Denis O'Brien is an Irish billionaire businessman, and the founder and owner of Digicel. He was listed among the World's Top 200 Billionaires in 2015 and was Ireland's richest native-born citizen for a period of several years. His business interests have also extended to aircraft leasing, utilities support (Actavo), petroleum, football, and healthcare. As former chairman of the Esat Digifone consortium, O'Brien was questioned by the Moriarty Tribunal, which investigated the awarding of a mobile phone licence to Esat, among other things.

John Ignatius Quinn, commonly known as Seán Quinn, is an Irish businessman and conglomerateur. In 2008 he was the richest person in the Republic of Ireland, but in 2012 he was declared bankrupt.

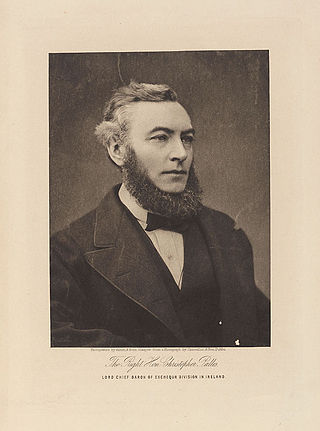

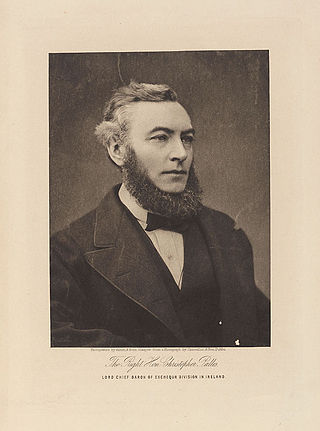

Christopher Palles was an Irish barrister, Solicitor-General, Attorney-General and a judge for over 40 years. His biographer, Vincent Thomas Hyginus Delany, described him as "the greatest of the Irish judges". He served as the last Lord Chief Baron of the Exchequer from 1874 until his retirement from the bench in 1916.

DHN Food Distributors Ltd v Tower Hamlets London Borough Council [1976] 1 WLR 852 is a UK company law case where, on the basis that a company should be compensated for loss of its business under a compulsory acquisition order, a group was recognised as a single economic entity. It stands as a liberal example of when UK courts may lift the veil of incorporation of a company.

Moylist Construction Limited v Doheny, [2016] IESC 9, [2016] 2 IR 283 was an Irish Supreme Court case in which the Supreme Court confirmed the Irish courts’ jurisdiction to strike out (dismiss) weak cases—those it considered “bound to fail."

Irish Life and Permanent plc v Dunne, [2015] IESC 46, [2016] 1 IR 92, was an Irish Supreme Court case in which the Supreme Court clarified the impact of a lender failing to comply with the Code of Conduct on Mortgage Arrears 2010 on that lender's right to obtain an order of possession of mortgaged property.

Nottinghamshire County Council v B[2011] IESC 48; [2013] 4 IR 662 was an Irish Supreme Court case in which the Supreme Court refused to overturn an order of the High Court returning children of married parents from England to that jurisdiction, following a request by the English courts under the Hague Convention on the Civil Aspects of International Child Abduction 1980.

Sivsivadze v Minister for Justice[2015] IESC 53; [2015] 2 ILRM 73; [2016] 2 IR 403 was an Irish Supreme Court case in which the Supreme Court dismissed a challenge to the constitutionality of section 3(1) of the Immigration Act 1999, under which the Minister for Justice order the deportation of a non-national for an indefinite period.

J. McD v P.L and B.M[2007] IESC 28, [2008] ILRM 81 is an Irish Supreme Court case the rights of a sperm donor to access a child born through his donation. The Appellant, who was the biological father, questioned whether he could be a guardian of the infant despite never having had a romantic relationship with the first named respondent who was the mother. The case raised important questions around the Irish legal definition of "family." The case is also important because the Supreme Court over-turned a High Court ruling that had relied on Article 8 of the European Convention of Human Rights.

