Related Research Articles

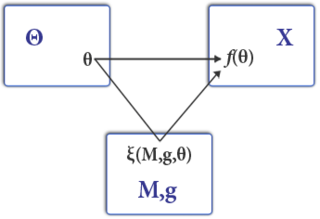

Mechanism design is a field in economics and game theory that takes an objectives-first approach to designing economic mechanisms or incentives, toward desired objectives, in strategic settings, where players act rationally. Because it starts at the end of the game, then goes backwards, it is also called reverse game theory. It has broad applications, from economics and politics in such fields as market design, auction theory and social choice theory to networked-systems.

In game theory, an asymmetric game where players have private information is said to be strategy-proof or strategyproof (SP) if it is a weakly-dominant strategy for every player to reveal his/her private information, i.e. given no information about what the others do, you fare best or at least not worse by being truthful.

A Vickrey auction or sealed-bid second-price auction (SBSPA) is a type of sealed-bid auction. Bidders submit written bids without knowing the bid of the other people in the auction. The highest bidder wins but the price paid is the second-highest bid. This type of auction is strategically similar to an English auction and gives bidders an incentive to bid their true value. The auction was first described academically by Columbia University professor William Vickrey in 1961 though it had been used by stamp collectors since 1893. In 1797 Johann Wolfgang von Goethe sold a manuscript using a sealed-bid, second-price auction.

A double auction is a process of buying and selling goods with multiple sellers and multiple buyers. Potential buyers submit their bids and potential sellers submit their ask prices to the market institution, and then the market institution chooses some price p that clears the market: all the sellers who asked less than p sell and all buyers who bid more than p buy at this price p. Buyers and sellers that bid or ask for exactly p are also included. A common example of a double auction is stock exchange.

A Vickrey–Clarke–Groves (VCG) auction is a type of sealed-bid auction of multiple items. Bidders submit bids that report their valuations for the items, without knowing the bids of the other bidders. The auction system assigns the items in a socially optimal manner: it charges each individual the harm they cause to other bidders. It gives bidders an incentive to bid their true valuations, by ensuring that the optimal strategy for each bidder is to bid their true valuations of the items; it can be undermined by bidder collusion and in particular in some circumstances by a single bidder making multiple bids under different names. It is a generalization of a Vickrey auction for multiple items.

Fair item allocation is a kind of the fair division problem in which the items to divide are discrete rather than continuous. The items have to be divided among several partners who potentially value them differently, and each item has to be given as a whole to a single person. This situation arises in various real-life scenarios:

In mechanism design, a Vickrey–Clarke–Groves (VCG) mechanism is a generic truthful mechanism for achieving a socially-optimal solution. It is a generalization of a Vickrey–Clarke–Groves auction. A VCG auction performs a specific task: dividing items among people. A VCG mechanism is more general: it can be used to select any outcome out of a set of possible outcomes.

Truthful job scheduling is a mechanism design variant of the job shop scheduling problem from operations research.

In mechanism design, an agent is said to have single-parameter utility if his valuation of the possible outcomes can be represented by a single number. For example, in an auction for a single item, the utilities of all agents are single-parametric, since they can be represented by their monetary evaluation of the item. In contrast, in a combinatorial auction for two or more related items, the utilities are usually not single-parametric, since they are usually represented by their evaluations to all possible bundles of items.

A Bayesian-optimal mechanism (BOM) is a mechanism in which the designer does not know the valuations of the agents for whom the mechanism is designed, but the designer knows that they are random variables and knows the probability distribution of these variables.

Rental harmony is a kind of a fair division problem in which indivisible items and a fixed monetary cost have to be divided simultaneously. The housemates problem and room-assignment-rent-division are alternative names to the same problem.

Fisher market is an economic model attributed to Irving Fisher. It has the following ingredients:

A deferred-acceptance auction (DAA) is an auction in which the allocation is chosen by repeatedly rejecting the least attractive bids. It is a truthful mechanism with strategic properties that make it particularly suitable to complex auctions such as the radio spectrum reallocation auction. An important advantage of DAA over the more famous VCG auction is that DAA is immune to manipulations by coalitions of bidders, while VCG is immune to manipulations only by individual bidders.

In economics and mechanism design, a cost-sharing mechanism is a process by which several agents decide on the scope of a public product or service, and how much each agent should pay for it. Cost-sharing is easy when the marginal cost is constant: in this case, each agent who wants the service just pays its marginal cost. Cost-sharing becomes more interesting when the marginal cost is not constant. With increasing marginal costs, the agents impose a negative externality on each other; with decreasing marginal costs, the agents impose a positive externality on each other. The goal of a cost-sharing mechanism is to divide this externality among the agents.

The Price of Anarchy (PoA) is a concept in game theory and mechanism design that measures how the social welfare of a system degrades due to selfish behavior of its agents. It has been studied extensively in various contexts, particularly in auctions.

Truthful resource allocation is the problem of allocating resources among agents with different valuations over the resources, such that agents are incentivized to reveal their true valuations over the resources.

When allocating objects among people with different preferences, two major goals are Pareto efficiency and fairness. Since the objects are indivisible, there may not exist any fair allocation. For example, when there is a single house and two people, every allocation of the house will be unfair to one person. Therefore, several common approximations have been studied, such as maximin-share fairness (MMS), envy-freeness up to one item (EF1), proportionality up to one item (PROP1), and equitability up to one item (EQ1). The problem of efficient approximately fair item allocation is to find an allocation that is both Pareto-efficient (PE) and satisfies one of these fairness notions. The problem was first presented at 2016 and has attracted considerable attention since then.

Market equilibrium computation is a computational problem in the intersection of economics and computer science. The input to this problem is a market, consisting of a set of resources and a set of agents. There are various kinds of markets, such as Fisher market and Arrow–Debreu market, with divisible or indivisible resources. The required output is a competitive equilibrium, consisting of a price-vector, and an allocation, such that each agent gets the best bundle possible given the budget, and the market clears.

Fair allocation of items and money is a class of fair item allocation problems in which, during the allocation process, it is possible to give or take money from some of the participants. Without money, it may be impossible to allocate indivisible items fairly. For example, if there is one item and two people, and the item must be given entirely to one of them, the allocation will be unfair towards the other one. Monetary payments make it possible to attain fairness, as explained below.

A knapsack auction is an auction in which several identical items are sold, and there are several bidders with different valuations interested in different amounts of items. The goal is to choose a subset of the bidders with a total demand, at most, the number of items and, subject to that, a maximum total value. Finding this set of bidders requires solving an instance of the knapsack problem, which explains the term "knapsack auction".

References

- ↑ Cole, Richard; Gkatzelis, Vasilis; Goel, Gagan (2013). "Mechanism design for fair division". Proceedings of the fourteenth ACM conference on Electronic commerce. EC '13. New York, NY, USA: ACM. pp. 251–268. arXiv: 1212.1522 . doi:10.1145/2492002.2482582. ISBN 9781450319621.

- ↑ Abebe, Rediet; Cole, Richard; Gkatzelis, Vasilis; Hartline, Jason D. (2019-03-18). "A Truthful Cardinal Mechanism for One-Sided Matching". arXiv: 1903.07797 [cs.GT].