| Type | Regional stock exchange |

|---|---|

| Location | New Orleans, Louisiana, United States |

| Closed | 1959 |

| Key people | William Huger (early president) |

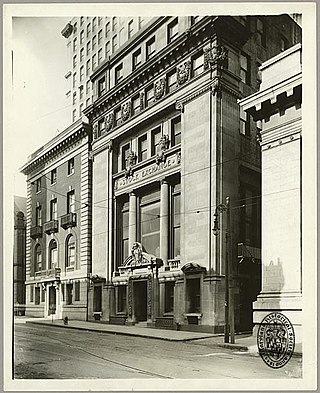

The New Orleans Stock Exchange, or the New-Orleans Stock Exchange, [1] was a regional stock exchange based in New Orleans, Louisiana. [2] As early as 1880, the exchange's sales of stock reached a reported total of $7,891,300. [3] The exchange moved into a new building in 1906, described as the most expensive and artistic structure of its size in the city. At the time, membership was limited to seventy members, with 61 "visiting members." [3] In 1959, the exchange board voted to merge with the Midwest Stock Exchange in Chicago. [4]

In 1880, the exchange's sales of stock reached a reported total of $7,891,300, with 52,609 shares being exchanged. [3] In 1887, the exchange extended its hours to 4 pm due to increased trading volumes. [3] In September 1889, the exchange was reported "paralyzed" after developments in a State bond swindle, with the New York Times reporting that "transactions in [Louisiana] State and city Government securities are at a standstill." [5] As of 1894, Captain William Huger of New Orleans was president of the New-Orleans Stock Exchange. [1]

The New Orleans Stock Exchange moved into a new building in 1906, described as the most expensive and artistic structure of its size in the city, and build of marble and mahogany. At the time, the value of the exchange's membership share had grown from an initial $100 to over $6,000, with membership limited to seventy members. In 1906, there were also provisions for "visiting members," with 61 at the time. [3] On December 14, 1907, a special meeting of the exchange held a unanimous vote to re-open for general business on January 15, 1908. The exchange continued to trade in bonds during the interim, but not stocks. [2]

In August 1914, the New Orleans exchange closed for stock trading due to the outbreak of World War I. [3] The former president of the exchange, Eugene Chassanoil, reportedly shot and killed himself at the exchange on August 14, 1914. The Times reported that the 67-year old had been in ill-health for some time. [6] As of April 1927, Cartwright Eustis served as president of the New Orleans Stock Exchange. [7] In February 1928, the exchange was closed on a Saturday so members could attend the opening of Pontchartrain Bridge. [8] On December 22, 1931, the exchange voted to discontinue the trading of bank stocks. [9]

In October 1933, Louisiana Senator Huey Long was challenged by John Dane of the exchange for calling the New Orleans Stock Exchange a "gambling house," with Dane writing that "our little Exchange in New Orleans is a true investment exchange if there is any such thing in the world." [10] On November 29, 1938, a hearing was set by the SEC in New Orleans for the New Orleans Stock Yards, Inc. to stop listing its $100-par-value common stock on the New Orleans Stock Exchange. [11] The application was granted by the SEC, effective on January 16, 1939. [12]

In April 1941, the New Orleans Stock Exchange was one of 18 eighteen regional stock exchanges that received invitations to "parley" with the SEC on possible amendments to securities laws. [13] The exchange representatives, Fred N. Ogden and Robert R. Wolfe, both attended the conference on April 28, 1941 to discuss proposed amendments to the Securities Act to be presented to Congress that May. [14]

