The Federal Housing Administration (FHA), also known as the Office of Housing within the Department of Housing and Urban Development (HUD), is a United States government agency founded by President Franklin Delano Roosevelt, created in part by the National Housing Act of 1934. The FHA insures mortgages made by private lenders for single-family properties, multifamily rental properties, hospitals, and residential care facilities. FHA mortgage insurance protects lenders against losses. If a property owner defaults on their mortgage, FHA pays a claim to the lender for the unpaid principal balance. Because lenders take on less risk, they are able to offer more mortgages. The goal of the organization is to facilitate access to affordable mortgage credit for low- and moderate-income and first-time homebuyers, for the construction of affordable and market rate rental properties, and for hospitals and residential care facilities in communities across the United States and its territories.

The United States Department of Housing and Urban Development (HUD) is a Cabinet department in the executive branch of the U.S. federal government. Although its beginnings were in the House and Home Financing Agency, it was founded as a Cabinet department in 1965, as part of the "Great Society" program of President Lyndon B. Johnson, to develop and execute policies on housing and metropolises.

The Government National Mortgage Association (GNMA), or Ginnie Mae, is a government-owned corporation of the United States Federal Government within the Department of Housing and Urban Development (HUD). It was founded in 1968 and works to expand affordable housing by guaranteeing housing loans (mortgages) thereby lowering financing costs such as interest rates for those loans. It does that through guaranteeing to investors the on-time payment of mortgage-backed securities (MBS) even if homeowners default on the underlying mortgages and the homes are foreclosed upon.

A reverse mortgage is a mortgage loan, usually secured by a residential property, that enables the borrower to access the unencumbered value of the property. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Borrowers are still responsible for property taxes or homeowner's insurance. Reverse mortgages allow elders to access the home equity they have built up in their homes now, and defer payment of the loan until they die, sell, or move out of the home. Because there are no required mortgage payments on a reverse mortgage, the interest is added to the loan balance each month. The rising loan balance can eventually grow to exceed the value of the home, particularly in times of declining home values or if the borrower continues to live in the home for many years. However, the borrower is generally not required to repay any additional loan balance in excess of the value of the home.

Refinancing is the replacement of an existing debt obligation with another debt obligation under different terms. The terms and conditions of refinancing may vary widely by country, province, or state, based on several economic factors such as inherent risk, projected risk, political stability of a nation, currency stability, banking regulations, borrower's credit worthiness, and credit rating of a nation. In many industrialized nations, a common form of refinancing is for a place of primary residency mortgage.

An FHA insured loan is a US Federal Housing Administration mortgage insurance backed mortgage loan that is provided by an FHA-approved lender. FHA mortgage insurance protects lenders against losses. They have historically allowed lower-income Americans to borrow money to purchase a home that they would not otherwise be able to afford. Because this type of loan is more geared towards new house owners than real estate investors, FHA loans are different from conventional loans in the sense that the house must be owner-occupant for at least a year. Since loans with lower down-payments usually involve more risk to the lender, the home-buyer must pay a two-part mortgage insurance that involves a one-time bulk payment and a monthly payment to compensate for the increased risk. Frequently, individuals "refinance" or replace their FHA loan to remove their monthly mortgage insurance premium. Removing mortgage insurance premium by paying down the loan has become more difficult with FHA loans as of 2013.

Lenders mortgage insurance (LMI), also known as private mortgage insurance (PMI) in the US, is insurance payable to a lender or trustee for a pool of securities that may be required when taking out a mortgage loan. It is insurance to offset losses in the case where a mortgagor is not able to repay the loan and the lender is not able to recover its costs after foreclosure and sale of the mortgaged property. Typical rates are $55/mo. per $100,000 financed, or as high as $125/mo. for a typical $200,000 loan.

The Federal Home Loan Banks are 11 U.S. government-sponsored banks that provide liquidity to the members of financial institutions to support housing finance and community investment.

Canada Mortgage and Housing Corporation (CMHC) is a Crown Corporation of the Government of Canada. It was originally established after World War II, to help returning war veterans find housing. It has since expanded its mandate to improve Canadians' "access to housing". The organization's primary goals are to provide mortgage liquidity, assist in affordable housing development, and provide unbiased research and advice to the Canadian government, and housing industry.

Down payment, is an initial up-front partial payment for the purchase of expensive items/services such as a car or a house. It is usually paid in cash or equivalent at the time of finalizing the transaction. A loan of some sort is then required to finance the remainder of the payment.

Mortgage insurance is an insurance policy which compensates lenders or investors in mortgage-backed securities for losses due to the default of a mortgage loan. Mortgage insurance can be either public or private depending upon the insurer. The policy is also known as a mortgage indemnity guarantee (MIG), particularly in the UK.

The California Housing Finance Agency (CalHFA), established in 1975, is an independent California state agency within the California Department of Housing and Community Development that makes low-rate housing loans through the sale of taxable and tax exempt bonds.