Bank of Ireland v O'Donnell & ors[2015] IESC 90 is an Irish Supreme Court case that centred around whether the appellants had any right or capacity to bring a motion before the court. They wanted to seek an order of a stay on Mr Justice McGovern's order dated 24 July 2014. In their appeal, they referred to the principle of objective bias and Mr Justice McGovern's refusal to recuse himself. The Supreme Court rejected the application for a stay and held that the law regarding objective bias was clearly stated in the lower court.

Grace and anor v An Bórd Pleanála & ors[2017] IESC 10 is an Irish Supreme Court case in which the Court clarified the criteria for ''standing'' in relation to judicial review of environmental concerns.

N.H.V. v Minister for Justice & Equality [2017] IESC 35 was an Irish Supreme Court case in which the Court upheld a challenge to the absolute prohibition on employment of asylum seekers contained in Section 9(4) of the Refugee Act 1996 and held it to be contrary to the constitutional right to seek employment.

Collins v Minister for Finance[2016] IESC 73; [2017] 1 ILRM 65; [2017] 3 IR 99, is a reported Irish Supreme Court case in which it was held that the Minister for Finance did not breach his power in issuing promissory notes under the Credit Institutions Act 2008, which was found to be constitutional. Collins' appeal was dismissed by the Supreme Court, which concluded that, “a Minister for Finance can spend any amount of money they deem necessary in an emergency without going back to the Dáil and we will be challenging that in the Dáil itself.” The case thus legalised emergency measure to deal with Ireland's financial crisis. This was a case in which "the matters described" were of "national importance."

T(D) v L(F) & Anor, [2003] IESC 59 is a reported Irish Supreme Court case in which the Court held that in relation to foreign divorce proceedings, the burden of proof is on the parties to establish their domicile. Thus, in this case the Supreme Court dismissed the appeal of the husband and upheld the judgement of the High Court as he was unable to establish his domicile.

Bank of Ireland Mortgage Bank v Coleman[2009] IESC 38; [2009] 2 ILRM 363; [2009] 3 IR 699 is an Irish Supreme Court case in which the Court clarified the inherent jurisdiction of the court with respect of a solicitor's misconduct. The court also considered the remedies available where a solicitor is in breach of a solicitor's undertaking.

Hickey v McGowan & ors, [2017] IESC 6 is a reported Irish Supreme Court case decision. This case concerns child abuse and vicarious liability. The second defendant sexually abused the plaintiff in class, in the presence of the other students. This happened at least once a week. Four boys who witnessed the abuse in the class gave evidence, which was accepted by the High Court. It was determined that there must be a "close connection" between the wrongful act and the actions that one had engaged the offender to perform in order for one to be made liable for the act of another.

Permanent TSB Plc v. Langan and Anor, [2017] IESC 71; [2018] 1 I.R. 375, is a reported Irish Supreme Court case decision. The Court allowed the appeal from the Court of Appeal. It was found that the Circuit Court had the authority to conduct possession proceedings in this case.

O'Farrell and Others v Governor of Portlaoise Prison, [2016] IESC 37, [2016] 3 IR 619 is a reported Irish Supreme Court decision. The Court, split four-three dismissed an appeal from the State over the release of three dissident prisoners. According to Section 9 of the Transfer of Sentenced Persons Act 1995, the Court ruled that it did not have the right to increase the prison sentences of three people who had been sent from England to Ireland to finish their sentences. This case is important as it showed a flaw in the way the Irish prison system carried out prison sentences handed down by courts in other countries. This led to the early release of a number of prisoners.

Child and Family Agency v O.A. [2015] IESC 52, also known as Child and Family Agency (Tusla) v OA, is a reported Irish Supreme Court case decision. It was decided that parents should not get an order for costs in the District Court unless there are specific elements in the case at hand. The Supreme Court set up these specific points and ruled that the Circuit Court should only overturn District Court decisions if they do not follow the principles and criteria set out.

Quinn -v- Irish Bank Resolution Corporation Ltd & ors [2015] IESC 29, [2016] 1 IR 1 is a reported Irish Supreme Court case decision. This case involved businessman Sean Quinn and his Family in their dealings with Anglo Irish Bank. This important decision was about whether or not a contract is automatically unenforceable if it is illegal.