Notes

This section is empty.You can help by adding to it.(July 2010) |

This page summarizes projects that propose to bring more than 20,000 barrels per day (3,200 m3/d) of new liquid fuel capacity to market with the first production of fuel beginning in 2018. This is part of the Wikipedia summary of Oil Megaprojects.

| Overview | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Country | Project Name | Year startup | Operator | Area | Type | Grade | 2P resvs | GOR | Peak Year | Peak | Discovery | Capital Inv. | Notes | Ref |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| OPEC | ||||||||||||||

| Iran | South Pars Ph 19 | 2018 | PetroPars, IOEC | Offshore | Condensate | 77 | ||||||||

| Non-OPEC | ||||||||||||||

| Canada | Kearl Mine Ph 2 | 2018 | Imperial/ExxonMobil | LAND | Bitumen | Oil Sands | 100 | Application | ||||||

| Canada | Long Lake Upgrader Ph 4 | 2018 | OPTI /Nexen | LAND | Bitumen | Oil Sands | 0 | Mining, Upgrading, No FID, 60 kbd | [3] | |||||

| Canada | Sunrise Ph 4 | 2018 | Husky Energy | Oil Sands | Bitumen | 1.0-2.2 | 0 | suspended 50 kbd | SAGD | [4] [5] [6] | ||||

| Canada | Gregoire Lake (Phase 2) | 2018 | CNRL | LAND | Bitumen | Oil Sands | 30 | In-Situ, Announced | [2] | |||||

This section is empty.You can help by adding to it.(July 2010) |

Oil sands, also known as tar sands or crude bitumen, or more technically bituminous sands, are a type of unconventional petroleum deposit. Oil sands are either loose sands or partially consolidated sandstone containing a naturally occurring mixture of sand, clay, and water, saturated with a dense and extremely viscous form of petroleum technically referred to as bitumen.

The Athabasca oil sands are large deposits of bitumen or extremely heavy crude oil, located in northeastern Alberta, Canada – roughly centred on the boomtown of Fort McMurray. These oil sands, hosted primarily in the McMurray Formation, consist of a mixture of crude bitumen, silica sand, clay minerals, and water. The Athabasca deposit is the largest known reservoir of crude bitumen in the world and the largest of three major oil sands deposits in Alberta, along with the nearby Peace River and Cold Lake deposits.

Husky Energy Inc. is a Canadian-based integrated energy company, headquartered in Calgary, Alberta. Its common shares are publicly traded on the Toronto Stock Exchange under the symbol HSE. The Company operates in Western and Atlantic Canada, the United States and the Asia Pacific Region, with Upstream and Downstream business segments. Husky Energy is controlled by Hong Kong billionaire Li Ka-Shing who owns a majority share of approximately 70% according to Bloomberg and Financial Post data.

Shell Canada Limited is the subsidiary of Anglo-Dutch Royal Dutch Shell and one of Canada's largest integrated oil companies. Exploration and production of oil, natural gas and sulphur is a major part of its business, as well as the marketing of gasoline and related products through the company's approximately 1,800 stations across Canada.

Unconventional oil is petroleum produced or extracted using techniques other than the conventional method. Oil industries and governments across the globe are investing in unconventional oil sources due to the increasing scarcity of conventional oil reserves. Unconventional oil and gas have already made a dent in international energy linkages by reducing US energy import dependency

BP Canada Energy Group ULC, is a Canadian oil and gas company headquartered in Calgary, Alberta, and a subsidiary of BP plc.

Suncor Energy is a Canadian integrated energy company based in Calgary, Alberta. It specializes in production of synthetic crude from oil sands. Suncor ranks number 134 in the Forbes Global 2000 list.

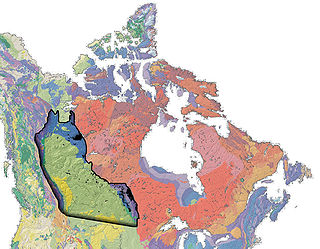

The Western Canadian Sedimentary Basin (WCSB) is a vast sedimentary basin underlying 1,400,000 square kilometres (540,000 sq mi) of Western Canada including southwestern Manitoba, southern Saskatchewan, Alberta, northeastern British Columbia and the southwest corner of the Northwest Territories. It consists of a massive wedge of sedimentary rock extending from the Rocky Mountains in the west to the Canadian Shield in the east. This wedge is about 6 kilometres (3.7 mi) thick under the Rocky Mountains, but thins to zero at its eastern margins. The WCSB contains one of the world's largest reserves of petroleum and natural gas and supplies much of the North American market, producing more than 16,000,000,000 cubic feet (450,000,000 m3) per day of gas in 2000. It also has huge reserves of coal. Of the provinces and territories within the WCSB, Alberta has most of the oil and gas reserves and almost all of the oil sands.

