Enron Corporation was an American energy, commodities, and services company based in Houston, Texas. It was founded by Kenneth Lay in 1985 as a merger between Lay's Houston Natural Gas and InterNorth, both relatively small regional companies. Before its bankruptcy on December 2, 2001, Enron employed approximately 20,600 staff and was a major electricity, natural gas, communications, and pulp and paper company, with claimed revenues of nearly $101 billion during 2000. Fortune named Enron "America's Most Innovative Company" for six consecutive years.

Andrew Stuart Fastow is an American convicted felon and former financier who was the chief financial officer of Enron Corporation, an energy trading company based in Houston, Texas, until he was fired shortly before the company declared bankruptcy. Fastow was one of the key figures behind the complex web of off-balance-sheet special purpose entities used to conceal Enron's massive losses in their quarterly balance sheets. By unlawfully maintaining personal stakes in these ostensibly independent ghost-entities, he was able to defraud Enron out of tens of millions of dollars.

Arthur Andersen was an American accounting firm based in Chicago that provided auditing, tax advising, consulting and other professional services to large corporations. By 2001, it had become one of the world's largest multinational corporations and was one of the "Big Five" accounting firms. The firm collapsed by mid-2002, as details of its questionable accounting practices for energy company Enron and telecommunications company WorldCom were revealed amid the two high-profile bankruptcies. The scandals were a factor in the enactment of the Sarbanes–Oxley Act of 2002.

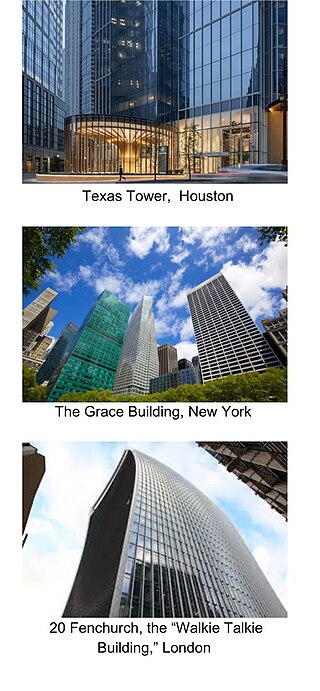

Vinson & Elkins LLP is an international law firm with approximately 700 lawyers worldwide headquartered in Downtown Houston, Texas.

Dynegy Inc. is an electric company based in Houston, Texas. It owns and operates a number of power stations in the U.S., all of which are natural gas-fueled or coal-fueled. Dynegy was acquired by Vistra Corp on April 9, 2018. The company is located at 601 Travis Street in Downtown Houston. The company was founded in 1984 as Natural Gas Clearinghouse. It was originally an energy brokerage, buying and selling natural gas supplies. It changed its name to NGC Corporation in 1995 after entering the electrical power generation business.

Wendy Lee Gramm is an American economist who led the Commodity Futures Trading Commission during the Reagan administration. She is also the wife of former United States Senator Phil Gramm. Gramm has gained notoriety for her role in the Enron scandal.

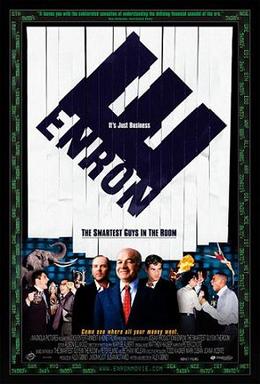

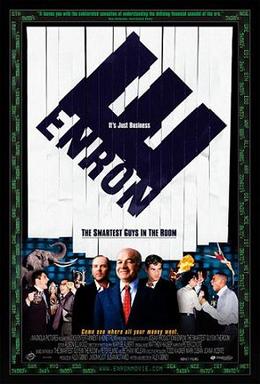

Enron: The Smartest Guys in the Room is a 2005 American documentary film based on the best-selling 2003 book of the same name by Fortune reporters Bethany McLean and Peter Elkind, who are credited as writers of the film alongside the director, Alex Gibney. It examines the 2001 collapse of the Enron Corporation, which resulted in criminal trials for several of the company's top executives during the ensuing Enron scandal, and contains a section about the involvement of Enron traders in the 2000-01 California electricity crisis. Archival footage is used alongside new interviews with McLean and Elkind, several former Enron executives and employees, stock analysts, reporters, and former Governor of California Gray Davis.

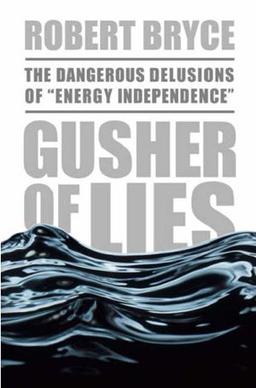

Robert Bryce is an American author and journalist based in Austin, Texas. His articles on energy, politics, and other topics have appeared in numerous publications, including the New York Times,Washington Post,Wall Street Journal,Forbes, Real Clear Energy,Counterpunch, and National Review.

