazine. He derived his fortune from his extensive holdings in a considerable number of Mexican companies through his conglomerate, Grupo Carso. As of December 2023, the Bloomberg Billionaires Index ranked him as the 11th-richest person in the world, with a net worth of $105 billion or about 7% of Mexico's GDP, making him the richest person in Latin America.

Blackstone Inc. is an American alternative investment management company based in New York City. Blackstone's private equity business has been one of the largest investors in leveraged buyouts in the last three decades, while its real estate business has actively acquired commercial real estate across the globe. Blackstone is also active in credit, infrastructure, hedge funds, secondaries, growth equity, and insurance solutions. As of May 2024, Blackstone has more than US$1 trillion in total assets under management, making it the largest alternative investment firm globally.

Bain Capital, LP is an American private investment firm based in Boston, Massachusetts, with around $185 billion of assets under management. It specializes in private equity, venture capital, credit, public equity, impact investing, life sciences, crypto, tech opportunities, partnership opportunities, special situations, and real estate. Bain Capital invests across a range of industry sectors and geographic regions. The firm was founded in 1984 by partners from the consulting firm Bain & Company. The company is headquartered at 200 Clarendon Street in Boston with 22 offices in North America, Europe, Asia, and Australia.

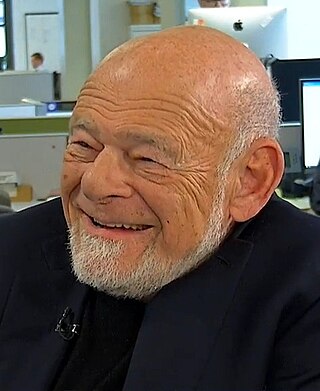

Samuel Zell was an American billionaire businessman and philanthropist primarily engaged in real estate investment. Companies founded by or controlled by Zell include Equity Residential, Equity International, EQ Office, Covanta, Tribune Media, and Anixter.

Babcock & Brown LP was a global investment and advisory firm, established in 1977, based in Sydney, Australia, that went into liquidation in 2009.

Carnegie Investment Bank AB is a Swedish financial services group with activities in securities brokerage, investment banking and private banking.

Don Amancio Ortega Gaona, OMC is a Spanish billionaire businessman. He is the founder and former chairman of Inditex fashion group, best known for its chains of Zara and Bershka clothing and accessories shops. He is considered a pioneer in fast fashion. As of November 2023, Ortega had a net worth of $73 billion, making him the third-wealthiest person in Europe after Bernard Arnault and Francoise Bettencourt Meyers, and the 14th-wealthiest in the world. For a brief period of time in 2015, he was the richest man in the world, surpassing Bill Gates when his net worth peaked to $80 billion as Zara's parent company, Inditex's, stock peaked.

Istithmar World ("istithmar" for "investment" is an investment firm based in Dubai, United Arab Emirates. This company is a state-run business owned by Dubai World, a Dubai government-owned company, and was established in 2003. Originally known as "Istithmar," the company was renamed as "Istithmar World" in 2008.

Bure Equity is a Swedish investment company involved in communications, textiles, training, and education. It is the largest private school operator in Sweden. Bure Equity owns Vittra, a company that runs schools in Sweden and other countries.

The Sweden financial crisis 1990–1994 took place in Sweden when the deflation of a housing bubble caused a severe credit crunch and bank crisis and a deep recession. Similar crises took place in countries around the same time, such as in Finland and the Savings and Loans crisis in the United States. The causes of the crisis were similar to those of the subprime mortgage crisis of 2007–2008. In response, the government took the following actions:

In the United States, the Great Recession was a severe financial crisis combined with a deep recession. While the recession officially lasted from December 2007 to June 2009, it took many years for the economy to recover to pre-crisis levels of employment and output. This slow recovery was due in part to households and financial institutions paying off debts accumulated in the years preceding the crisis along with restrained government spending following initial stimulus efforts. It followed the bursting of the housing bubble, the housing market correction and subprime mortgage crisis.

Elliott Investment Management L.P. is an American investment management firm. It is also one of the largest activist funds in the world.

Christoffel F. Hendrik Wiese is a South African businessman and billionaire. His source of wealth is consumer retail.

Jason Mudrick is an American investment manager who founded and became chief investment officer of Mudrick Capital Management, an investment firm focused on special situations such as distressed securities and deep value event driven investing.

Refaat El-Sayed is a businessman of Egyptian and Swedish nationality. At the beginning of the 1980s, he took command of a small biotech company, Fermenta, which he quickly turned into one of the success stories of the Stockholm stock exchange. El-Sayed soon became Sweden's richest man, and made the fortune of his employees and shareholders. A charismatic leader, he was a favourite of the media, and in December 1985 he was named "Swede of the year" by the TV news program Rapport. The following month, Fermenta announced a partnership with Swedish industrial giant Volvo. El-Sayed was at the peak of his fame.

A balance sheet recession is a type of economic recession that occurs when high levels of private sector debt cause individuals or companies to collectively focus on saving by paying down debt rather than spending or investing, causing economic growth to slow or decline. The term is attributed to economist Richard Koo and is related to the debt deflation concept described by economist Irving Fisher. Recent examples include Japan's recession that began in 1990 and the U.S. recession of 2007-2009.

American Capital, Ltd. was a publicly traded private equity and global asset management firm, trading on NASDAQ under the symbol "ACAS" from 1997 to 2017 and a component of the S&P 500 Index from 2007 to 2009. American Capital was sold to Ares Management in 2017 at a sale price that totaled $4.1 billion. For those investors who bought American Capital stock in its August 29, 1997 IPO, and held their shares through the sale of American Capital on January 3, 2017, they received a 14% compounded annual return including dividends.

Carl-Eric Björkegren was a Swedish director, art collector, and businessman. After a successful career within the steel conglomerate Sandvik AB, he transitioned into the financial industry - leveraging and acquiring real estate, stocks, and art. For many, he was a symbol of the 1980s boom economy. Björkegren was, for a period, one of Sweden's wealthiest individuals and possessed what was described as Sweden's finest private art collection. In the early 1990s, his empire crumbled, and he eventually declared personal bankruptcy with 1.3 billion Swedish kronor in debt. In 1994, he disappeared without a trace. On 11 November 2005, Björkegren was declared dead in absentia by the Stockholm District Court.

References

- 1 2 3 "Maths O. Sundqvist död". Dagens Nyheter (in Swedish). September 23, 2012.

- ↑ Sveriges befolkning 1990. Sundqvist, Maths O.

- 1 2 3 4 LT:s räddare död Archived 2012-09-25 at the Wayback Machine , Resume, September 24, 2012.

- 1 2 "Maths O. Sundqvist hittad död" [Maths O Sundqvist found dead]. Aftonbladet (in Swedish). September 23, 2012.