In November 1948, the New Orleans Stock Exchange was invited to take part in meetings concerning the formation of a new Consolidated Regional Exchange, along with representatives from the Cleveland Stock Exchange, Cincinnati Stock Exchange, St. Louis Stock Exchange, Minneapolis-St. Paul Stock Exchange and Chicago Stock Exchange. [15] On January 30, 1958, it was announced that Walter D. Kingston Sr. had been elected president of the New Orleans Stock Exchange. [16] In 1959, the exchange board voted to merge with the Midwest Stock Exchange in Chicago. [4] With the merger, Walter D. Kingston was president of the New Orleans Stock Exchange, with all eligible stocks on the New Orleans exchange transferred to the Midwest exchange. Also, Kingston said that "all transfer agents and registrars [for handling stocks] of New Orleans issues will remain solely in our city, to the benefit of New Orleans banks. Furthermore, all commissions earned by New Orleans members will be retained in our city, due to the Midwest exchange's unique clearing-by-mail plan." Among the companies on the New Orleans exchange at the time were the department store D. H. Holmes, Standard Fruit, New Orleans Public Service, Gulf States Utilities, and others. [4]

NYSE American, formerly known as the American Stock Exchange (AMEX), and more recently as NYSE MKT, is an American stock exchange situated in New York City. AMEX was previously a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange.

The Nasdaq Stock Market is an American stock exchange based in New York City. It is the most active stock trading venue in the US by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges.

The New York Stock Exchange is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed companies at US$30.1 trillion as of February 2018. The average daily trading value was approximately US$169 billion in 2013. The NYSE trading floor is at the New York Stock Exchange Building on 11 Wall Street and 18 Broad Street and is a National Historic Landmark. An additional trading room, at 30 Broad Street, was closed in February 2007.

A ticker symbol or stock symbol is an abbreviation used to uniquely identify publicly traded shares of a particular stock on a particular stock market. In short, ticker symbols are arrangements of symbols or characters representing specific assets or securities listed on a stock exchange or traded publicly. A stock symbol may consist of letters, numbers, or a combination of both. "Ticker symbol" refers to the symbols that were printed on the ticker tape of a ticker tape machine.

NYSE Chicago, formerly known as the Chicago Stock Exchange (CHX), is a stock exchange in Chicago, Illinois, US. The exchange is a national securities exchange and self-regulatory organization, which operates under the oversight of the U.S. Securities and Exchange Commission (SEC). Intercontinental Exchange (ICE) acquired CHX in July 2018 and the exchange rebranded as NYSE Chicago in February 2019.

Pump and dump (P&D) is a form of securities fraud that involves artificially inflating the price of an owned stock through false and misleading positive statements, in order to sell the cheaply purchased stock at a higher price. Once the operators of the scheme "dump" (sell) their overvalued shares, the price falls and investors lose their money. This is most common with small-cap cryptocurrencies and very small corporations/companies, i.e. "microcaps".

The Securities Exchange Act of 1934 is a law governing the secondary trading of securities in the United States of America. A landmark of wide-ranging legislation, the Act of '34 and related statutes form the basis of regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law.

Penny stocks are common shares of small public companies that trade for less than one dollar per share. The U.S. Securities and Exchange Commission (SEC) uses the term "Penny stock" to refer to a security, a financial instrument which represents a given financial value, issued by small public companies that trade at less than $5 per share. Penny stocks are priced over-the-counter, rather than on the trading floor. The term "penny stock" refers to shares that, prior to the SEC's reclassification, traded for "pennies on the dollar". In 1934, when the United States government passed the Securities Exchange Act to regulate any and all transactions of securities between parties which are "not the original issuer", the SEC at the time disclosed that equity securities which trade for less than $5 per share could not be listed on any national stock exchange or index.

The Arizona Stock Exchange (AZX) was an electronically enabled stock exchange for extended-hours trading. It was founded in 1990 as Wunsch Auction Systems by R. Steven Wunsch, and moved from New York City to Arizona in 1992. It closed in October 2001 due to lack of trading volume.

OTC Markets Group is an American financial market providing price and liquidity information for almost 10,000 over-the-counter (OTC) securities. The group has its headquarters in New York City. OTC-traded securities are organized into three markets to inform investors of opportunities and risks: OTCQX, OTCQB and Pink.

