The Nasdaq Stock Market, also known as Nasdaq, is an American stock exchange located at One Liberty Plaza in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind only the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S. stock and options exchanges.

In finance, being short in an asset means investing in such a way that the investor will profit if the value of the asset falls. This is the opposite of a more conventional "long" position, where the investor will profit if the value of the asset rises.

The Australian Securities Exchange is Australia's primary securities exchange. It is owned by the Australian Securities Exchange Ltd, or ASX Limited, an Australian public company. Prior to December 2006 it was known as the Australian Stock Exchange, which was formed on 1 April 1987, incorporated under legislation of the Australian Parliament as an amalgamation of the six state securities exchanges. It merged with the Sydney Futures Exchange in 2006.

London Stock Exchange is a stock exchange located in the City of London, England. As of April 2018, London Stock Exchange had a market capitalisation of US$4.59 trillion. It was founded in 1571, making it one of the oldest exchanges in the world. Its current premises are situated in Paternoster Square close to St Paul's Cathedral in the City of London. It is part of London Stock Exchange Group (LSEG). London Stock Exchange Group was created in October 2007 when London Stock Exchange merged with Milan Stock Exchange, Borsa Italiana.

Day trading is speculation in securities, specifically buying and selling financial instruments within the same trading day, such that all positions are closed before the market closes for the trading day. Traders who trade in this capacity with the motive of profit are therefore speculators. The methods of quick trading contrast with the long-term trades underlying buy and hold and value investing strategies. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open.

In financial services, a broker-dealer is a natural person, company or other organization that engages in the business of trading securities for its own account or on behalf of its customers. Broker-dealers are at the heart of the securities and derivatives trading process.

An electronic communication network (ECN) is a type of computerized forum or network that facilitates the trading of financial products outside traditional stock exchanges. An ECN is generally an electronic system that widely disseminates orders entered by market makers to third parties and permits the orders to be executed against in whole or in part. The primary products that are traded on ECNs are stocks and currencies. ECNs are generally passive computer-driven networks that internally match limit orders and charge a very small per share transaction fee.

Formally known as an "over-allotment option", a greenshoe is the term commonly used to describe a special arrangement in a share offering, for example an initial public offering (IPO), which enables the investment bank representing the underwriters to support the share price after the offering without putting their own capital at risk. The option is codified as a provision in the underwriting agreement between the leading underwriter - the lead manager - and the issuer or vendor.

A rights issue or rights offer is a dividend of subscription rights to buy additional securities in a company made to the company's existing security holders. When the rights are for equity securities, such as shares, in a public company, it is a non-dilutive(can be dilutive) pro rata way to raise capital. Rights issues are typically sold via a prospectus or prospectus supplement. With the issued rights, existing security-holders have the privilege to buy a specified number of new securities from the issuer at a specified price within a subscription period. In a public company, a rights issue is a form of public offering. Sometimes Right issue can give privileges to people like director, employees those are having some ownership in company to buy the issues.

Front running, also known as tailgating, is the prohibited practice of entering into an equity (stock) trade, option, futures contract, derivative, or security-based swap to capitalize on advance, nonpublic knowledge of a large ("block") pending transaction that will influence the price of the underlying security. In essence, it means the practice of engaging in a Personal Securities Transaction in advance of a transaction in the same security for a client's account. Front running is considered a form of market manipulation in many markets. Cases typically involve individual brokers or brokerage firms trading stock in and out of undisclosed, unmonitored accounts of relatives or confederates. Institutional and individual investors may also commit a front running violation when they are privy to inside information. A front running firm either buys for its own account before filling customer buy orders that drive up the price, or sells for its own account before filling customer sell orders that drive down the price. Front running is prohibited since the front-runner profits from nonpublic information, at the expense of its own customers, the block trade, or the public market.

A financial quotation refers to specific market data relating to a security or commodity. While the term quote specifically refers to the bid price or ask price of an instrument, it may be more generically used to relate to the last price which the security traded at. This may refer to both exchange-traded and over-the-counter financial instruments.

In finance, margin is collateral that the holder of a financial instrument has to deposit with a counterparty to cover some or all of the credit risk the holder poses for the counterparty. This risk can arise if the holder has done any of the following:

An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or cryptocurrency exchange. These instructions can be simple or complicated, and can be sent to either a broker or directly to a trading venue via direct market access. There are some standard instructions for such orders.

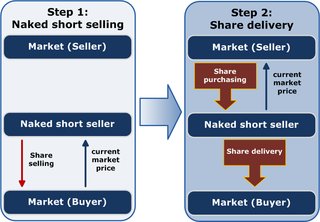

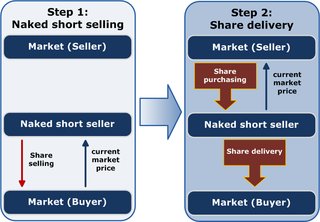

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the security or ensuring that the security can be borrowed, as is conventionally done in a short sale. When the seller does not obtain the shares within the required time frame, the result is known as a "failure to deliver" ("FTD"). The transaction generally remains open until the shares are acquired by the seller, or the seller's broker settles the trade.

Regulation National Market System is a US financial regulation promulgated and described by the United States Securities and Exchange Commission (SEC) as "a series of initiatives designed to modernize and strengthen the National Market System for equity securities". The Reg NMS is intended to assure that investors receive the best (NBBO) price executions for their orders by encouraging competition in the marketplace. Some contend that the rule has contributed to the rise of high-frequency trading,, which is sometimes regarded as controversial.

Microcap stock fraud is a form of securities fraud involving stocks of "microcap" companies, generally defined in the United States as those with a market capitalization of under $250 million. Its prevalence has been estimated to run into the billions of dollars a year. Many microcap stocks are penny stocks, which the SEC defines as a security that trades at less than $5 per share, is not listed on a national exchange, and fails to meet other specific criteria.

In finance, a dark pool is a private forum for trading securities, derivatives, and other financial instruments. Liquidity on these markets is called dark pool liquidity. The bulk of dark pool trades represent large trades by financial institutions that are offered away from public exchanges like the New York Stock Exchange and the NASDAQ, so that such trades remain confidential and outside the purview of the general investing public. The fragmentation of electronic trading platforms has allowed dark pools to be created, and they are normally accessed through crossing networks or directly among market participants via private contractual arrangements. Generally dark pools are not available to the public, but in some cases they may be accessed indirectly by retail investors and traders via retail brokers.

Stock of a corporation, is all of the shares into which ownership of the corporation is divided. In American English, the shares are collectively known as "stock". A single share of the stock represents fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the stockholder to that fraction of the company's earnings, proceeds from liquidation of assets, or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classes of stock may be issued for example without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of shareholders.

Smart order routing (SOR) is an automated process of handling orders, aimed at taking the best available opportunity throughout a range of different trading venues.

Securities market participants in the United States include corporations and governments issuing securities, persons and corporations buying and selling a security, the broker-dealers and exchanges which facilitate such trading, banks which safe keep assets, and regulators who monitor the markets' activities. Investors buy and sell through broker-dealers and have their assets retained by either their executing broker-dealer, a custodian bank or a prime broker. These transactions take place in the environment of equity and equity options exchanges, regulated by the U.S. Securities and Exchange Commission (SEC), or derivative exchanges, regulated by the Commodity Futures Trading Commission (CFTC). For transactions involving stocks and bonds, transfer agents assure that the ownership in each transaction is properly assigned to and held on behalf of each investor.