| Type | Curb-stone stock exchange |

|---|---|

| Location | New York City, United States |

| Founded | 1836 |

| Closed | 1848 |

The New Board was an organization of curb-stone brokers established in 1836 in New York City to compete with the New York Stock and Exchange Board. It folded in 1848. [1]

The first local rival of the New York Stock Exchange (NYSE), the New Board emerged in 1835 [1] among the rough and tumble conditions of the very speculative curb-side trading during the down-turn in the market in general. [2] The "curb" or "outside" trading the exchange used was a system in which "brokers and dealers traded directly with each other in the street near the exchange." [1] This board grew out of a failed attempt of these brokers to work with the Wall Street board. [3]

Bloomberg writes that it formed "in response to an economic boom and the formation of the first railroad corporations." [1] According to historian Robert Sobel, the New Board was the first of a number of alternative set-ups that occurred in New York trading during periods of high volume, succeeding at first, setting up rival organizations and then succumbing during ensuing less bullish times. [3]

At first, the new organization was very successful, growing, while Wall Street was in a general decline. [3] To compete, the NYSE quickly began offering a second daily opportunity to buy or sell securities. [1] After its immediate success and strong rivalry, it declined, with most members going bankrupt within three years of its founding. Nevertheless, it remained larger than the older board until 1845. [3] The New Board's brokers were "crushed" by the Panic of 1837 and the recession that followed. The exchange then faded before folding in 1848. [1]

NYSE American, formerly known as the American Stock Exchange (AMEX), and more recently as NYSE MKT, is an American stock exchange situated in New York City. AMEX was previously a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange.

The Nasdaq Stock Market, also known as Nasdaq or NASDAQ, is an American stock exchange located at One Liberty Plaza in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind only the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S. stock and options exchanges.

The New York Stock Exchange is an American stock exchange located at 11 Wall Street, Lower Manhattan, New York City, New York. It is by far the world's largest stock exchange by market capitalization of its listed companies at US$30.1 trillion as of February 2018. The average daily trading value was approximately US$169 billion in 2013. The NYSE trading floor is located at 11 Wall Street and is composed of 21 rooms used for the facilitation of trading. An additional trading room, located at 30 Broad Street, was closed in February 2007. The main building and the 11 Wall Street building were designated National Historic Landmarks in 1978.

Wall Street is an eight-block-long street in the Financial District of Lower Manhattan in New York City. It runs between Broadway in the west to South Street and the East River in the east. The term "Wall Street" has become a metonym for the financial markets of the United States as a whole, the American financial services industry, New York–based financial interests, or the Financial District itself.

Euronext N.V. is the largest bourse in continental Europe, operating markets in Amsterdam, Brussels, London, Lisbon, Dublin, Oslo and Paris. Euronext had 1,500 listed companies worth €4.1 trillion in market capitalisation as of end July 2019. In addition to cash and derivatives markets, Euronext provides listing market data, market solutions, custody and settlement services. Its total product offering includes equities, exchange-traded funds, warrants and certificates, bonds, derivatives, commodities and indices as well as a foreign exchange trading platform.

Deutsche Börse AG or the Deutsche Börse Group, is a marketplace organizer for the trading of shares and other securities. It is also a transaction services provider. It gives companies and investors access to global capital markets. It is a joint stock company and was founded in 1993. The headquarters are in Frankfurt. As of December 2010, the over 765 companies listed had a combined market capitalization of EUR 1.4 trillion. On 1 October 2014, Deutsche Börse AG became the 14th announced member of the United Nations Sustainable Stock Exchanges initiative.

Broad Street is a north–south street in the Financial District in the New York City borough of Manhattan. It stretches from South Street to Wall Street.

A trading curb is a financial regulatory instrument that is in place to prevent stock market crashes from occurring, and is implemented by the relevant stock exchange organization. Since their inception, circuit breakers have been modified to prevent both speculative gains and dramatic losses within a small time frame. When triggered, circuit breakers either stop trading for a small amount of time or close trading early in order to allow accurate information to flow among market makers and for institutional traders to assess their positions and make rational decisions.

