Related Research Articles

Larry A. Silverstein is an American businessman. Among his real estate projects, he is the developer of the rebuilt World Trade Center complex in Lower Manhattan, New York City, as well as one of New York's tallest residential towers at 30 Park Place, where he owns a home.

The Vanguard Group, Inc. is an American registered investment advisor founded on May 1, 1975, and based in Malvern, Pennsylvania, with about $9.3 trillion in global assets under management as of May 2024. It is the largest provider of mutual funds and the second-largest provider of exchange-traded funds (ETFs) in the world after BlackRock's iShares. In addition to mutual funds and ETFs, Vanguard offers brokerage services, educational account services, financial planning, asset management, and trust services. Several mutual funds managed by Vanguard are ranked at the top of the list of US mutual funds by assets under management. Along with BlackRock and State Street, Vanguard is considered to be one of the Big Three index fund managers that play a dominant role in corporate America.

Compagnie Financière Richemont S.A., commonly known as Richemont, is a Switzerland-based luxury goods holding company founded in 1988 by South African businessman Johann Rupert. Through its various subsidiaries, Richemont produces and sells jewellery, watches, leather goods, pens, firearms, clothing, and accessories. Richemont is publicly traded as CFR on the SIX Swiss Exchange and the JSE.

In economics, a luxury good is a good for which demand increases more than what is proportional as income rises, so that expenditures on the good become a more significant proportion of overall spending. Luxury goods are in contrast to necessity goods, where demand increases proportionally less than income. Luxury goods is often used synonymously with superior goods.

Amazon China, formerly known as Joyo.com, is an online shopping website. Joyo.com was founded in early 2000 by the Chinese entrepreneur Lei Jun in Beijing, China. The company primarily sold books and other media goods, shipping to customers nationwide. Joyo.com was renamed to “Amazon China” when sold to Amazon Inc in 2004 for US$75 Million. Amazon China closed its domestic business in China in June 2019, offering only products from sellers located overseas.

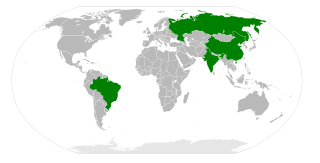

BRIC is a term describing the foreign investment strategies grouping acronym that stands for Brazil, Russia, India, and China. The separate BRICS organisation would go on to become a political and economic organization largely based on such grouping. The grouping has been rendered as "the BRICs", "the BRIC countries", "the BRIC economies", or alternatively as the "Big Four".

Masstige is a marketing term meaning downward brand extension. The word is a portmanteau of the words mass and prestige and has been described as "prestige for the masses".

Coty Inc. is an American multinational beauty company founded in 1904 by François Coty. With its subsidiaries, it develops, manufactures, markets, and distributes fragrances, cosmetics, skin care, nail care, and both professional and retail hair care products. Coty owns around 40 brands as of 2024.

In marketing and financial services, mass affluent and emerging affluent are the high end of the mass market, or individuals with, in 2004 terms, US$100,000 to US$1,000,000 of liquid financial assets plus an annual household income over US$75,000.

IQVIA, formerly Quintiles and IMS Health, Inc., is an American Fortune 500 and S&P 500 multinational company serving the combined industries of health information technology and clinical research. IQVIA is a provider of biopharmaceutical development, professional consulting and commercial outsourcing services, focused primarily on Phase I-IV clinical trials and associated laboratory and analytical services, including investment strategy and management consulting services. It has a network of more than 88,000 employees in more than 100 countries and a market capitalization of US$49 billion as of August 2021. As of 2023, IQVIA was reported to be one of the world's largest contract research organizations (CRO).

Jing Ulrich, née Li (李晶), is Managing Director and the Vice Chairman of Investment Banking at JPMorgan Chase.

Professor Li Huatian (1922–2007) was one of the first few computer scientists in China and was well known for his early contributions to the areas of computer science and computer networks.

The economy of the People's Republic of China is a developing mixed socialist market economy, incorporating industrial policies and strategic five-year plans. China is the world's second largest economy by nominal GDP and since 2017 has been the world's largest economy when measured by purchasing power parity (PPP). China accounted for 19% of the global economy in 2022 in PPP terms, and around 18% in nominal terms in 2022. The economy consists of state-owned enterprises (SOEs) and mixed-ownership enterprises, as well as a large domestic private sector which contribute approximately 60% of the GDP, 80% of urban employment and 90% of new jobs, the system also consist of a high degree of openness to foreign businesses. According to the annual data of major economic indicators released by the National Bureau of Statistics since 1952, China's GDP grew by an average of 6.17% per year in the 26 years from 1953 to 1978. China implemented economic reform in 1978, and from 1979 to 2023, the country's GDP growth rate grew by an average of 8.93% per year in the 45 years since its implementing economic reform. According to preliminary data released by the authorities, China's GDP in 2023 was CN¥126.06 trillion with a real GDP increase of at least 5.2% from 2022.

