In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster. There is no official definition of a recession, according to the IMF.

The economy of the United Kingdom is a highly developed social market economy. It is the sixth-largest national economy in the world measured by nominal gross domestic product (GDP), ninth-largest by purchasing power parity (PPP), and twenty-first by nominal GDP per capita, constituting 3.1% of nominal world GDP. The United Kingdom constituted 2.17% of world GDP by purchasing power parity (PPP) in 2024 estimates.

Anatole Kaletsky is an economist and journalist based in the United Kingdom. He has written since 1976 for The Economist, The Financial Times and The Times of London before joining Reuters and The International Herald Tribune in 2012. He has been named Newspaper Commentator of the Year in the BBC's What the Papers Say awards, and has twice received the British Press Award for Specialist Writer of the Year.

Leo Victor Panitch was a Canadian research professor of political science and a Canada Research Chair in comparative political economy at York University.

Capital controls are residency-based measures such as transaction taxes, other limits, or outright prohibitions that a nation's government can use to regulate flows from capital markets into and out of the country's capital account. These measures may be economy-wide, sector-specific, or industry specific. They may apply to all flows, or may differentiate by type or duration of the flow.

Hyman Philip Minsky was an American economist, a professor of economics at Washington University in St. Louis, and a distinguished scholar at the Levy Economics Institute of Bard College. His research attempted to provide an understanding and explanation of the characteristics of financial crises, which he attributed to swings in a potentially fragile financial system. Minsky is sometimes described as a post-Keynesian economist because, in the Keynesian tradition, he supported some government intervention in financial markets, opposed some of the financial deregulation of the 1980s, stressed the importance of the Federal Reserve as a lender of last resort and argued against the over-accumulation of private debt in the financial markets.

Sam Gindin is a Canadian intellectual and activist known for his expertise on the labour movement and the economics of the automobile industry.

Monopoly Capital: An Essay on the American Economic and Social Order is a 1966 book by the Marxian economists Paul Sweezy and Paul A. Baran. It was published by Monthly Review Press. It made a major contribution to Marxian theory by shifting attention from the assumption of a competitive economy to the monopolistic economy associated with the giant corporations that dominate the modern accumulation process. Their work played a leading role in the intellectual development of the New Left in the 1960s and 1970s. As a review in the American Economic Review stated, it represented "the first serious attempt to extend Marx’s model of competitive capitalism to the new conditions of monopoly capitalism." It attracted renewed attention following the Great Recession.

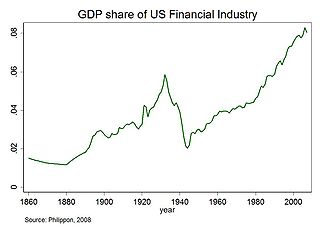

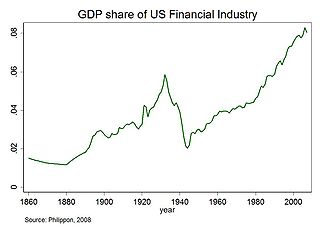

Financialization is a term sometimes used to describe the development of financial capitalism during the period from 1980 to present, in which debt-to-equity ratios increased and financial services accounted for an increasing share of national income relative to other sectors.

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression.

The Ascent of Money: A Financial History of the World is a 2008 book by then-Harvard professor Niall Ferguson, and an adapted television documentary for Channel 4 (UK) and PBS (US), which in 2009 won an International Emmy Award. It examines the long history of money, credit, and banking.

Following the global 2007–2008 financial crisis, there was a worldwide resurgence of interest in Keynesian economics among prominent economists and policy makers. This included discussions and implementation of economic policies in accordance with the recommendations made by John Maynard Keynes in response to the Great Depression of the 1930s, most especially fiscal stimulus and expansionary monetary policy.

The European recession is part of the Great Recession that began in mid-2007. The crisis spread rapidly and affected much of the region, with several countries already in recession as of February 2009, and most others suffering marked economic setbacks. The global recession was first seen in Europe, as Ireland was the first country to fall into recession from Q2-Q3 2007 – followed by temporary growth in Q4 2007 – and then a two-year-long recession.

Naked Capitalism is a liberal American group blog. Susan Webber, the principal of Aurora Advisors Incorporated, a management-consulting firm based in New York City, launched the site in late 2006, using the pen name Yves Smith. She focused on finance and economic news and analysis, with an emphasis on legal and ethical issues of the banking industry and the mortgage foreclosure process, the worldwide effects of the 2007–2008 financial crisis, the Great Recession, and its aftermath. Since 2020, the site has also provided a special, continuing coverage of the COVID-19 pandemic. The site became one of the most highly frequented financial blogs on the Internet and has published a number of noted exposés since.

In the United States, the Great Recession was a severe financial crisis combined with a deep recession. While the recession officially lasted from December 2007 to June 2009, it took many years for the economy to recover to pre-crisis levels of employment and output. This slow recovery was due in part to households and financial institutions paying off debts accumulated in the years preceding the crisis along with restrained government spending following initial stimulus efforts. It followed the bursting of the housing bubble, the housing market correction and subprime mortgage crisis.

Many factors directly and indirectly serve as the causes of the Great Recession that started in 2008 with the US subprime mortgage crisis. The major causes of the initial subprime mortgage crisis and the following recession include lax lending standards contributing to the real-estate bubbles that have since burst; U.S. government housing policies; and limited regulation of non-depository financial institutions. Once the recession began, various responses were attempted with different degrees of success. These included fiscal policies of governments; monetary policies of central banks; measures designed to help indebted consumers refinance their mortgage debt; and inconsistent approaches used by nations to bail out troubled banking industries and private bondholders, assuming private debt burdens or socializing losses.

The 2007–2008 financial crisis, or the global financial crisis (GFC), was the most severe worldwide economic crisis since the Great Depression. Predatory lending in the form of subprime mortgages targeting low-income homebuyers, excessive risk-taking by global financial institutions, a continuous buildup of toxic assets within banks, and the bursting of the United States housing bubble culminated in a "perfect storm", which led to the Great Recession.

Freefall: America, Free Markets, and the Sinking of the World Economy is a book on the causes and consequences of the Great Recession by economist and Nobel laureate Joseph E. Stiglitz, first published in 2010 by W. W. Norton & Company. While focusing on the roots of the financial crisis of 2007–2008 and the subsequent global economic slowdown, which he claims to find mainly in fiscal policy as conducted during the Bush presidency and decisions made by the Federal Reserve, Stiglitz also talks about the failure to cope with the recession during the months succeeding the Wall Street Crash of 2008. Finally, he sketches various schemes as to the possible future of the American economy, vigorously proposing a profound policy shift. In compliance with Stiglitz's general attitude towards economic policy, Freefall contains "proposals to tame the banking sector and to foster a more humanistic style of capitalism in the United States and abroad." According to an assessment written by Larry Elliott for The Guardian, the book "reeks of 'I told you so'." because during the years preceding the crisis, Stiglitz had "warned policy makers repeatedly that the United States was headed toward a deep, painful recession if pre-emptive interventions were not made."

Capital in the Twenty-First Century is a book written by French economist Thomas Piketty. It focuses on wealth and income inequality in Europe and the United States since the 18th century. It was first published in French in August 2013; an English translation by Arthur Goldhammer followed in April 2014.

PostCapitalism: A Guide to Our Future is a 2015 book by British journalist and writer Paul Mason.