Related Research Articles

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, which is the study of production, distribution, and consumption of goods and services; the discipline of financial economics bridges the two. Financial activities take place in financial systems at various scopes; thus, the field can be roughly divided into personal, corporate, and public finance.

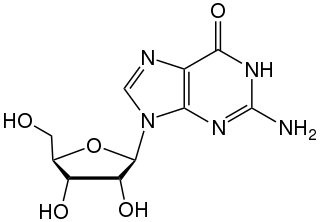

Guanosine (symbol G or Guo) is a purine nucleoside comprising guanine attached to a ribose (ribofuranose) ring via a β-N9-glycosidic bond. Guanosine can be phosphorylated to become guanosine monophosphate (GMP), cyclic guanosine monophosphate (cGMP), guanosine diphosphate (GDP), and guanosine triphosphate (GTP). These forms play important roles in various biochemical processes such as synthesis of nucleic acids and proteins, photosynthesis, muscle contraction, and intracellular signal transduction (cGMP). When guanine is attached by its N9 nitrogen to the C1 carbon of a deoxyribose ring it is known as deoxyguanosine.

A hedge fund is a pooled investment fund that holds liquid assets and that makes use of complex trading and risk management techniques to improve investment performance and insulate returns from market risk. Among these portfolio techniques are short selling and the use of leverage and derivative instruments. In the United States, financial regulations require that hedge funds be marketed only to institutional investors and high-net-worth individuals.

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities.

Year 390 BC was a year of the pre-Julian Roman calendar. At the time, it was known as the Year of the Tribunate of Ambustus, Longus, Ambustus, Fidenas, Ambustus and Cornelius. The denomination 390 BC for this year has been used since the early medieval period, when the Anno Domini calendar era became the prevalent method in Europe for naming years.

The Salii, Salians, or Salian priests were the "leaping priests" of Mars in ancient Roman religion, supposed to have been introduced by King Numa Pompilius. They were twelve patrician youths dressed as archaic warriors with an embroidered tunic, a breastplate, a short red cloak, a sword, and a spiked headdress called an apex. They were charged with the twelve bronze shields called ancilia, which—like those of the Mycenaeans—resembled a figure eight. One of the shields was said to have fallen from heaven in the reign of King Numa and eleven copies were made to protect the identity of the sacred shield on the advice of the nymph Egeria, consort of Numa, who prophesied that wherever that shield was preserved, the people would be the dominant people of the earth.

Obsolescence is the process of becoming antiquated, out of date, old-fashioned, no longer in general use, or no longer useful, or the condition of being in such a state. When used in a biological sense, it means imperfect or rudimentary when compared with the corresponding part of other organisms. The international standard IEC 62402:2019 Obsolescence Management defines obsolescence as the "transition from available to unavailable from the manufacturer in accordance with the original specification".

John Wiley & Sons, Inc., commonly known as Wiley, is an American multinational publishing company that focuses on academic publishing and instructional materials. The company was founded in 1807 and produces books, journals, and encyclopedias, in print and electronically, as well as online products and services, training materials, and educational materials for undergraduate, graduate, and continuing education students.

Asset-based lending is any kind of lending secured by an asset. This means, if the loan is not repaid, the asset is taken. In this sense, a mortgage is an example of an asset-based loan. More commonly however, the phrase is used to describe lending to business and large corporations using assets not normally used in other loans. Typically, the different types of asset-based loans include accounts receivable financing, inventory financing, equipment financing, or real estate financing. Asset-based lending in this more specific sense is possible only in certain countries whose legal systems allow borrowers to pledge such assets to lenders as collateral for loans.

Clearstream is a financial services company that specializes in the settlement of securities transactions and is owned by Deutsche Börse AG. It provides settlement and custody as well as other related services for securities across all asset classes. It is one of two European International central securities depositories.