Observers and analysts have attributed the reasons for the 2001–2006 housing bubble and its 2007–10 collapse in the United States to "everyone from home buyers to Wall Street, mortgage brokers to Alan Greenspan". Other factors that are named include "Mortgage underwriters, investment banks, rating agencies, and investors", "low mortgage interest rates, low short-term interest rates, relaxed standards for mortgage loans, and irrational exuberance" Politicians in both the Democratic and Republican political parties have been cited for "pushing to keep derivatives unregulated" and "with rare exceptions" giving Fannie Mae and Freddie Mac "unwavering support".

The United States Housing and Economic Recovery Act of 2008 was designed primarily to address the subprime mortgage crisis. It authorized the Federal Housing Administration to guarantee up to $300 billion in new 30-year fixed rate mortgages for subprime borrowers if lenders wrote down principal loan balances to 90 percent of current appraisal value. It was intended to restore confidence in Fannie Mae and Freddie Mac by strengthening regulations and injecting capital into the two large U.S. suppliers of mortgage funding. States are authorized to refinance subprime loans using mortgage revenue bonds. Enactment of the Act led to the government conservatorship of Fannie Mae and Freddie Mac.

Loan modification is the systematic alteration of mortgage loan agreements that help those having problems making the payments by reducing interest rates, monthly payments or principal balances. Lending institutions could make one or more of these changes to relieve financial pressure on borrowers to prevent the condition of foreclosure. Loan modifications have been practiced in the United States since The 2008 Crash Of The Housing Market from Washington Mutual, Chase Home Finance, Chase, JP Morgan & Chase, other contributors like MER's. Crimes of Mortgage ad Real Estate Staff had long assisted nd finally the squeaky will could not continue as their deviant practices broke the state and crashed. Modification owners either ordered by The United States Department of Housing, The United States IRS or President Obamas letters from Note Holders came to those various departments asking for the Democratic process to help them keep their homes and protection them from explosion. Thus the birth of Modifications. It is yet to date for clarity how theses enforcements came into existence and except b whom, but t is certain that note holders form the Midwest reached out in the Democratic Process for assistance. FBI Mortgage Fraud Department came into existence. Modifications HMAP HARP were also birthed to help note holders get Justice through reduced mortgage by making terms legal. Modification of mortgage terms was introduced by IRS staff addressing the crisis called the HAMP TEAMS that went across the United States desiring the new products to assist homeowners that were victims of predatory lending practices, unethical staff, brokers, attorneys and lenders that contributed to the crash. Modification were a fix to the crash as litigation has ensued as the lenders reorganized and renamed the lending institutions and government agencies are to closely monitor them. Prior to modifications loan holders that experiences crisis would use Loan assumptions and Loan transfers to keep the note in the 1930s. During the Great Depression, loan transfers, loan assumption, and loan bail out programs took place at the state level in an effort to reduce levels of loan foreclosures while the Federal Bureau of Investigation, Federal Trade Commission, Comptroller, the United States Government and State Government responded to lending institution violations of law in these arenas by setting public court records that are legal precedence of such illegal actions. The legal precedents and reporting agencies were created to address the violations of laws to consumers while the Modifications were created to assist the consumers that are victims of predatory lending practices. During the so-called "Great Recession" of the early 21st century, loan modification became a matter of national policy, with various actions taken to alter mortgage loan terms to prevent further economic destabilization. Due to absorbent personal profits nothing has been done to educate Homeowners or Creditors that this money from equity, escrow is truly theirs the Loan Note Holder and it is their monetary rights as the real prize and reason for the Housing Crash was the profit n obtaining the mortgage holders Escrow. The Escrow and Equity that is accursed form the Note Holders payments various staff through the United States claimed as recorded and cashed by all staff in real-estate from local residential Tax Assessing Staff, Real Estate Staff, Ordinance Staff, Police Staff, Brokers, attorneys, lending institutional staff but typically Attorneys who are also typically the owners or Rental properties that are trained through Bankruptcies'. that collect the Escrow that is rightfully the Homeowners but because most Homeowners are unaware of what money is due them and how they can loose their escrow. Most Creditors are unaware that as the note holder that the Note Holder are due an annual or semi annual equity check and again bank or other lending and or legal intuitions staff claim this monies instead. This money Note Holders were unaware of is the prize of real estate and the cause of the Real Estate Crash of 2008 where Lending Institutions provided mortgages to people years prior they know they would eventually loose with Loan holders purchasing Balloon Mortgages lending product that is designed to make fast money off the note holder whom is always typically unaware of their escrow, equity and that are further victimized by conferences and books on HOW TO MAKE MONEY IN REAL STATE - when in fact the money is the Note Holder. The key of the crash was not the House, but the loan product used and the interest and money that was accrued form the note holders that staff too immorally. The immoral and illegal actions of predatory lending station and their staff began with the inception of balloon mortgages although illegal activity has always existed in the arena, yet the crash created "Watch Dog" like HAMP TEAM, IRS, COMPTROLLER< Federal Trade Commission Consumer Protection Bureau, FBI, CIA, Local Police Department, ICE and other watch dog agencies came into existence to examine if houses were purchased through a processed check at Government Debited office as many obtained free homes illegally. Many were incarcerated for such illegal actions. Modifications fixed the Notes to proper lower interest, escrow, tax fees that staff typically raised for no reason. Many people from various arenas involved in reals estate have been incarcerated for these actions as well as other illegal actions like charging for a modification. Additionally Modifications were also made to address the falsifications such as inappropriate mortgage charges, filing of fraudulently deeds, reporting of and at times filing of fraudulent mortgages that were already paid off that were fraudulently continued by lenders staff and attorneys or brokers or anyone in the Real Estate Chain through the issues of real estate terms to continue to violate United States Laws, contract law and legal precedence where collusion was often done again to defraud and steal from the Note Holder was such a common practice that was evidence as to why the Mortgage Crash in 2008 occurred for the purpose of winning the prize of stealing from Homeowners and those that foreclosed was actually often purposefully for these monies note holders were unaware of to be obtained which was why Balloon mortgages and loans were given to the staff in the Real Estate Market with the hope and the expectation that the loan holders would default as it offered opportunity to commit illegal transactions of obtaining the homeowners funds. While such scams were addressed through modifications in 2008. The Market relied heavily on Consumers ignorance to prosper, ignorance of real estate terms, ignorance on what they were to be charged properly for unethical financial gain and while staff in real estates lending arenas mingled terms to deceive y deliberate confusion consumers out of cash and homes while the USA Government provided Justice through President Obama's Inception and IRS Inception of Modifications which addressed these unethical profits in Reals Estate. It was in 2009 that HARP, HAMP and Modifications were introduced to stop the victimization of Note Holders. Taking on the Banks that ran USA Government was a great and dangerous undertaking that made America Great Again as Justice for Consumers reigned. Legal action taken against institutions that have such business practices can be viewed in State Code of Law and Federal Law on precedent cases that are available to the public. Finally, It had been unlawful to be charged by an attorney to modify as well as for banking staff to modify terms to increase a mortgage and or change lending product to a balloon in an concerted effort to make homeowner foreclose which is also illegal, computer fraud and not the governments intended purpose or definition of a modification. There are reputable companies that are trained to assist with foreclosure defense and home retention options. In addition, hud.gov offers a variety of non-profit agencies that offer assistance.