Xinyuan Real Estate Co., Ltd. is a Chinese real estate company.

The US bear market of 2007–2009 was a 17-month bear market that lasted from October 9, 2007 to March 9, 2009, during the 2007–2008 financial crisis. The S&P 500 lost approximately 50% of its value, but the duration of this bear market was just below average.

Beginning in 2008, many nations of the world enacted fiscal stimulus plans in response to the Great Recession. These nations used different combinations of government spending and tax cuts to boost their sagging economies. Most of these plans were based on the Keynesian theory that deficit spending by governments can replace some of the demand lost during a recession and prevent the waste of economic resources idled by a lack of demand. The International Monetary Fund recommended that countries implement fiscal stimulus measures equal to 2% of their GDP to help offset the global contraction. In subsequent years, fiscal consolidation measures were implemented by some countries in an effort to reduce debt and deficit levels while at the same time stimulating economic recovery.

The Luxury Institute is a premium goods and services research, training and consulting firm based in New York City, New York and Boca Raton, Florida. It has the largest global network of luxury experts. It has conducted more quantitative and qualitative research on affluent consumers than any other entity. Over the last 17 years, the firm has served over 1,100 luxury and premium goods and services brands. The Luxury Institute's reports, as well as CEO Milton Pedraza, have been cited in luxury industry articles by publications including Marketing Week, The Wall Street Journal, Women's Wear Daily, and the CEOWORLD magazine.

Mary Callahan Erdoes is an American investment manager and businesswoman. She is the chief executive officer (CEO) of the asset and wealth management division of J.P. Morgan, serving since 2009. With the firm since 1996, she began her career as a portfolio manager, specializing in fixed income trading. From 2005 to 2009, she served as the CEO of the firm's private bank, advising wealthy families and institutions. Her career has led to her being described as the most powerful woman in American finance. She has been noted as a potential successor to Jamie Dimon, as CEO of JPMorgan Chase.

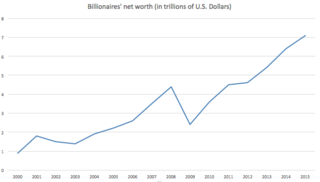

The World's Billionaires is an annual ranking of people who are billionaires, i.e., they are considered to have a net worth of US$1 billion or more, by the American business magazine Forbes. The list was first published in March 1987. The total net worth of each individual on the list is estimated and is cited in United States dollars, based on their documented assets and accounting for debt and other factors. Royalty and dictators whose wealth comes from their positions are excluded from these lists. This ranking is an index of the wealthiest documented individuals, excluding any ranking of those with wealth that is not able to be completely ascertained.

Simon Targett is an English historian, lecturer and freelance journalist. He is a former associate editor of the Financial Times. In March 2018 Barnes & Noble included his book New World, Inc.: The Making of America by England’s Merchant Adventurers, co-written with American business writer John Butman, in its list of best history books of the month.

References

- ↑ Rapoza, Kenneth. "In Auto Market, China Steps On The Gas". Forbes.

- ↑ Seckler, Valerie (20 August 2008). "Q&A: Michael Silverstein". WWD.

- ↑ Fard, Maggie (2012-12-02). "D.C. welcomes its first Costco". The Washington Post. Archived from the original on 2013-04-13.

- ↑ Harris, Melissa (2009-11-08). "Chicago executive Michael Silverstein writes about selling to women, talks about himself". Chicago Tribune. Archived from the original on September 27, 2014.

- ↑ Mead, Rebecca (19 October 2009). "Happy Hunting". The New Yorker.

- ↑ Seelye, Katharine Q. (2005-03-07). "A Flood of Magazines for Those Awash in Cash". The New York Times.

- ↑ "The disappearing mid-market". The Economist. 2006-05-20.

- ↑ Kapner, Suzanne (2009-08-20). "The female economy: What women want". Fortune. Archived from the original on 2009-10-04.

- ↑ Rapoza, Kenneth. "At D11, It's Clear: China Beats U.S. in Mobile & Internet". Forbes.

- ↑ "To Fully Participate in the Emerging $10 Trillion Consumer". Bloomberg Television.