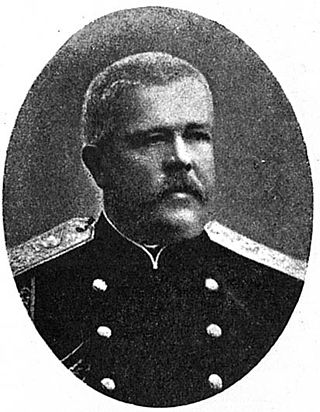

Alexander Romanovich Drenteln (1820-1888) was a Russian general.

Financial modeling is the task of building an abstract representation of a real world financial situation. This is a mathematical model designed to represent the performance of a financial asset or portfolio of a business, project, or any other investment.

Frank J. Fabozzi is an American economist, educator, writer, and investor, currently Professor of Practice at The Johns Hopkins University Carey Business School and a Member of Edhec Risk Institute. He was previously a Professor of Finance at EDHEC Business School, Professor in the Practice of Finance and Becton Fellow in the Yale School of Management, and a Visiting Professor of Finance at the Sloan School of Management at the Massachusetts Institute of Technology. He has authored and edited many books, three of which were coauthored with Nobel laureates, Franco Modigliani and Harry Markowitz. He has been the editor of the Journal of Portfolio Management since 1986 and is on the board of directors of the BlackRock complex of closed-end funds.

Moorad Choudhry was formerly Head of Business Treasury, Global Banking and Markets at Royal Bank of Scotland.

In finance, a bullet strategy is followed by a trader investing in intermediate-duration bonds, but not in long- and short-duration bonds.

An X-Value Adjustment is an umbrella term referring to a number of different “valuation adjustments” that banks must make when assessing the value of derivative contracts that they have entered into. The purpose of these is twofold: primarily to hedge for possible losses due to other parties' failures to pay amounts due on the derivative contracts; but also to determine the amount of capital required under the bank capital adequacy rules. XVA has led to the creation of specialized desks in many banking institutions to manage XVA exposures.

Securities market participants in the United States include corporations and governments issuing securities, persons and corporations buying and selling a security, the broker-dealers and exchanges which facilitate such trading, banks which safe keep assets, and regulators who monitor the markets' activities. Investors buy and sell through broker-dealers and have their assets retained by either their executing broker-dealer, a custodian bank or a prime broker. These transactions take place in the environment of equity and equity options exchanges, regulated by the U.S. Securities and Exchange Commission (SEC), or derivative exchanges, regulated by the Commodity Futures Trading Commission (CFTC). For transactions involving stocks and bonds, transfer agents assure that the ownership in each transaction is properly assigned to and held on behalf of each investor.

Jason Goepfert is an American researcher and columnist focused on the development of behavioral finance. Prior to founding Sundial Capital Research, he was the manager of back office operations for Deephaven Capital Management, a Minnesota-based hedge fund, and Wells Fargo's online brokerage unit.

The Central Depository of Armenia (CDA) is the Central Depository of Armenia, established in 1996. The CDA is one of the oldest securities market institutions in the country and is headquartered in Yerevan. The Central Bank of Armenia is the regulatory body of the CDA. The CDA is a full member of the Federation of Euro-Asian Stock Exchanges.

Central Depository Bangladesh Limited is a Bangladesh government regulatory agency that records and facilates the trade of securities in Bangladesh. It is the National Numbering Agency for International Securities Identification Number in Bangladesh and member of the Association of National Numbering Agencies. Sheikh Kabir Hossain is chairman of the board of directors. It is Bangladesh's only securities depository enterprise.

References

- ↑ Arnett III, George W. (2011). Global Securities Markets (1st ed.). Hoboken, New Jersey: John Wiley & Sons, Inc. pp. 61–63. ISBN 978-1-118-02771-4.

- ↑ "Method of Operation". Central Depository of Bangladesh. Retrieved 14 February 2017.

The investor opens a depository account with a participant or CDBL.

- ↑ Arnett III, George W. (2011). Global Securities Markets (1st ed.). Hoboken, New Jersey: John Wiley & Sons, Inc. p. 47. ISBN 978-1-118-02771-4.