Securities fraud, also known as stock fraud and investment fraud, is a deceptive practice in the stock or commodities markets that induces investors to make purchase or sale decisions on the basis of false information, frequently resulting in losses, in violation of securities laws.

A regional stock exchange is a term used in the United States to describe stock exchanges that operate outside of the country's main financial center in New York City. A regional stock exchange operates in the trading of listed and over-the-counter (OTC) equities under the SEC's Unlisted Trading Privileges (UTP) rule.

Microcap stock fraud is a form of securities fraud involving stocks of "microcap" companies, generally defined in the United States as those with a market capitalization of under $250 million. Its prevalence has been estimated to run into the billions of dollars a year. Many microcap stocks are penny stocks, which the SEC defines as a security that trades at less than $5 per share, is not listed on a national exchange, and fails to meet other specific criteria.

The New-York Petroleum Exchange and Stock Board was a resource and stock exchange in New York City. Founded as the New-York Petroleum Exchange, in 1884 the exchange reported oil clearances amounting to 2,373,582,000 barrels, averaging 7,782,000 barrels per day. That year the exchange also began trading in stocks, bonds, and other securities. The institution merged with the competing exchange New-York Mining and National Petroleum Exchange on February 28, 1885, forming the Consolidated Stock and Petroleum Exchange.

The Baltimore Stock Exchange was a regional stock exchange based in Baltimore, Maryland. Opened prior to 1881, The exchange's building was destroyed by the Great Baltimore Fire of 1904, and was then located at 210 East Redwood Street in Baltimore's old financial district. In 1918, the exchange had 87 members, with six or seven members at the time serving the United States in World War I. The Baltimore Stock Exchange was acquired by the Philadelphia Stock Exchange in 1949, becoming the Philadelphia-Baltimore Stock Exchange. The Baltimore Stock Exchange Building was sold and renamed the Totman Building.

The Minneapolis-St. Paul Stock Exchange was a regional stock exchange based in Minnesota, United States. It opened for business in 1929, and merged with the Chicago Stock Exchange in 1949.

The St. Louis Stock Exchange was a regional stock exchange located in St. Louis, Missouri. Opened in 1899, in September 1949, the St. Louis Stock Exchange was acquired by the Chicago Stock Exchange, and renamed the Midwest Stock Exchange.

The Chicago Curb Exchange was an organized securities market and curb exchange located in Chicago, Illinois. It was alternately known as the Chicago Market.

The Holding Foreign Companies Accountable Act is a 2020 law that requires companies publicly listed on stock exchanges in the United States to disclose to the United States Securities and Exchange Commission information on foreign jurisdictions that prevent the Public Company Accounting Oversight Board (PCAOB) from conducting inspections. Under the law, such companies will be banned from trading and delisted from exchanges if the PCAOB is not able to audit specified reports for three consecutive years. The bill requires such companies to declare they are not owned or controlled by Chinese government.

Eugene Chassanoil, aged 67, ex-President of the New Orleans Stock Exchange, shot and killed himself at the Exchange today. He had been in ill-health for some time.

The New Orleans Stock Exchange will close Saturday in order that members may attend the opening of the Pontchartrain Bridge.

The New Orleans Stock Exchange voted today to discontinue trading and bank stocks. An official statement said that while "all stocks of every character have naturally declined in value" without effect upon the operations of the corporations which they represent, "in the case of banks corresponding material declines in stock quotations might have a harmful effect which would be undeserved.

A hearing has been set for Nov. 29 at New Orleans by the Securities and Exchange Commission on an application by New Orleans Stock Yards, Inc., to withdraw its $100-par-value common stock from listing on the New Orleans Stock Exchange. The petitioners set forth, according to the SEC, that on certain days in days in June publication of extremely low bid quotations on the company's common stock caused apprehension among stockholders and delisting is sought to offset the possibility of the recurrence of such a situation.

The Securities and Exchange Commission sent telegrams today to the heads of eighteen regional stock exchanges asking them to send representatives to a conference here on next Friday to discuss possible amendments to the various securities laws it administers.