Related Research Articles

Keynesian economics are the various macroeconomic theories and models of how aggregate demand strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation.

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole—for example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies.

In economics, stagflation or recession-inflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for economic policy, since actions intended to lower inflation may exacerbate unemployment.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves.

Maurice Harold Macmillan, 1st Earl of Stockton, was a British statesman and Conservative politician who was Prime Minister of the United Kingdom from 1957 to 1963. Nicknamed "Supermac", he was known for his pragmatism, wit, and unflappability.

Nigel Lawson, Baron Lawson of Blaby, was a British politician and journalist. A member of the Conservative Party, he served as Member of Parliament for Blaby from 1974 to 1992, and served in Margaret Thatcher's Cabinet from 1981 to 1989. Prior to entering the Cabinet, he served as the Financial Secretary to the Treasury from May 1979 until his promotion to Secretary of State for Energy. He was appointed Chancellor of the Exchequer in June 1983 and served until his resignation in October 1989. In both Cabinet posts, Lawson was a key proponent of Thatcher's policies of privatisation of several key industries.

Black Wednesday was a financial crisis that occurred on 16 September 1992 when the UK Government was forced to withdraw sterling from the European Exchange Rate Mechanism (ERM), following a failed attempt to keep its exchange rate above the lower limit required for the ERM participation. At that time, the United Kingdom held the Presidency of the Council of the European Union.

Norman Stewart Hughson Lamont, Baron Lamont of Lerwick, is a British politician and former Conservative MP for Kingston-upon-Thames. He served as Chancellor of the Exchequer from 1990 until 1993. He was created a life peer in 1998. Lamont was a supporter of the Eurosceptic organisation Leave Means Leave.

William Henry Beveridge, 1st Baron Beveridge, was a British economist and Liberal politician who was a progressive and social reformer who played a central role in designing the British welfare state. His 1942 report Social Insurance and Allied Services served as the basis for the welfare state put in place by the Labour government elected in 1945.

Richard Austen Butler, Baron Butler of Saffron Walden,, also known as R. A. Butler and familiarly known from his initials as Rab, was a prominent British Conservative Party politician. His obituary in The Times called him "the creator of the modern educational system, the key-figure in the revival of post-war Conservatism, arguably the most successful chancellor since the war and unquestionably a Home Secretary of reforming zeal". He was one of his party's leaders in promoting the post-war consensus through which the major parties largely agreed on the main points of domestic policy until the 1970s; it is sometimes known as "Butskellism" from a fusion of his name with that of his Labour counterpart, Hugh Gaitskell.

The Reserve Bank of Australia (RBA) is Australia's central bank and banknote issuing authority. It has had this role since 14 January 1960, when the Reserve Bank Act 1959 removed the central banking functions from the Commonwealth Bank.

In economics, aggregate supply (AS) or domestic final supply (DFS) is the total supply of goods and services that firms in a national economy plan on selling during a specific time period. It is the total amount of goods and services that firms are willing and able to sell at a given price level in an economy.

Anthony Patrick Leslie Minford is a British macroeconomist who is professor of applied economics at Cardiff Business School, Cardiff University, a position he has held since 1997. He was Edward Gonner Professor of Applied Economics at the University of Liverpool from 1976 to 1997. In 2016, Minford was a notable member of the Economists for Brexit group which, in opposition to the consensus view of economists, advocated the UK leaving the European Union. His prediction of an 8% drop in the cost of living soon after leaving failed to materialize.

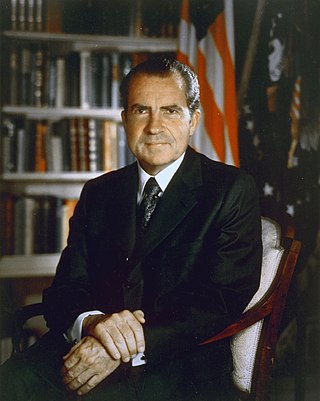

The Nixon shock was a series of economic measures undertaken by United States President Richard Nixon in 1971, in response to increasing inflation, the most significant of which were wage and price freezes, surcharges on imports, and the unilateral cancellation of the direct international convertibility of the United States dollar to gold.