Lend America was a national mortgage banking organization based on Melville, New York. The company used cable television infomercials and toll-free numbers to promote its services which include refinancing of mortgages with fixed-rate loans guaranteed by the Federal Housing Administration.

On December 16, 2003, President George W. Bush signed into law the American Dream Downpayment Initiative, which was aimed at helping approximately "40,000 families a year" with their down payment and closing costs, and further strengthen America’s housing market. This legislation complemented the President's "aggressive housing agenda" announced in a speech he gave at the Department of Housing and Urban Development on June 18, 2002.

PACE financing is a means used in the United States of America of financing energy efficiency upgrades, disaster resiliency improvements, water conservation measures, or renewable energy installations of residential, commercial, and industrial property owners. Depending on state legislation, PACE financing can be used to finance building envelope energy efficiency improvements such as insulation and air sealing, cool roofs, water efficiency products, seismic retrofits, and hurricane preparedness measures. In some states, commercial PACE financing can also fund a portion of new construction projects, as long as the building owner agrees to build the new structure to exceed the local energy code.

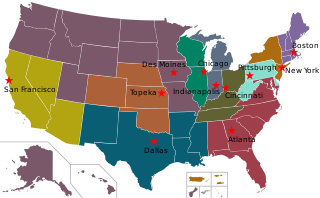

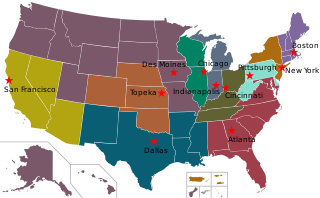

Housing trust funds are established sources of funding for affordable housing construction and other related purposes created by governments in the United States (U.S.). Housing Trust Funds (HTF) began as a way of funding affordable housing in the late 1970s. Since then, elected government officials from all levels of government in the U.S. have established housing trust funds to support the construction, acquisition, and preservation of affordable housing and related services to meet the housing needs of low-income households. Ideally, HTFs are funded through dedicated revenues like real estate transfer taxes or document recording fees to ensure a steady stream of funding rather than being dependent on regular budget processes. As of 2016, 400 state, local and county trust funds existed across the U.S.

The Transportation, Housing and Urban Development, and Related Agencies Appropriations Act, 2015 is an appropriations bill that would provide funding for the United States Department of Transportation and the United States Department of Housing and Urban Development (HUD) for fiscal year 2015.