Natural Gas Pipeline Company of America (NGPL) is a natural gas pipeline company. It owns pipelines which bring natural gas from the Texas Permian Basin and Gulf of Mexico into the Chicago area. It has had several corporate owners over the past century, and is owned by Kinder Morgan, Brookfield Infrastructure Partners, and ArcLight Capital Partners.

Lou Lung Pai is a Chinese-American businessman and former Enron executive. He was CEO of Enron subsidiaries Enron Energy Services and Enron Xcelerator, a venture capital division. He left Enron with over $250 million. Pai was the second-largest land owner in Colorado after he purchased the 77,500-acre (314 km2) Taylor Ranch for $23 million in 1999, though he sold the property in June 2004 for $60 million.

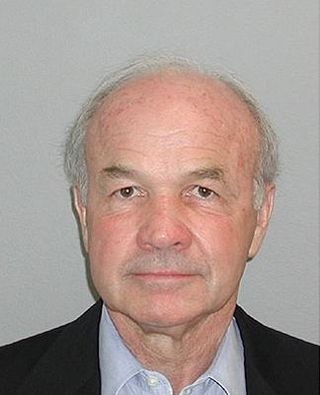

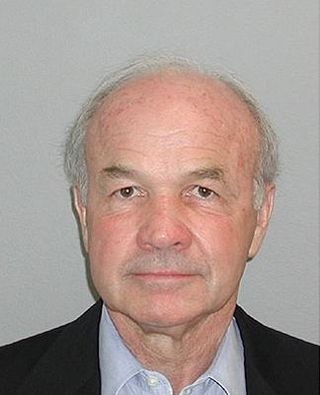

Kenneth Lee Lay was an American businessman who was the founder, chief executive officer and chairman of Enron. He was heavily involved in Enron's accounting scandal that unraveled in 2001 into the largest bankruptcy ever to that date. Lay was indicted by a grand jury and was found guilty of 10 counts of securities fraud at trial. Lay died in July 2006 while vacationing in his house near Aspen, Colorado, three months before his scheduled sentencing. A preliminary autopsy reported Lay died of a heart attack caused by coronary artery disease. His death resulted in a vacated judgment.

Rebecca P. Mark-Jusbasche, known during her international business career as Rebecca Mark, is the former head of Enron International, a subsidiary of Enron. She was also CEO of Azurix Corp., a publicly traded water services company originally developed by Enron International. Mark was promoted to Vice Chairman of Enron in 1998 and was a member of its board of directors. She resigned from Enron in August 2000.

Julie Moos is a Canadian photographer and art writer.

The Enron scandal was an accounting scandal involving Enron Corporation, an American energy company based in Houston, Texas. When news of widespread fraud within the company became public in October 2001, the company declared bankruptcy and its accounting firm, Arthur Andersen – then one of the five largest audit and accountancy partnerships in the world – was effectively dissolved. In addition to being the largest bankruptcy reorganization in U.S. history at that time, Enron was cited as the biggest audit failure.

Pipe dream, a phrase describing a wild or unattainable plan, may refer to:

Accounting scandals are business scandals which arise from intentional manipulation of financial statements with the disclosure of financial misdeeds by trusted executives of corporations or governments. Such misdeeds typically involve complex methods for misusing or misdirecting funds, overstating revenues, understating expenses, overstating the value of corporate assets, or underreporting the existence of liabilities; these can be detected either manually, or by the means of deep learning. It involves an employee, account, or corporation itself and is misleading to investors and shareholders.

Power Hungry: The Myths of "Green" Energy and the Real Fuels of the Future is a book by Robert Bryce about energy, mainly from a United States perspective. It was published in 2010 by PublicAffairs. A short essay based on the book was released as an op-ed by the author in The Washington Post.

Gusher of Lies: The Dangerous Delusions of Energy Independence is a book by Robert Bryce which was released in 2008 and is published by PublicAffairs.

Bush Family Fortunes: The Best Democracy Money Can Buy is a 2004 documentary film directed by Steven Grandison and Greg Palast. The film, which examines various aspects of the presidency of George W. Bush, including the 2000 US presidential election and the Iraq War, is adapted from the 2003 BBC production Bush Family Fortunes and based on the 2002 book The Best Democracy Money Can Buy by investigative journalist Palast, who had spent years tracking the Bush family for the BBC and The Guardian newspaper. The research for the original BBC film, which claims to have exposed the George W. Bush military service controversy, was also drawn upon by Michael Moore for Fahrenheit 9/11 (2004) and footage was used by Robert Greenwald in Unprecedented: The 2000 Presidential Election (2002).

"Tone at the top" is a term that originated in the field of accounting and is used to describe an organization's general ethical climate, as established by its board of directors, audit committee, and senior management. Having good tone at the top is believed by business ethics experts to help prevent fraud and other unethical practices. The very same idea is expressed in negative terms by the old saying "A fish rots from the head down".