A condominium is an ownership regime in which a building is divided into multiple units that are either each separately owned, or owned in common with exclusive rights of occupation by individual owners. These individual units are surrounded by common areas that are jointly owned and managed by the owners of the units. The term can be applied to the building or complex itself, and is sometimes applied to individual units. The term "condominium" is mostly used in the US and Canada, but similar arrangements are used in many other countries under different names.

Unfair business practices describes a set of practices by businesses which are considered unfair, and which may be unlawful. It includes practices which are covered by other areas of law, such as fraud, misrepresentation, and oppressive or unconscionable contract terms. Protections may be afforded to business-to-business dealings, or may be limited to those dealing as consumers. Regulation of such practices is a departure from traditional views of freedom to agree on contractual terms, summed up in the 1804 French Civil Code as qui dit contractuel dit juste.

A leasehold estate is an ownership of a temporary right to hold land or property in which a lessee or a tenant has rights of real property by some form of title from a lessor or landlord. Although a tenant does hold rights to real property, a leasehold estate is typically considered personal property.

Real estate appraisal, property valuation or land valuation is the process of assessing the value of real property. Real estate transactions often require appraisals because every property has unique characteristics. The location also plays a key role in valuation. Appraisal reports form the basis for mortgage loans, settling estates and divorces, taxation, and so on. Sometimes an appraisal report is used to establish a sale price for a property.

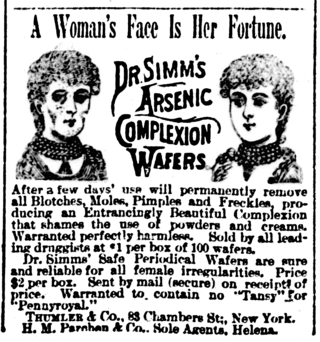

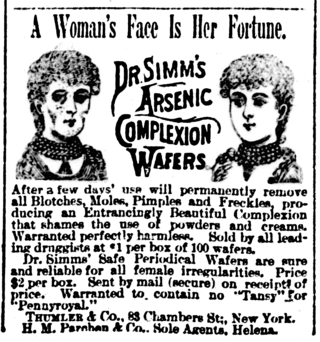

False advertising is the act of publishing, transmitting, distributing, or otherwise publicly circulating an advertisement containing a false claim, or statement, made intentionally to promote the sale of property, goods, or services. A false advertisement can be classified as deceptive if the advertiser deliberately misleads the consumer, rather than making an unintentional mistake. A number of governments use regulations or other laws and methods to limit false advertising.

Property management is the operation, control, maintenance, and oversight of real estate and physical property. This can include residential, commercial, and land real estate. Management indicates the need for real estate to be cared for and monitored, with accountability for and attention to its useful life and condition. This is much akin to the role of management in any business.

The Philadelphia Mint is a branch of the United States Mint in Philadelphia. It was built in 1792 following the Coinage Act of 1792, in order to establish a national identity and the needs of commerce in the United States, and is the first and oldest national mint facility.

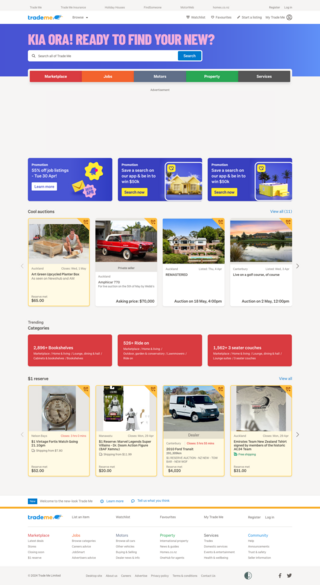

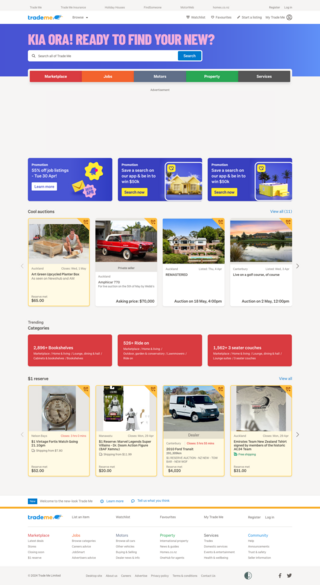

Trade Me is New Zealand's largest online auction and classifieds website. Managed by Trade Me Ltd., the site was founded in 1999 by New Zealand entrepreneur Sam Morgan, who sold it to Fairfax in 2006 for NZ$700 million. Trade Me was publicly listed as a separate entity on 13 December 2011 under the ticker "TME". In May 2019, Trade Me was acquired by private equity firm Apax Partners for NZ$2.56 billion. Trade Me Ltd also operates several sister websites including FindSomeone and Holiday Houses.

