The Mercedes-Benz Group AG is a German multinational automotive corporation headquartered in Stuttgart, Baden-Württemberg, Germany. It is one of the world's leading car manufacturers. Daimler-Benz was formed with the merger of Benz & Cie., the world's oldest car company, and Daimler Motoren Gesellschaft in 1926. The company was renamed DaimlerChrysler upon the acquisition of American automobile manufacturer Chrysler Corporation in 1998, and was again renamed Daimler AG upon divestment of Chrysler in 2007. In 2021, Daimler AG was the second-largest German automaker and the sixth-largest worldwide by production. In February 2022, Daimler was renamed Mercedes-Benz Group as part of a transaction that spun-off its commercial vehicle segment as an independent company, Daimler Truck.

Fiat S.p.A., or Fabbrica Italiana Automobili Torino, was an Italian holding company whose original and core activities were in the automotive industry, and that was succeeded by Fiat Chrysler Automobiles NV (FCA). The Fiat Group contained many brands such as Ferrari, Maserati, Fiat, Alfa Romeo, the Chrysler Group, and many more. On 29 January 2014, it was announced that Fiat S.p.A. was to be merged into a new Netherlands-based holding company Fiat Chrysler Automobiles NV (FCA), taking place before the end of 2014. Fiat Chrysler Automobiles became the new owner of Fiat Group. On 1 August 2014, Fiat S.p.A. received necessary shareholder approval to proceed with the merger. The merger became effective 12 October 2014.

American Motors Corporation was an American automobile manufacturing company formed by the merger of Nash-Kelvinator Corporation and Hudson Motor Car Company on May 1, 1954. At the time, it was the largest corporate merger in U.S. history.

The Goldman Sachs Group, Inc. is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many international financial centers. Goldman Sachs is the second largest investment bank in the world by revenue and is ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue. It is considered a systemically important financial institution by the Financial Stability Board.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

Cerberus Capital Management, L.P. is a global alternative investment firm with assets across credit, private equity, and real estate strategies. The firm is based in New York City, and run by Steve Feinberg, who co-founded Cerberus in 1992, with William L. Richter, who serves as a senior managing director. The firm has affiliate and advisory offices in the United States, Europe and Asia.

In finance, the private-equity secondary market refers to the buying and selling of pre-existing investor commitments to private-equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private-equity funds as well as hedge funds can be more complex and labor-intensive.

740 Park Avenue is a luxury cooperative apartment building on the west side of Park Avenue between East 71st and 72nd Streets in the Lenox Hill neighborhood of Manhattan, New York City, United States. It was described in Business Insider in 2011 as "a legendary address" that was "at one time considered the most luxurious and powerful residential building in New York City". The "pre-war" building's side entrance address is 71 East 71st Street.

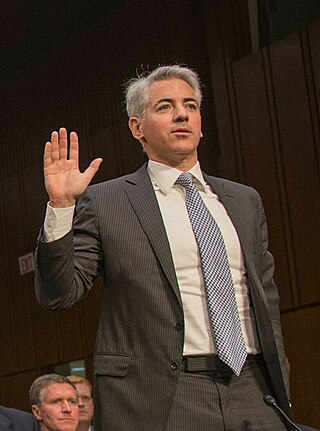

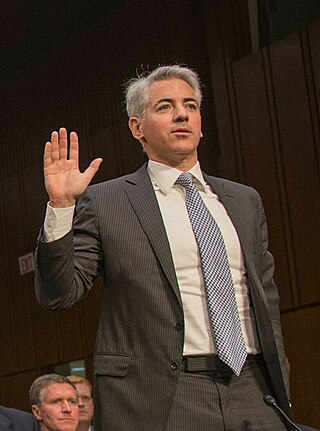

William Albert Ackman is an American billionaire hedge fund manager who is the founder and chief executive officer of Pershing Square Capital Management, a hedge fund management company. His investment approach has made him an activist investor. As of January 2024, Ackman's net worth was estimated at $4 billion by Forbes.

Raymond Thomas Dalio is an American billionaire investor and hedge fund manager, who has served as co-chief investment officer of the world's largest hedge fund, Bridgewater Associates, since 1985. He founded Bridgewater in 1975 in New York.

Private equity in the 2000s represents one of the major growth periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital expanded along parallel and interrelated tracks.

Fuel hedging is a contractual tool some large fuel consuming companies, such as airlines, cruise lines and trucking companies, use to reduce their exposure to volatile and potentially rising fuel costs. A fuel hedge contract is a futures contract that allows a fuel-consuming company to establish a fixed or capped cost, via a commodity swap or option. The companies enter into hedging contracts to mitigate their exposure to future fuel prices that may be higher than current prices and/or to establish a known fuel cost for budgeting purposes. If such a company buys a fuel swap and the price of fuel declines, the company will effectively be forced to pay an above-market rate for fuel. If the company buys a fuel call option and the price of fuel increases, the company will receive a return on the option that offsets their actual cost of fuel. If the company buys a fuel call option, which requires an upfront premium cost, much like insurance, and the price of fuel decreases, the company will not receive a return on the option but they will benefit from buying fuel at the then-lower cost.

Sculptor Capital Management is an American global diversified alternative asset management firm. They are one of the largest institutional alternative asset managers in the world.

The 2008–2010 automotive industry crisis formed part of the 2007–2008 financial crisis and the resulting Great Recession. The crisis affected European and Asian automobile manufacturers, but it was primarily felt in the American automobile manufacturing industry. The downturn also affected Canada by virtue of the Automotive Products Trade Agreement.

Fuel price risk management, a specialization of both financial risk management and oil price analysis and similar to conventional risk management practice, is a continual cyclic process that includes risk assessment, risk decision making and the implementation of risk controls. It focuses primarily on when and how an organization can best hedge against exposure to fuel price volatility. It is generally referred to as "bunker hedging" in marine and shipping contexts and "fuel hedging" in aviation and trucking contexts.

Elliott Investment Management is an American investment management firm. It is also one of the largest activist funds in the world.

Pershing Square Capital Management is an American hedge fund management company founded and run by Bill Ackman, headquartered in New York City.

Israel “Izzy” Englander is an American investor, hedge fund manager, and philanthropist. In 1989, he founded his hedge fund, Millennium Management, with Ronald Shear. The fund was started with US$35 million, and as of 2023 had US$61.2 billion in assets under management.

Millennium Management is an investment management firm with a multistrategy hedge fund offering. In 2023, it was one of the world's largest alternative asset management firms with over $58.9 billion assets under management as of June 2023. The firm operates in America, Europe and Asia. As of 2022, Millennium had posted the fourth highest net gains of any hedge fund since its inception in 1989.

SAC Capital Advisors was a group of hedge funds founded by Steven A. Cohen in 1992. The firm employed approximately 800 people in 2010 across its offices located in Stamford, Connecticut and New York City, and various offices. It reportedly lost many of its traders in the wake of various investigations by the Securities and Exchange Commission (SEC). In 2010, the SEC opened an insider trading investigation of SAC and in 2013 several former employees were indicted by the U.S. Department of Justice. In November 2013, the firm itself pleaded guilty to insider trading charges and paid $1.2 billion in penalties. The firm shrank after returning the vast majority of its outside investor capital. Point72 Asset Management was established as a separate family office in 2014. SAC ceased to exist as a separate entity in 2016.