Modern monetary theory or modern money theory (MMT) is a heterodox macroeconomic theory that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of the financial assets needed to pay taxes and satisfy savings desires. According to MMT, governments do not need to worry about accumulating debt since they can create new money by using fiscal policy in order to pay interest. MMT argues that the primary risk once the economy reaches full employment is inflation, which acts as the only constraint on spending. MMT also argues that inflation can be addressed by increasing taxes on everyone to reduce the spending capacity of the private sector.

The Panic of 1825 was a stock market crash that started in the Bank of England, arising in part out of speculative investments in Latin America, including the imaginary country of Poyais. The crisis was felt most acutely in Britain, where it led to the closure of twelve banks. It was also manifest in the markets of Europe, Latin America and the United States. Nationwide gold and silver confiscation ensued and an infusion of gold reserves from the Banque de France saved the Bank of England from collapse. The panic has been called the first modern economic crisis not attributable to an external event, such as a war, and so the start of modern economic cycles. The Napoleonic Wars had been highly profitable for all sectors of the British financial system, and the expansionist monetary actions taken during transition from war to peace brought a surge of prosperity and speculative ventures. The stock market boom became a bubble and banks caught in the euphoria made risky loans.

Non-accelerating inflation rate of unemployment (NAIRU) is a theoretical level of unemployment below which inflation would be expected to rise. It was first introduced as NIRU by Franco Modigliani and Lucas Papademos in 1975, as an improvement over the "natural rate of unemployment" concept, which was proposed earlier by Milton Friedman.

Gordon Brown served as Chancellor of the Exchequer of the United Kingdom from 2 May 1997 to 27 June 2007. His tenure was marked by major reform of Britain's monetary and fiscal policy architecture, transferring interest rate setting powers to the Bank of England, by a wide extension of the powers of the Treasury to cover much domestic policy and by transferring responsibility for banking supervision to the Financial Services Authority. Brown presided over the longest period of sustained economic growth in British history. He had previously served as Shadow Chancellor of the Exchequer in the Tony Blair Shadow Cabinet from 1994 to 1997. As Shadow Chancellor, Brown as Chancellor-in-waiting was seen as a good choice by business and the middle class.

The 1997 United Kingdom budget was delivered by Gordon Brown, the Chancellor of the Exchequer, to the House of Commons on 2 July 1997. It was the first budget to be presented by Brown during his tenure as Chancellor, and the first Labour budget to be presented since April 1979. The 1997 budget marked a significant change of direction in economic policy following Labour's election win in May 1997. Among the measures announced were a five-year plan to reduce the budget deficit, a £5.2bn windfall tax on recently privatised utilities which was to fund Labour's planned Welfare to Work scheme, and a reduction in VAT on fuel. The budget was welcomed by business, which viewed it as fiscally responsible, but it was greeted less warmly by the UK's utility providers.

The 1996 United Kingdom budget was delivered by Kenneth Clarke, the Chancellor of the Exchequer, to the House of Commons on 26 November 1996. It was Clarke's fourth budget, the last to be delivered during his tenure as chancellor, and the last budget to be presented by the Conservative government of John Major before the party was defeated by Labour in the 1997 general election. Prior to Clarke's budget statement being presented to the House of Commons, its contents were leaked to the Daily Mirror, which returned the document to the government but decided to print some of the details, thus helping Tony Blair, then the leader of the Opposition, to prepare his response. Clarke described his statement as one that outlined a "Rolls-Royce recovery – built to last" and predicted economic growth of 2.5% for 1997 and 3.5% for 1998, but Blair dismissed it as "a last-gasp budget of a government whose time is up".

References

- Barnett, Correlli (2002). The Verdict of Peace. London: Pan.

- Burnham, Peter (2003). Remaking the Postwar World Economy: Robot and British Policy in the 1950s. Basingstoke: Palgrave Macmillan. ISBN 0-333-55725-5.

- Morgan, Kenneth O. (2001). Britain since 1945: The People's Peace. Oxford: Oxford University Press.

- Kynaston, David (2009). Family Britain, 1951–1957. London: Bloomsbury. pp. 74–76. ISBN 978-1-4088-0083-6.