A licensed conveyancer is a specialist legal professional in the United Kingdom, New Zealand, Australia or South Africa who has been trained to deal with all aspects of property law.

Misleading or deceptive conduct is a doctrine of Australian law.

Otago Polytechnic is a public New Zealand tertiary education institute, centred in Dunedin with additional campuses in Cromwell and Auckland. Otago Polytechnic provides career-focused education and training, offering a range of New Zealand accredited postgraduate qualifications, degrees, diplomas and certificates at levels 2–10. In November 2022, it became a business unit of the national mega polytechnic Te Pūkenga, ending its existence as an independent entity.

A secured loan is a loan in which the borrower pledges some asset as collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan. The debt is thus secured against the collateral, and if the borrower defaults, the creditor takes possession of the asset used as collateral and may sell it to regain some or all of the amount originally loaned to the borrower. An example is the foreclosure of a home. From the creditor's perspective, that is a category of debt in which a lender has been granted a portion of the bundle of rights to specified property. If the sale of the collateral does not raise enough money to pay off the debt, the creditor can often obtain a deficiency judgment against the borrower for the remaining amount.

Individual fishing quotas (IFQs), also known as "individual transferable quotas" (ITQs), are one kind of catch share, a means by which many governments regulate fishing. The regulator sets a species-specific total allowable catch (TAC), typically by weight and for a given time period. A dedicated portion of the TAC, called quota shares, is then allocated to individuals. Quotas can typically be bought, sold and leased, a feature called transferability. As of 2008, 148 major fisheries around the world had adopted some variant of this approach, along with approximately 100 smaller fisheries in individual countries. Approximately 10% of the marine harvest was managed by ITQs as of 2008. The first countries to adopt individual fishing quotas were the Netherlands, Iceland and Canada in the late 1970s, and the most recent is the United States Scallop General Category IFQ Program in 2010. The first country to adopt individual transferable quotas as a national policy was New Zealand in 1986.

The Commerce Commission is a New Zealand government agency with responsibility for enforcing legislation that relates to competition in the country's markets, fair trading and consumer credit contracts, and regulatory responsibility for areas such as electricity and gas, telecommunications, dairy products and airports. It is an independent Crown entity established under the Commerce Act 1986. Although responsible to the Minister of Commerce and Consumer Affairs and the Minister of Broadcasting, Communications and Digital Media, the Commission is run independently from the government, and is intended to be an impartial promotor and enforcer of the law.

Mary Lord née Hyde was an English Australian woman who in the period 1855 to 1859 sued the Commissioners of the City of Sydney and won compensation for the sum of over £15,600 for the inundation of her property at Botany.

The Fair Trading Act 1986 is a statute of New Zealand, developed as complementary legislation to the Commerce Act 1986. Its purpose is to encourage competition and to protect consumers/customers from misleading and deceptive conduct and unfair trade practices.

The Government House was a Georgian-style mansion at the foot of Broadway, south of Bowling Green, on the site previously occupied by Fort George in Manhattan, New York City. Built in 1790 by the state of New York, it was intended to be the executive mansion for President George Washington, but he never occupied it. Before it was completed, the federal government moved temporarily to Philadelphia; then permanently to Washington, D.C. It then became the state governor’s residence and was used by George Clinton and John Jay. Later it was leased to John Avery and was known as the Elysian Boarding House. After the passage of the Customs Administration Act in 1799, it was converted into the Custom House in New York. Parts of the building were later leased to the American Academy of Arts, who then offered space to the New-York Historical Society in 1809. In 1813, the property was sold to the city. In 1815, the land was sold to the public and the building demolished.

Hay v Chalmers [1991] 3 NZBLC 102,000 was a New Zealand case in which a mechanic made defamatory comments about the plaintiff, and instead of taking defamation action in the courts, a costly and complex action, instead sought compensation instead for misleading conduct under section 9 of the Fair Trading Act 1986, where there are few legal defences.

Prozorro.Sale is a joint-stock company 100% owned by the state represented by the Ministry of Economy of Ukraine. The company is an online electronic auction system of the same name for the sale and lease of property. Prozorro.Sale JSC administers this IT system, which guarantees the bid security, technical reliability and non-interference in auctions.

Narragansett Park was an American horse and motor racing venue in Cranston, Rhode Island.