RELX is a British-Dutch multinational information and analytics company headquartered in London, England. Its businesses provide scientific, technical and medical information and analytics; legal information and analytics; decision-making tools; and organise exhibitions. It operates in 40 countries and serves customers in over 180 nations. It was previously known as Reed Elsevier, and came into being in 1992 as a result of the merger of Reed International, a British trade book and magazine publisher, and Elsevier, a Netherlands-based scientific publisher.

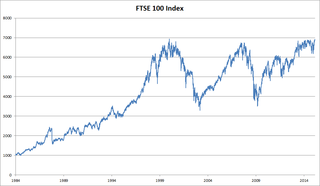

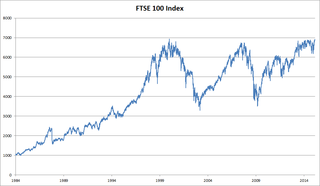

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie", is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation. The index is maintained by the FTSE Group, a subsidiary of the London Stock Exchange Group.

Legal & General Group plc, commonly known as Legal & General, is a British multinational financial services and asset management company headquartered in London, England. Its products and services include investment management, lifetime mortgages, pensions, annuities, and life assurance. As of January 2020, it no longer provides general insurance following the sale of Legal & General Insurance to Allianz. It has operations in the United Kingdom and United States, with investment management businesses in the Gulf, Europe and Asia.

MetLife, Inc. is the holding corporation for the Metropolitan Life Insurance Company (MLIC), better known as MetLife, and its affiliates. MetLife is among the largest global providers of insurance, annuities, and employee benefit programs, with 90 million customers in over 60 countries. The firm was founded on March 24, 1868. MetLife ranked No. 43 in the 2018 Fortune 500 list of the largest United States corporations by total revenue.

Prudential Financial, Inc. is an American Fortune Global 500 and Fortune 500 company whose subsidiaries provide insurance, retirement planning, investment management, and other products and services to both retail and institutional customers throughout the United States and in over 40 other countries. In 2019, Prudential was the largest insurance provider in the United States with $815.1 billion in total assets.

George Wimpey was a British construction firm. Formed in 1880 and based in Hammersmith, it initially operated largely as a road surfacing contractor. The business was acquired by Godfrey Mitchell in 1919, and he developed it into a construction and housebuilding firm. In July 2007, Wimpey merged with Taylor Woodrow to create Taylor Wimpey. Wimpey was first listed on the London Stock Exchange in 1934.

Genworth Financial is an S&P 400 insurance company. The firm was founded as The Life Insurance Company of Virginia in 1871. In 1986, Life of Virginia was acquired by Combined Insurance, which became Aon plc in 1987. In 1996, Life of Virginia was sold to GE Capital. In May 2004, Genworth Financial was formed out of various insurance businesses of General Electric in the largest IPO of that year. Genworth Financial is incorporated in Virginia.

Wolters Kluwer N.V. is a Dutch information services company. The company is headquartered in Alphen aan den Rijn, Netherlands (Global) and Philadelphia, United States (corporate). Wolters Kluwer in its current form was founded in 1987 with a merger between Kluwer Publishers and Wolters Samsom. The company serves legal, business, tax, accounting, finance, audit, risk, compliance, and healthcare markets. It operates in over 150 countries.

Scottish Widows is a life insurance and pensions company located in Edinburgh, Scotland, and is a subsidiary of Lloyds Banking Group. Its product range includes life assurance and pensions. The company has been providing financial services to the UK market since 1815. The company sells products through independent financial advisers, direct to customers and through Lloyds Banking Group bank branches. The investment and asset management arm was sold in 2013 to Aberdeen Asset Management.

Unum Group is a Chattanooga, Tennessee-based Fortune 500 insurance company formerly known as UnumProvident. Unum Group was created by the 1999 merger of Unum Corporation and The Provident Companies and comprises four distinct businesses – Unum US, Unum UK, Unum Poland and Colonial Life. Its underwriting insurers include The Paul Revere Life Insurance Company and Provident Life and Accident Insurance Company. Unum is the top disability insurer in both the United States and United Kingdom and also offers other insurance products including accident, critical illness and life insurance.

Cinven is a global private equity firm founded in 1977, with offices in nine international locations in Guernsey, London, New York, Paris, Frankfurt, Milan, Luxembourg, Madrid, and Hong Kong that acquires Europe and United States based corporations, and emerging market firms that fit with their core businesses, and necessitate a minimum equity investment of €100 million or more. In 2015, it had €10.6 billion in assets under management.

Great-West Lifeco Inc. is a Canadian insurance-centered financial holding company that operates in North America, Europe and Asia through five wholly owned, regionally focused subsidiaries. Many of the companies it has indirect control over are part of its largest subsidiary, The Canada Life Assurance Company; the others are managed by Great-West Lifeco U.S. LLC, a U.S. based subsidiary. Great-West Lifeco is indirectly controlled by Montreal billionaire Paul Desmarais through his stake in the Power Corporation of Canada, which owns 72% of Great-West Lifeco. The hyphen in the company's name was originally a typesetter's error.

Numericable was a major European cable operator and telecommunications services company. Numericable was originally created in 2007 from the merger between former competitors Noos and NC Numericable networks. Numericable Group SA was founded in August 2013 to act as the parent company of Numericable group companies and to offer its shares on the stock exchange. The company provides cable broadband services in France, Luxembourg and Portugal, offering digital and analog television, Internet, and phone services to homes. From 2008, Numericable also offered mobile telephone services to its customers.

Taylor Wimpey plc is one of the largest home construction companies in the United Kingdom.

Saga is a British company focused on serving the needs of those aged 50 and over. It has 2.7 million customers. The company operates from several sites on the Kent and Sussex coast: four in Folkestone at Middelburg Square, Enbrook Park, Cheriton Park and Ross Way; the fifth at the Eurokent Business park in Ramsgate, and the newest at Priory Square in Hastings. It is listed on the London Stock Exchange.

ProAssurance Corporation, headquartered in Birmingham, Alabama, is a property and casualty company that sells professional liability insurance to doctors. The company was founded in 1976 as Mutual Assurance and was later renamed to Medical Assurance in 1997. The name "ProAssurance" was created in 2001 when Medical Assurance merged with Professionals Group. The company is currently the fourth largest medical professional liability insurance writer and has over $6 billion in assets.

Countryside Properties is a UK housebuilding and urban regeneration company, operating in London and the South East of England, and with a presence in the North West of England through its Partnerships division. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

Spire Healthcare plc is the second largest provider of private healthcare in the United Kingdom. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

Just Group plc, formerly JRP Group plc and, before that, Just Retirement Group plc, is a British company specialising in retirement products and services headquartered in Reigate, Surrey. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

Cover-More Group is a global travel insurance and medical assistance provider headquartered in Sydney, Australia. The group was acquired by Zurich Insurance Group in April 2017. The company has more than 40% share of the Australian market. The group also has leading market positions in India, Ireland, Latin America, New Zealand and the USA where Cover-More owns Travelex Insurance Services. The global group has more than 18 million customers and employs more than 2200 people. Cover-More has operations in 22 countries including Australia, New Zealand, India, China, Malaysia, the United Kingdom, the USA, Canada, Brazil and Argentina.