Punitive damages, or exemplary damages, are damages assessed in order to punish the defendant for outrageous conduct and/or to reform or deter the defendant and others from engaging in conduct similar to that which formed the basis of the lawsuit. Although the purpose of punitive damages is not to compensate the plaintiff, the plaintiff will receive all or some of the punitive damages in award.

In the United States, antitrust law is a collection of mostly federal laws that regulate the conduct and organization of businesses to promote competition and prevent unjustified monopolies. The three main U.S. antitrust statutes are the Sherman Act of 1890, the Clayton Act of 1914, and the Federal Trade Commission Act of 1914. These acts serve three major functions. First, Section 1 of the Sherman Act prohibits price fixing and the operation of cartels, and prohibits other collusive practices that unreasonably restrain trade. Second, Section 7 of the Clayton Act restricts the mergers and acquisitions of organizations that may substantially lessen competition or tend to create a monopoly. Third, Section 2 of the Sherman Act prohibits monopolization.

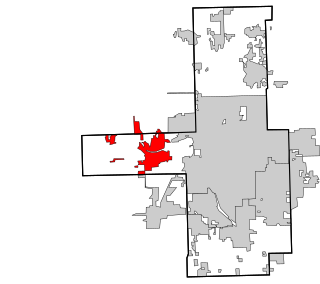

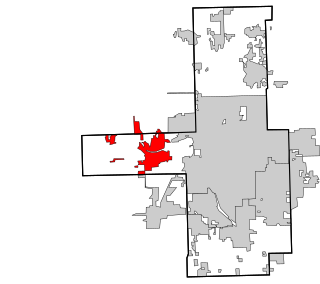

Sand Springs is a city in Osage, Creek and Tulsa counties in the U.S. state of Oklahoma. A western suburb of Tulsa, it is located predominantly in Tulsa County. The population was 19,874 in the 2020 U. S. Census, an increase of 5.1 percent from the figure of 18,906 recorded in 2010.

A declaratory judgment, also called a declaration, is the legal determination of a court that resolves legal uncertainty for the litigants. It is a form of legally binding preventive by which a party involved in an actual or possible legal matter can ask a court to conclusively rule on and affirm the rights, duties, or obligations of one or more parties in a civil dispute. The declaratory judgment is generally considered a statutory remedy and not an equitable remedy in the United States, and is thus not subject to equitable requirements, though there are analogies that can be found in the remedies granted by courts of equity. A declaratory judgment does not by itself order any action by a party, or imply damages or an injunction, although it may be accompanied by one or more other remedies.

An energy derivative is a derivative contract based on an underlying energy asset, such as natural gas, crude oil, or electricity. Energy derivatives are exotic derivatives and include exchange-traded contracts such as futures and options, and over-the-counter derivatives such as forwards, swaps and options. Major players in the energy derivative markets include major trading houses, oil companies, utilities, and financial institutions.

Smith v Hughes (1871) LR 6 QB 597 is an English contract law case. In it, Blackburn J set out his classic statement of the objective interpretation of people's conduct when entering into a contract. The case regarded a mistake made by Mr. Hughes, a horse trainer, who bought a quantity of oats that were the same as a sample he had been shown. However, Hughes had misidentified the kind of oats: his horse could not eat them, and refused to pay for them. Smith, the oat supplier, sued for Hughes to complete the sale as agreed. The court sided with Smith, as he provided the oats Hughes agreed to buy. That Hughes made a mistake was his own fault, as he had not been misled by Smith. Since Smith had made no fault, there was no mutual mistake, and the sale contract was still valid.

Restraints of trade is a common law doctrine relating to the enforceability of contractual restrictions on freedom to conduct business. It is a precursor of modern competition law. In an old leading case of Mitchel v Reynolds (1711) Lord Smith LC said,

it is the privilege of a trader in a free country, in all matters not contrary to law, to regulate his own mode of carrying it on according to his own discretion and choice. If the law has regulated or restrained his mode of doing this, the law must be obeyed. But no power short of the general law ought to restrain his free discretion.

Peevyhouse v. Garland Coal & Mining Co., 382 P.2d 109, is a US contract law case decided by the Supreme Court of Oklahoma. It concerns the question of when specific performance of a contractual obligation will be granted and the measure of expectation damages.

Lefkowitz v. Great Minneapolis Surplus Store, Inc 86 NW 2d 689 is an American contract law case. It concerns the distinction between an offer and an invitation to offer. The case held that a clear, definite, explicit and non-negotiable advertisement constitutes an offer, acceptance of which creates a binding contract. Furthermore, it held that an advertisement which did not clarify the terms of its bargains, such as with fine print, could not then be modified with arbitrary house rules.

Contract law regulates the obligations established by agreement, whether express or implied, between private parties in the United States. The law of contracts varies from state to state; there is nationwide federal contract law in certain areas, such as contracts entered into pursuant to Federal Reclamation Law.

The Gold Clause Cases were a series of actions brought before the Supreme Court of the United States, in which the court narrowly upheld restrictions on the ownership of gold implemented by the administration of U.S. President Franklin D. Roosevelt in response to the Great Depression.

A take-or-pay contract is a rule structuring negotiations between companies and their suppliers. With this kind of contract, the company either takes the product from the supplier or pays the supplier a penalty. For any product the company takes, they agree to pay the supplier a certain price, say $50 per ton. Furthermore, up to an agreed-upon ceiling, the company is required to pay the supplier even for products they do not take. This "penalty" price is lower, say $40 a ton.

Lingenfelder v. Wainwright Brewing Co., 15 S.W. 844 (1891), was a case decided by the Supreme Court of Missouri that held that forgoing a suit for damages for lack of performance on a contract does not constitute consideration for a modification of that contract.

Britton v. Turner, 6 N.H. 481 (1834), was a case decided by the Supreme Court of New Hampshire that marked one of the first appearances of the contract law concept of guilty party restitution.

Weyerhaeuser Company v. Ross-Simmons Hardwood Lumber Company, 549 U.S. 312 (2007), was a United States Supreme Court case related to antitrust regulations.

United States v. Colgate & Co., 250 U.S. 300 (1919), is a United States antitrust law case in which the United States Supreme Court noted that a company has the power to decide with whom to do business. Per the Colgate Doctrine, a company may unilaterally terminate business with any other company without triggering a violation of the antitrust laws.

Gallagher v. Lambert, 143 A.D.2d 313 (1988), was a New York Supreme Court, Appellate Division case between Plaintiff James Gallagher who was a former employee for Benjamin Lambert at Eastdil Realty, Inc. The case involves the scope of contract law in regards to dealing in good faith under employment termination and stock buyback options. The Appellate Division's decision was affirmed by the New York Court of Appeals.

Chicago Options Associates (COA) is a finance company in Chicago, Illinois which specializes in trading options and futures contracts. It was founded in 1987 by Oliver R. W. Pergams and Michael E. Davis. In 1994 Davis was its chief executive officer, hiring then-graduate student Jimmy Wales as research director; Wales served in this position until 1998.

AI Enterprises Ltd v Bram Enterprises Ltd, 2014 SCC 12 was a unanimous decision of the Supreme Court of Canada that standardized Canadian jurisprudence with respect to the economic tort of unlawful means.

Gerald J.P. Stephens v. Paul Flynn Ltd.[2008] IESC 4; [2008] 4 IR 31 was an Irish Supreme Court case in which the Court ruled that, absent special circumstances, a party's failure to deliver a statement of claim within a period of twenty months is inexcusable and will justify dismissal of the litigation.