Canada's oil sands and heavy oil resources are among the world's great petroleum deposits. They include the vast oil sands of northern Alberta, and the heavy oil reservoirs that surround the small city of Lloydminster, which sits on the border between Alberta and Saskatchewan. The extent of these resources is well known, but better technologies to produce oil from them are still being developed.

The Kearl Oil Sands Project is an oil sands mine in the Athabasca Oil Sands region at the Kearl Lake area, about 70 kilometres (43 mi) north of Fort McMurray in Alberta, Canada. The project is being developed in three phases with the first phase completed mid-2013.

Oil shale economics deals with the economic feasibility of oil shale extraction and processing. Although usually oil shale economics is understood as shale oil extraction economics, the wider approach evaluates usage of oil shale as whole, including for the oil-shale-fired power generation and production of by-products during retorting or shale oil upgrading processes.

Following is a list of Oil megaprojects in the year 2010, projects that propose to bring more than 20,000 barrels per day (3,200 m3/d) of new liquid fuel capacity to market with the first production of fuel. This is part of the Wikipedia summary of Oil Megaprojects.

This page summarizes projects that propose to bring more than 20,000 barrels per day (3,200 m3/d) of new liquid fuel capacity to market, with the first production of fuel beginning in 2012. This is part of the Wikipedia summary of oil megaprojects.

This page summarizes projects that propose to bring more than 20,000 barrels per day (3,200 m3/d) of new liquid fuel capacity to market, with the first production of fuel beginning in 2013. This is part of the Wikipedia summary of oil megaprojects.

This page summarizes projects that propose to bring more than 20,000 barrels per day (3,200 m3/d) of new liquid fuel capacity to market with the first production of fuel beginning in 2014. This is part of the Wikipedia summary of Oil Megaprojects.

This page summarizes projects that propose to bring more than 20,000 barrels per day (3,200 m3/d) of new liquid fuel capacity to market with the first production of fuel beginning in 2016. This is part of the Wikipedia summary of Oil Megaprojects.

Japan Canada Oil Sands Limited (JACOS) is an oil sands extraction company. It is the operator of the Hangingstone oil sands project. JACOS is a subsidiary of JAPEX.

This page summarizes projects that propose to bring more than 20,000 barrels per day (3,200 m3/d) of new liquid fuel capacity to market with the first production of fuel beginning in 2020. This is part of the Wikipedia summary of Oil Megaprojects.

Although there are numerous oil companies operating in Canada, the majority of production, refining and marketing is done by fewer than 20 of them. According to the 2013 edition of Forbes Global 2000, canoils.com and any other list that emphasizes market capitalization and revenue when sizing up companies, as of March 31, 2014 these are the largest Canada-based oil and gas companies. However more recent changes, possibly mergers or a stronger showing in the price of oil could mean a few of the oil sands producers are underrepresented; this is because Canadian companies are increasingly dependent on production from that source, which is hurt severely when oil prices decline below 50 to 60 dollars a barrel since costs per barrel traditionally exceed $28 and non-upgraded bitumen produces 1.7 fewer barrels per metric ton than West Texas Intermediate oil. A few of the larger companies don't show up in the Forbes list because its ranking system takes many different factors into account. Syncrude and Irving Oil are also leaders in the Canadian industry, with Syncrude being the top producer of oil sands crude and Irving Oil operating the largest oil refinery in the country. Also, based on the price paid for a 9% share in Syncrude Canada Ltd by Sinopec the company could be worth as much as US$50 billion. Canadian oil company profits quickly recovered from the financial crisis; In 2009 they were down 90% but in 2010 they reached $8.4 billion; Helping profits is the smaller price gap between West Texas Intermediate oil ($85/bbl) and Western Canadian heavy crude ($65/bbl) with the price of upgraded synthetic oil surpassing WTI when supply falls. The two largest are 2 of the 11 most valuable Canadian companies. 2,412 oil and gas companies are based in Calgary, Alberta alone.

Western Canadian Select is one of North America's largest heavy crude oil streams. It is a heavy blended crude oil, composed mostly of bitumen blended with sweet synthetic and condensate diluents and 25 existing streams of both conventional and unconventional Alberta heavy crude oils at the large Husky Energy terminal in Hardisty, Alberta. Western Canadian Select—which is the benchmark for emerging heavy, high TAN (acidic) crudes— is one of many petroleum products from the Western Canadian Sedimentary Basin oil sands. WCS was launched in December 2004 as a new heavy oil stream by EnCana, Canadian Natural Resources Limited, Petro-Canada and Talisman Energy Inc.. Husky Energy has managed WCS terminal operations since 2004 and joined the WCS Founders in 2015.