Overspending is spending more money than one can afford. It is a common problem when easy credit is available. The term overspending is also used for investment projects when payments exceed actual calculated cost. [1]

Overspending is spending more money than one can afford. It is a common problem when easy credit is available. The term overspending is also used for investment projects when payments exceed actual calculated cost. [1]

Some overspending is a form of addictive behaviour due to psychological dependence. [2] The sufferers spend in order to relieve other problems in their lives such anxiety or stress. Others may overspend to impress their associates, for example, by picking up the bill for a meal at a restaurant. [3] There are some who want to impress their neighbors and bring large packets, furniture frequently.

Sources of credit such as credit cards enable overspending by allowing consumers to spend beyond their income. Financial counselors advise indebted consumers to avoid buying goods on credit and even to cut up their credit cards. [4]

An analysis of consumer expenditure showed that 40% of US households overspent in 1990. [5] Other things being equal, educated people were more likely to overspend than the less-educated. [5]

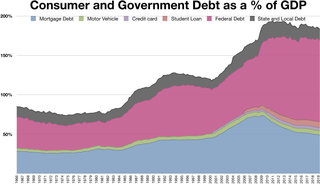

In April 2008, consumer debt in the USA, excluding mortgages, reached a total of $2.56 trillion—over $8,000 per person. [4]

The factors which result in overspending include:

Savings may prevent overspending because they provide a reserve for unexpected contingencies such as medical expenses and loss of income due to illness. [5]

Bankruptcy is a serious result of overspending. In 1991, 0.9% of US households were declared bankrupt. [5]

The Roman Emperors had little access to credit. The treasury was built up by prudent or miserly Emperors like Hadrian and Tiberius and then dissipated by the spendthrift emperors like Nero, Caligula and Commodus. When the treasury ran short, it was most often replenished by proscription and expropriation of the wealth of rich citizens. The overspending which depleted the treasury was largely due to attempts to buy popularity by means of handouts, gifts and lavish entertainments. [6]

Democratic governments commonly overspend due to political pressure and their high level of creditworthiness which enables them to borrow large sums. Such overspending is higher when legislative districts have varied levels of income and problems since all districts are taxed to provide benefits for some districts and this is politically successful. A powerful central executive such as a strong mayor with veto power can offset this tendency. [7]

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster. There is no official definition of a recession, according to the IMF.

Debt is an obligation that requires one party, the debtor, to pay money borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity.

An expense is an item requiring an outflow of money, or any form of fortune in general, to another person or group as payment for an item, service, or other category of costs. For a tenant, rent is an expense. For students or parents, tuition is an expense. Buying food, clothing, furniture, or an automobile is often referred to as an expense. An expense is a cost that is "paid" or "remitted", usually in exchange for something of value. Something that seems to cost a great deal is "expensive". Something that seems to cost little is "inexpensive". "Expenses of the table" are expenses for dining, refreshments, a feast, etc.

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit, the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. A central point of controversy in economics, government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression.

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government revenues and spending. For a government that uses accrual accounting the budget balance is calculated using only spending on current operations, with expenditure on new capital assets excluded. A positive balance is called a government budget surplus, and a negative balance is a government budget deficit. A government budget presents the government's proposed revenues and spending for a financial year.

Personal finance is the financial management that an individual or a family unit performs to budget, save, and spend monetary resources in a controlled manner, taking into account various financial risks and future life events.

In economics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It specifies the amount of goods and services that will be purchased at all possible price levels. Consumer spending, investment, corporate and government expenditure, and net exports make up the aggregate demand.

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Fixed-income securities can be contrasted with equity securities that create no obligation to pay dividends or any other form of income. Bonds carry a level of legal protections for investors that equity securities do not: in the event of a bankruptcy, bond holders would be repaid after liquidation of assets, whereas shareholders with stock often receive nothing.

Consumption is the act of using resources to satisfy current needs and wants. It is seen in contrast to investing, which is spending for acquisition of future income. Consumption is a major concept in economics and is also studied in many other social sciences.

In economics, consumer debt is the amount owed by consumers. It includes debts incurred on purchase of goods that are consumable and/or do not appreciate. In macroeconomic terms, it is debt which is used to fund consumption rather than investment.

A country's gross government debt is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt.

Household debt is the combined debt of all people in a household, including consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.

A personal budget or household budget is a plan for the coordination of income and expenses.

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. CBO estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034 and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.

Dissaving is negative saving. If spending is greater than disposable income, dissaving is taking place. This spending is financed by already accumulated savings, such as money in a savings account, or it can be borrowed. Household dissaving therefore corresponds to an absolute decrease in their financial investments.

Bankruptcy is a legally declared inability or impairment of ability of an individual or organization to pay their creditors. In most cases personal bankruptcy is initiated by the bankrupt individual. Bankruptcy is a legal process that discharges most debts, but has the disadvantage of making it more difficult for an individual to borrow in the future. To avoid the negative impacts of personal bankruptcy, individuals in debt have a number of bankruptcy alternatives.

Fiscal policy are "measures employed by governments to stabilize the economy, specifically by manipulating the levels and allocations of taxes and government expenditures". In the Philippines, this is characterized by continuous and increasing levels of debt and budget deficits, though there were improvements in the last few years of the first decade of the 21st century.

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the federal government budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt.

The Impact of the Korean War on the Economy of the United States refers to the ways in which the American economy was affected by the Korean experience from 1950 to 1953. The Korean War boosted GDP growth through government spending, which in turn constrained investment and consumption. While taxes were raised significantly to finance the war, the Federal Reserve followed an anti-inflationary policy. Though there was a large increase in prices at the outset of the war, price and wage controls ultimately stabilized prices by the end of the war. Consumption and investment continued to grow after the war, but below the trend rate prior to the war.

In China, the Moonlight Clan is a name given to people who expend their entire salary before the end of each month. The term is derived from a lunar cycle. While yue guang translates directly to "moonlight", it is also a pun derived from the combination of its individual words, yue and guang. Zu refers to a group of people who shares this characteristic. In the United States, a comparable notion is referred to as "living paycheck to paycheck". "Moonlight clan" is a relatively new Chinese neologism to describe young workers who spend their salaries faster than they earn it. The Moonlite are generally younger generations. They are different from their parents' diligent and thrifty consumption concepts. To chase new trends and have fun, they don't care about the cost as long as they like. Material life is what they yearn for, but also the motivation to earn money. The older generation believes that "saving is more significant than spending", and they are very upset about their behavior; however, their motto is "spending can lead to make more money". The Moonlite are companies' favorite group of consumers, since they have strong purchasing power from desires; more importantly, they have the ability to make money and have money to spend.

{{citation}}: CS1 maint: multiple names: authors list (link)