Related Research Articles

A board of directors is an executive committee that jointly supervises the activities of an organization, which can be either a for-profit or a nonprofit organization such as a business, nonprofit organization, or a government agency.

Business is the practice of making one's living or making money by producing or buying and selling products. It is also "any activity or enterprise entered into for profit."

A holding company is a company whose primary business is holding a controlling interest in the securities of other companies. A holding company usually does not produce goods or services itself. Its purpose is to own stock of other companies to form a corporate group.

A shareholder of corporate stock refers to an individual or legal entity that is registered by the corporation as the legal owner of shares of the share capital of a public or private corporation. Shareholders may be referred to as members of a corporation. A person or legal entity becomes a shareholder in a corporation when their name and other details are entered in the corporation's register of shareholders or members, and unless required by law the corporation is not required or permitted to enquire as to the beneficial ownership of the shares. A corporation generally cannot own shares of itself.

A joint-stock company is a business entity in which shares of the company's stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by their shares. Shareholders are able to transfer their shares to others without any effects to the continued existence of the company.

Corporate law is the body of law governing the rights, relations, and conduct of persons, companies, organizations and businesses. The term refers to the legal practice of law relating to corporations, or to the theory of corporations. Corporate law often describes the law relating to matters which derive directly from the life-cycle of a corporation. It thus encompasses the formation, funding, governance, and death of a corporation.

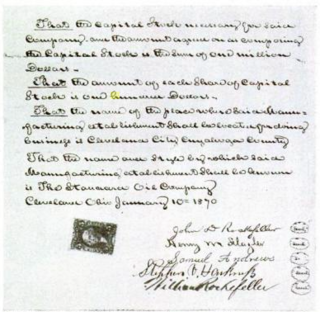

In corporate governance, a company's articles of association is a document that, along with the memorandum of association forms the company's constitution. The AoA defines the responsibilities of the directors, the kind of business to be undertaken, and the means by which the shareholders exert control over the board of directors.

A company, abbreviated as co., is a legal entity representing an association of people, whether natural, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Companies take various forms, such as:

A shareholders' agreement (SHA) is an enforceable agreement amongst the shareholders or members of a company. In practical effect, it is analogous to a partnership agreement. There are advantages of the shareholder's agreement: they provide a contractual remedy if their terms are broken, and they can help the corporate entity to maintain the absence of publicity and maintain confidentiality. Nonetheless, there are also some disadvantages that should be considered, such as the limited effect to the third parties and that alteration of the terms of an agreement can be time consuming.

In business or commercial law, an extraordinary resolution or special resolution is a resolution passed by the shareholders of a company by a greater majority than is required to pass an ordinary resolution. The precise figures vary in different countries, but commonly an extraordinary resolution must be affirmed by not less than 75% of members casting votes, whereas an ordinary resolution only requires a bare majority.

The Companies Act 2006 is an Act of the Parliament of the United Kingdom which forms the primary source of UK company law.

Australian corporations law has historically borrowed heavily from UK company law. Its legal structure now consists of a single, national statute, the Corporations Act 2001. The statute is administered by a single national regulatory authority, the Australian Securities & Investments Commission (ASIC).

Bushell v Faith [1970] AC 1099 is a UK company law case, concerning the possibility of weighting votes, and the relationship to section 184 of Companies Act 1948 which mandates that directors may be removed from a board by ordinary resolution.

Edwards v Halliwell [1950] 2 All ER 1064 is a UK labour law and UK company law case about the internal organisation of a trade union, or a company, and litigation by members to make an executive follow the organisation's internal rules.

Imperial Hydropathic Hotel Co, Blackpool v Hampson (1883) 23 Ch D 1 is a UK company law case, concerning the interpretation of a company's articles of association. On the specific facts it has been superseded by the Companies Act 2006 section 168, which allows a director to be removed through an ordinary majority resolution of the general meeting.

Shareholders in the United Kingdom are people and organisations who buy shares in UK companies. In large companies, such as those on the FTSE100, shareholders are overwhelmingly large institutional investors, such as pension funds, insurance companies, mutual funds or similar foreign organisations. UK shareholders have the most favourable set of rights in the world in their ability to control directors of corporations. UK company law gives shareholders the ability to,

The British Virgin Islands company law is the law that governs businesses registered in the British Virgin Islands. It is primarily codified through the BVI Business Companies Act, 2004, and to a lesser extent by the Insolvency Act, 2003 and by the Securities and Investment Business Act, 2010. The British Virgin Islands has approximately 30 registered companies per head of population, which is likely the highest ratio of any country in the world. Annual company registration fees provide a significant part of Government revenue in the British Virgin Islands, which accounts for the comparative lack of other taxation. This might explain why company law forms a much more prominent part of the law of the British Virgin Islands when compared to countries of similar size.

Indian company law regulates corporations formed under Section 2(20) of the Indian Companies Act of 2013, superseding the Companies Act of 1956.

Cayman Islands company law is primarily codified in the Companies Law and the Limited Liability Companies Law, 2016, and to a lesser extent in the Securities and Investment Business Law. The Cayman Islands is a leading offshore financial centre, and financial services form a significant part of the economy of the Cayman Islands. Accordingly company law forms a much more prominent part of the law of the Cayman Islands than might otherwise be expected.

Citco Banking Corporation NV v Pusser's Ltd[2007] UKPC 13 is a judicial decision of the Privy Council on appeal from the British Virgin Islands in relation to the validity of amendments to the memorandum and articles of association of a company, and the requirement of shareholders to exercise the votes attached to their shares in the best interests of the company as a whole.

References

- Clickdocs.com definition

- Guide to Types of Resolutions at CompaniesHouse.gov.uk (England and Wales)

- Ordinary Resolutions at PracticalLaw.com (England and Wales)

- Guide to Company Resolutions at ASIC.gov.au (Australia)

- Definition of Ordinary Resolution at CorporateOnline.gov.bc.ca (British Columbia, Canada)