Related Research Articles

The Tax Reform Act of 1986 (TRA) was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22, 1986.

In finance, a bond is a type of security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure.

Debt is an obligation that requires one party, the debtor, to pay money borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity.

A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and special districts. In the United States, interest income received by holders of municipal bonds is often, but not always, exempt from federal and state income taxation. Typically, only investors in the highest tax brackets benefit from buying tax-exempt municipal bonds instead of taxable bonds. Taxable equivalent yield calculations are required to make fair comparisons between the two categories.

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money.

The Low-Income Housing Tax Credit (LIHTC) is a federal program in the United States that awards tax credits to housing developers in exchange for agreeing to reserve a certain fraction of rent-restricted units for lower-income households. The program was created under the Tax Reform Act of 1986 (TRA86) to incentivize the use of private equity in developing affordable housing. Projects developed with LIHTC credits must maintain a certain percentage of affordable units for a set period of time, typically 30 years, though there is a "qualified contract" process that can allow property owners to opt out after 15 years. The maximum rent that can be charged for designated affordable units is based on Area Median Income (AMI); over 50% of residents in LIHTC properties are considered Extremely Low-Income. Less than 10% of current credit expenditures are claimed by individual investors.

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending, in addition to taxation. Since 2012, the U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt.

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Fixed-income securities can be contrasted with equity securities that create no obligation to pay dividends or any other form of income. Bonds carry a level of legal protections for investors that equity securities do not: in the event of a bankruptcy, bond holders would be repaid after liquidation of assets, whereas shareholders with stock often receive nothing.

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code. Such organizations are exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and unions.

The bond market is a financial market in which participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. As of 2021, the size of the bond market is estimated to be at $119 trillion worldwide and $46 trillion for the US market, according to the Securities Industry and Financial Markets Association (SIFMA).

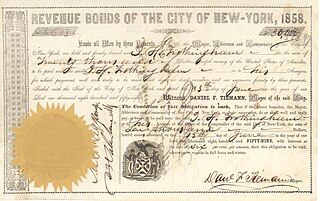

A revenue bond is a special type of municipal bond distinguished by its guarantee of repayment solely from revenues generated by a specified revenue-generating entity associated with the purpose of the bonds, rather than from a tax. Unlike general obligation bonds, only the revenues specified in the legal contract between the bond holder and bond issuer are required to be used for repayment of the principal and interest of the bonds; other revenues and the general credit of the issuing agency are not so encumbered. Because the pledge of security is not as great as that of general obligation bonds, revenue bonds may carry a slightly higher interest rate than G.O. bonds; however, they are usually considered the second-most secure type of municipal bonds.

A real estate mortgage investment conduit (REMIC) is "an entity that holds a fixed pool of mortgages and issues multiple classes of interests in itself to investors" under U.S. Federal income tax law and is "treated like a partnership for Federal income tax purposes with its income passed through to its interest holders". REMICs are used for the pooling of mortgage loans and issuance of mortgage-backed securities and have been a key contributor to the success of the mortgage-backed securities market over the past several decades.

TreasuryDirect is a website run by the Bureau of the Fiscal Service under the United States Department of the Treasury that allows US individual investors to purchase treasury securities, such as savings bonds, directly from the US government. It enables people to manage their investments online, including connecting their TreasuryDirect account to a bank account for deposits and withdrawals.

A 501(c)(3) organization is a United States corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

United States Savings Bonds are debt securities issued by the United States Department of the Treasury to help pay for the U.S. government's borrowing needs. They are considered one of the safest investments because they are backed by the full faith and credit of the United States government. The savings bonds are nonmarketable treasury securities issued to the public, which means they cannot be publicly traded or otherwise transferred. They are redeemable only by the original purchaser, a recipient or a beneficiary in case of the original holder's death.

Qualified Zone Academy Bonds (QZABs) are a U.S. government debt instrument created by Section 226 of the Taxpayer Relief Act of 1997. It was later revised and regulations may be found in Section 54(E) of the U.S. Code. The Tax Cuts and Jobs Act of 2017 eliminated QZABs as of January 30, 2018. QZABs allowed certain qualified public schools to borrow at nominal interest rates for public school renovation costs as well as for costs incurred in connection with the establishment of special programs in partnership with the private sector.

Build America Bonds are taxable municipal bonds that carry special tax credits and federal subsidies for either the bond issuer or the bondholder. Build America Bonds were created under Section 1531 of Title I of Division B of the American Recovery and Reinvestment Act that U.S. President Barack Obama signed into law on February 17, 2009. The program expired December 31, 2010.

Fiscal policy are "measures employed by governments to stabilize the economy, specifically by manipulating the levels and allocations of taxes and government expenditures". In the Philippines, this is characterized by continuous and increasing levels of debt and budget deficits, though there were improvements in the last few years of the first decade of the 21st century.

References

- ↑ Maguire, Steven; Hughes, Joseph S. (July 13, 2018). Private Activity Bonds: An Introduction (PDF). Washington, DC: Congressional Research Service. Retrieved 20 July 2018.

- ↑ Publication 4078: Tax-Exempt Private Activity Bonds (PDF). Rev. 9-2019. United States Department of the Treasury Internal Revenue Service. Catalog Number 34662G.