Bookkeeping is the recording of financial transactions, and is part of the process of accounting in business. Transactions include purchases, sales, receipts and payments by an individual person or an organization/corporation. There are several standard methods of bookkeeping, including the single-entry and double-entry bookkeeping systems. While these may be viewed as "real" bookkeeping, any process for recording financial transactions is a bookkeeping process.

In financial accounting, a balance sheet is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business partnership, a corporation, private limited company or other organization such as government or not-for-profit entity. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a "snapshot of a company's financial condition". Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business' calendar year.

In double entry bookkeeping, debits and credits are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. Each transaction transfers value from credited accounts to debited accounts. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account. Similarly, the landlord would enter a credit in the receivable account associated with the tenant and a debit for the bank account where the cheque is deposited.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable to a third party at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their receivables to a forfaiter. Factoring is commonly referred to as accounts receivable factoring, invoice factoring, and sometimes accounts receivable financing. Accounts receivable financing is a term more accurately used to describe a form of asset based lending against accounts receivable. The Commercial Finance Association is the leading trade association of the asset-based lending and factoring industries.

Accounts payable (AP) is money owed by a business to its suppliers shown as a liability on a company's balance sheet. It is distinct from notes payable liabilities, which are debts created by formal legal instrument documents.

Cheque clearing or bank clearance is the process of moving cash from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. This process is called the clearing cycle and normally results in a credit to the account at the bank of deposit, and an equivalent debit to the account at the bank on which it was drawn, with a corresponding adjustment of accounts of the banks themselves. If there are not enough funds in the account when the cheque arrived at the issuing bank, the cheque would be returned as a dishonoured cheque marked as non-sufficient funds.

Bank fraud is the use of potentially illegal means to obtain money, assets, or other property owned or held by a financial institution, or to obtain money from depositors by fraudulently posing as a bank or other financial institution. In many instances, bank fraud is a criminal offence. While the specific elements of particular banking fraud laws vary depending on jurisdictions, the term bank fraud applies to actions that employ a scheme or artifice, as opposed to bank robbery or theft. For this reason, bank fraud is sometimes considered a white-collar crime.

Cheque fraud, or check fraud, refers to a category of criminal acts that involve making the unlawful use of cheques in order to illegally acquire or borrow funds that do not exist within the account balance or account-holder's legal ownership. Most methods involve taking advantage of the float to draw out these funds. Specific kinds of cheque fraud include cheque kiting, where funds are deposited before the end of the float period to cover the fraud, and paper hanging, where the float offers the opportunity to write fraudulent cheques but the account is never replenished.

A cheque, or check, is a document that orders a bank to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where their money is held. The drawer writes the various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay that person or company the amount of money stated.

In economics, float is duplicate money present in the banking system during the time between a deposit being made in the recipient's account and the money being deducted from the sender's account. It can be used as investable asset, but makes up the smallest part of the money supply. Float affects the amount of currency available to trade and countries can manipulate the worth of their currency by restricting or expanding the amount of float available to trade.

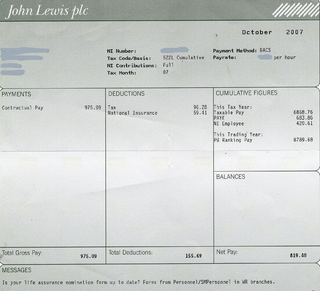

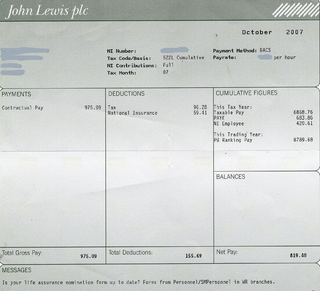

A paycheck, also spelled pay check or pay cheque, is traditionally a paper document issued by an employer to pay an employee for services rendered. In recent times, the physical paycheck has been increasingly replaced by electronic direct deposits to the employee's designated bank account or loaded onto a payroll card. Employees may still receive a pay slip to detail the calculations of the final payment amount.

Separation of duties is the concept of having more than one person required to complete a task. In business the separation by sharing of more than one individual in one single task is an internal control intended to prevent fraud and error. The concept is alternatively called segregation of duties or, in the political realm, separation of powers. In democracies, the separation of legislation from administration serves a similar purpose. The concept is addressed in technical systems and in information technology equivalently and generally addressed as redundancy.

A payment is the voluntary tender of money or its equivalent or of things of value by one party to another in exchange for goods, or services provided by them, or to fulfill a legal obligation. The party making a payment is commonly called the payer, while the payee is the party receiving the payment.

In banking, a lock box is a service offered by commercial banks to organizations that simplifies collection and processing of account receivables by having those organizations' customers' payments mailed directly to a location accessible by the bank.

Remittance advice is a letter sent by a customer to a supplier to inform the supplier that their invoice has been paid. If the customer is paying by cheque, the remittance advice often accompanies the cheque. The advice may consist of a literal letter or of a voucher attached to the side or top of the cheque.

Special journals are specialized lists of financial transaction records which accountants call journal entries. In contrast to a general journal, each special journal records transactions of a specific type, such as sales or purchases. For example, when a company purchases merchandise from a vendor, and then in turn sells the merchandise to a customer, the purchase is recorded in one journal and the sale is recorded in another.

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything that can be utilized to produce value and that is held by an economic entity and that could produce positive economic value. Simply stated, assets represent value of ownership that can be converted into cash . The balance sheet of a firm records the monetary value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business.

A bankers' clearing house is an organization that transfers money between member banks, originally to clear checks. For more than a century, this service has been expanded to include several other banking services now done electronically.

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below.

Unlike traditional factoring, where a supplier wants to finance its receivables, supply chain financing is a financing method initiated by the ordering party in order to help its suppliers to finance its receivables more easily and at a lower interest rate than what would normally be offered. In 2011, the reverse factoring market was still very small, accounting for less than 3% of the factoring market.