A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

In finance, a futures contract is a standardized legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price the parties agree to buy and sell the asset for is known as the forward price. The specified time in the future—which is when delivery and payment occur—is known as the delivery date. Because it is a function of an underlying asset, a futures contract is a derivative product.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

The New York Board of Trade, is a physical commodity futures exchange located in New York City. It is a wholly owned subsidiary of Intercontinental Exchange (ICE).

The London International Financial Futures and Options Exchange was a futures exchange based in London. In 2014, following a series of takeovers, LIFFE became part of Intercontinental Exchange, and was renamed ICE Futures Europe.

ICE Futures Canada (IFCA)—known as the Winnipeg Commodity Exchange (WCE) until 2008—was a derivatives market based in Winnipeg, Manitoba, and was Canada's only commodity futures exchange.

The New York Cotton Exchange (NYCE) is a commodities exchange founded in 1870 by a group of one hundred cotton brokers and merchants in New York City. In 1998, the New York Board of Trade (NYBOT) became the parent company of the New York Cotton Exchange, and it is now owned by IntercontinentalExchange (ICE).

Euronext Lisbon is a stock exchange in Lisbon, Portugal. It is part of Euronext pan-European exchange.

Coffee is a popular beverage and an important commodity. Tens of millions of small producers in developing countries make their living growing coffee. Over 2.25 billion cups of coffee are consumed in the world daily. Over 90 percent of coffee production takes place in developing countries—mainly South America—while consumption happens primarily in industrialized economies. There are 25 million small producers who rely on coffee for a living worldwide. In Brazil, where almost a third of the world's coffee is produced, over five million people are employed in the cultivation and harvesting of over three billion coffee plants; it is a more labour-intensive culture than alternative cultures of the same regions, such as sugar cane or cattle, as its cultivation is not automated, requiring frequent human attention.

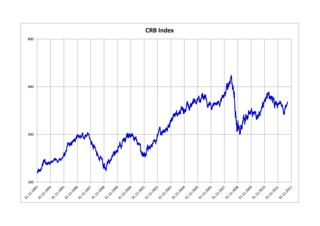

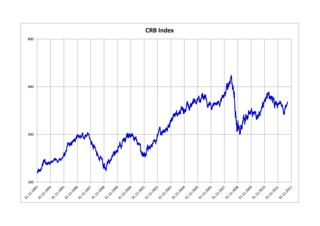

The Refinitiv/CoreCommodity CRB Index is a commodity futures price index. It was first calculated by Commodity Research Bureau, Inc. in 1957 and made its inaugural appearance in the 1958 CRB Commodity Year Book.

The Intercontinental Exchange (ICE) is an American Fortune 500 company formed in 2000 that operates global exchanges, clearing houses and provides mortgage technology, data and listing services. The company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and OTC energy, credit and equity markets.

The Coffee, Sugar and Cocoa Exchange (CSCE) was founded in 1882 as the Coffee Exchange in the City of New York. Sugar futures were added in 1914, and, on September 28, 1979, the New York Coffee and Sugar Exchange merged with the New York Cocoa Exchange to form CSCE. In 1998, CSCE merged with the New York Cotton Exchange as subsidiaries of the New York Board of Trade (NYBOT). The CSCE operates as an independent unit of NYBOT trading futures and options on coffee, sugar and cocoa and the S&P Commodity Index. Trading is by open outcry, from 8 a.m. to 2:45 p.m., Monday through Friday. In January 2007, NYBOT merged with IntercontinentalExchange (ICE) and became a wholly owned subsidiary of ICE.

Sucden is a French-based commodity broker of soft commodities and other financial products headquartered in Paris. It started as a sugar broker where it is amongst the world leaders with a market share of around 15% in volume in as of 2016, or 9.5 million tonnes. It has offices in a number of countries around the world, including London and Hong Kong.

Armajaro Asset Management is a commodity investment firm based in London. The company specializes within the cocoa and coffee markets, managing investments in soft commodity hedge funds. Armajaro is run by Anthony Ward.

ICE Clear Credit LLC, a Delaware limited liability company, is a Derivatives Clearing Organisation (DCO) previously known as ICE Trust US LLC which was launched in March 2009. ICE offers trade execution and processing for the credit derivatives markets through Creditex and clearing through ICE Trust™. ICE Clear Credit LLC operates as a central counterparty (CCP) and clearinghouse for credit default swap (CDS) transactions conducted by its participants. ICE Clear Credit LLC is a subsidiary of IntercontinentalExchange (ICE). ICE Clear Credit LLC is a wholly owned subsidiary of ICE US Holding Company LP which is "organized under the law of the Cayman Islands but has consented to the jurisdiction of United States courts and government agencies with respect to matters arising out of federal banking laws."

Mondelez International, Inc., often stylized as Mondelēz, is an American multinational confectionery, food, holding and beverage and snack food company based in Chicago, Illinois. Mondelez has an annual revenue of about $26 billion and operates in approximately 160 countries. It ranked No. 108 in the 2021 Fortune 500 list of the largest United States corporations by total revenue.

Cocoa Exchange may refer to:

A clearing house is a financial institution formed to facilitate the exchange of payments, securities, or derivatives transactions. The clearing house stands between two clearing firms. Its purpose is to reduce the risk of a member firm failing to honor its trade settlement obligations.