A revenue stamp, tax stamp, duty stamp or fiscal stamp is a (usually) adhesive label used to designate collected taxes or fees on documents, tobacco, alcoholic drinks, drugs and medicines, playing cards, hunting licenses, firearm registration, and many other things. Typically, businesses purchase the stamps from the government, and attach them to taxed items as part of putting the items on sale, or in the case of documents, as part of filling out the form.

This is a survey of the postage stamps and postal history of Brunei.

Revenue stamps of Malta were first issued in 1899, when the islands were a British colony. From that year to 1912, all revenue issues were postage stamps overprinted accordingly, that was either done locally or by De La Rue in London. Postage stamps also became valid for fiscal use in 1913, so no new revenues were issued until 1926–30, when a series of key type stamps depicting King George V were issued. These exist unappropriated for use as general-duty revenues, or with additional inscriptions indicating a specific use; Applications, Contracts, Registers or Stocks & Shares. The only other revenues after this series were £1 stamps depicting George VI and Elizabeth II. Postage stamps remained valid for fiscal use until at least the 1980s.

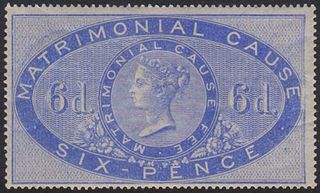

Revenue stamps of the United Kingdom refer to the various revenue or fiscal stamps, whether adhesive, directly embossed or otherwise, which were issued by and used in the Kingdom of England, the Kingdom of Great Britain, the United Kingdom of Great Britain and Ireland and the United Kingdom of Great Britain and Northern Ireland, from the late 17th century to the present day.

Trinidad and Tobago, formerly divided as two separate colonies, issued revenue stamps from 1879 to around 1991.

Revenue stamps of British Guiana refer to the various revenue or fiscal stamps, whether adhesive or directly embossed, which were issued by British Guiana prior to the colony's independence as Guyana in 1966. Between the 1860s and 1890s, the colony issued Inland Revenue and Summary Jurisdiction stamps, while revenue stamps and dual-purpose postage and revenue stamps were issued during the late 19th and 20th centuries. In around the 1890s or 1900s, British Guiana possibly issued stamps for taxes on medicine and matches, but it is unclear if these were actually issued. Guyana continued to issue its own revenue stamps after independence.

The St Paul's Shipwreck 10/- black is a postage and revenue stamp issued by the Crown Colony of Malta on 6 March 1919, and it is generally considered to be the country's rarest and most expensive stamp. It is rare because a very limited quantity of 1530 stamps was printed and it was inadvertently issued prematurely by the Post Office.

Eritrea first issued revenue stamps under the Italian Eritrea administration. It continued to issue revenues under British and Ethiopian occupation, as well as when it became an independent state. The capital Asmara also issued some revenues.

A postal fiscal is a revenue stamp that has been authorised for postal use. Postal fiscals may arise because there is a shortage of postage stamps for a country or out of economy to use up obsolete or excess stocks of revenue stamps. Postal fiscals are to be distinguished from stamps marked "Postage and Revenue" which were always intended for either use, or revenue stamps used postally by accident or because local postal regulations did not prohibit such use. Postal fiscal status may usually only be identified from the cancels on used stamps or where the stamp is found on cover.

New Zealand first issued revenue stamps on 1 January 1867 and their general use continued until the early 1950s. The only Revenue Stamp series still in use today is the Game Bird Habitat stamp which is used for payment of the Gun License for the duck shooting season which begins the first weekend of May. There were various types of fiscal stamps for different taxes.

Kenya, formerly known as British East Africa issued revenue stamps since 1891. There were numerous types of revenue stamps for a variety of taxes and fees. Also valid for fiscal use in Kenya were postage stamps issued by the following entities:

Revenue stamps of Jamaica were first issued in 1855. There were various types of fiscal stamps for different taxes.

Malaysia first issued revenue stamps as the Straits Settlements in 1863, and continues to do so to this day. Over the years, a number of entities in modern Malaysia have issued revenue stamps.

Over the years various Malay States issued their own revenue stamps. Now most states use Malaysian revenue stamps, except for Singapore which is independent and no longer uses revenue stamps.

Revenue stamps of Fiji were first issued in 1871 or 1872, when the Fiji islands were an independent kingdom. The first revenue stamps consisted of postage stamps overprinted with the letter D.

Revenue stamps of Seychelles were first issued in 1893, when the islands were a dependency of the British Crown Colony of Mauritius. The first stamps were Mauritius Internal Revenue stamps depicting Queen Victoria overprinted for use in Seychelles, and Bill stamps were also similarly overprinted. Postage stamps depicting Victoria or Edward VII were overprinted for fiscal use at various points between 1894 and 1904, while surcharges on Bill stamps were made in around 1897–98.

Revenue stamps of Montserrat were first issued in 1866, ten years before the island issued its first postage stamps. The island only issued two different designs of revenue stamps, but postage stamps were widely used for fiscal purposes and are still used as such today.

Few revenue stamps of Nigeria and its predecessor states have been issued, since most of the time dual-purpose postage and revenue stamps were used for fiscal purposes. The first revenue-only stamps were consular stamps of the Niger Coast Protectorate and the Southern Nigeria Protectorate, which were created by overprinting postage stamps in 1898 and 1902 respectively. The Northern Nigeria Protectorate did not issue any specific revenue stamps, but a £25 stamp of 1904 could not be used for postal purposes due to its extremely high face value.

Revenue stamps of Guyana refer to the various revenue or fiscal stamps, whether adhesive, directly embossed or otherwise, which have been issued by Guyana since its independence in 1966. Prior to independence, the country was known as British Guiana, and it had issued its own revenue stamps since the 19th century. Guyana used dual-purpose postage and revenue stamps until 1977, and it issued revenue-only stamps between 1975 and the 2000s. The country has also issued National Insurance stamps, labels for airport departure tax and excise stamps for cigarettes and alcohol.

Revenue stamps of Dominica were first issued in 1877, when the island was under British rule. Dominica issued very few revenue stamps, but dual-purpose postage and revenue stamps were widely used for fiscal purposes.