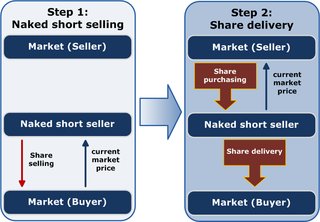

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the security or ensuring that the security can be borrowed, as is conventionally done in a short sale. When the seller does not obtain the shares within the required time frame, the result is known as a "failure to deliver" ("FTD"). The transaction generally remains open until the shares are acquired by the seller, or the seller's broker settles the trade.

NYSE Euronext, Inc. was a Euro-American multinational financial services corporation that operated multiple securities exchanges, including the New York Stock Exchange, Euronext and NYSE Arca. NYSE merged with Archipelago Holdings on March 7, 2006, forming NYSE Group, Inc. On April 4, 2007, NYSE Group, Inc. merged with Euronext N.V. to form the first global equities exchange, with its headquarters in Lower Manhattan. The corporation was then acquired by Intercontinental Exchange, which subsequently spun off Euronext.

The New York Gold Exchange was an exchange formed shortly after the beginning of the American Civil War for the purpose of creating an open market for transactions involving gold and the government-created paper currency, the greenback. Established in 1862, it closed in 1897.

Michael J. Meehan (1891–1948) was a stock trader on Wall St during the 1920s and 1930s. The Securities and Exchange Commission (SEC) forced him out of trading in 1935 as the first individual they prosecuted. During the Great Depression he purchased a controlling stake in the Good Humor ice cream company.

The phrase curbstone broker or curb-stone broker refers to a broker who conducts trading on the literal curbs of a financial district. Such brokers were prevalent in the 1800s and early 1900s, and the most famous curb market existed on Broad Street in the financial district of Manhattan. Curbstone brokers often traded stocks that were speculative in nature, as well as stocks in small industrial companies such as iron, textiles and chemicals. Efforts to organize and standardize the market started early in the 20th century under notable curb-stone brokers such as Emanuel S. Mendels.

Emanuel S. Mendels, Jr. (1850-1911) was an American businessman and broker. He was a leading curbstone broker who organized the Curb Market Agency in 1908 that developed appropriate trading rules for curbstone brokers. Later he formed the New York Curb Market Association, which supervised curb trading in an effort to prevent fraud. The New York Times called him the "father of the curb, writing "he, perhaps more than any other man, worked for the elevation of business done on the [New York curb market]."

Investors Exchange (IEX) is a stock exchange based in the United States. It was founded in 2012 and launched as a national securities exchange in September 2016. On October 24, 2017, IEX received regulatory approval from the SEC to list companies. IEX listed its first public company, Interactive Brokers, on October 5, 2018. The exchange said that companies would be able to list for free for the first five years, before a flat annual rate of $50,000. On September 23, 2019 it announced it was exiting its listing business.

The American Stock Exchange Building, formerly known as the New York Curb Exchange Building and also known as 86 Trinity Place or 123 Greenwich Street, is the former headquarters of the American Stock Exchange. Designed in two sections by Starrett & van Vleck, it is located between Greenwich Street and Trinity Place in the Financial District of Lower Manhattan in New York City, with its main entrance at Trinity Place. The building represents a link to the historical practices of stock trading outside the strictures of the New York Stock Exchange (NYSE), which took place outdoors "on the curb" prior to the construction of the structure.

The Consolidated Stock Exchange of New York, also known as the New York Consolidated Stock Exchange or Consolidated, was a stock exchange in New York City, New York in direct competition to the New York Stock Exchange (NYSE) from 1885–1926. It was formed from the merger of other smaller exchanges, and was referred to in the industry and press as the "Little Board." By its official formation in 1885, its membership of 2403 was considered the second largest membership of any exchange in the United States.

The Open Board of Stock Brokers was an early regional stock exchange in the United States. It was established in 1864, "to profit from the economic and investment boom sparked by the Civil War."

| This article about a financial services corporation of the United States is a stub. You can help Wikipedia by expanding it. |