Related Research Articles

Investment is traditionally defined as the "commitment of resources to achieve later benefits". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditure and receipts are defined in terms of money, then the net monetary receipt in a time period is termed as cash flow, while money received in a series of several time periods is termed as cash flow stream. Investment science is the application of scientific tools for investments.

A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date.

A reserve currency is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic action that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

In international economics, the balance of payments of a country is the difference between all money flowing into the country in a particular period of time and the outflow of money to the rest of the world. These financial transactions are made by individuals, firms and government bodies to compare receipts and payments arising out of trade of goods and services.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

The Bretton Woods system of monetary management established the rules for commercial relations among the United States, Canada, Western European countries, and Australia among 44 other countries after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold. It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits.

In finance, a swap is an agreement between two counterparties to exchange financial instruments, cashflows, or payments for a certain time. The instruments can be almost anything but most swaps involve cash based on a notional principal amount.

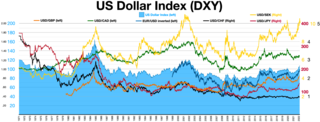

The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market.

Foreign exchange reserves are cash and other reserve assets such as gold held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and to maintain confidence in financial markets. Reserves are held in one or more reserve currencies, nowadays mostly the United States dollar and to a lesser extent the euro.

International finance is the branch of financial economics broadly concerned with monetary and macroeconomic interrelations between two or more countries. International finance examines the dynamics of the global financial system, international monetary systems, balance of payments, exchange rates, foreign direct investment, and how these topics relate to international trade.

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financial loss and uncertainty about its extent.

Foreign exchange risk is a financial risk that exists when a financial transaction is denominated in a currency other than the domestic currency of the company. The exchange risk arises when there is a risk of an unfavourable change in exchange rate between the domestic currency and the denominated currency before the date when the transaction is completed.

Currency depreciation is the loss of value of a country's currency with respect to one or more foreign reference currencies, typically in a floating exchange rate system in which no official currency value is maintained. Currency appreciation in the same context is an increase in the value of the currency. Short-term changes in the value of a currency are reflected in changes in the exchange rate.

In macroeconomics, crawling peg is an exchange rate regime that allows depreciation or appreciation to happen gradually. It is usually seen as a part of a fixed exchange rate regime.

Currency intervention, also known as foreign exchange market intervention or currency manipulation, is a monetary policy operation. It occurs when a government or central bank buys or sells foreign currency in exchange for its own domestic currency, generally with the intention of influencing the exchange rate and trade policy.

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold.

A foreign portfolio investment is a grouping of assets such as stocks, bonds, and cash equivalents. Portfolio investments are held directly by an investor or managed by financial professionals. In economics, foreign portfolio investment is the entry of funds into a country where foreigners deposit money in a country's bank or make purchases in the country's stock and bond markets, sometimes for speculation.

A foreign exchange derivative is a financial derivative whose payoff depends on the foreign exchange rates of two currencies. These instruments are commonly used for currency speculation and arbitrage or for hedging foreign exchange risk.

The United States dollar was established as the world's foremost reserve currency by the Bretton Woods Agreement of 1944. It claimed this status from sterling after the devastation of two world wars and the massive spending of the United Kingdom's gold reserves. Despite all links to gold being severed in 1971, the dollar continues to be the world's foremost reserve currency. Furthermore, the Bretton Woods Agreement also set up the global post-war monetary system by setting up rules, institutions and procedures for conducting international trade and accessing the global capital markets using the US dollar.

References

- ↑ Currency Privatization as a Substitute for Currency Boards and Dollarization

- ↑ "Everything to Know About Currency Risk In International Business". The Balance. Retrieved 2018-10-20.

- ↑ Staff, Investopedia (2005-05-11). "Currency Risk". Investopedia. Retrieved 2018-10-20.

- ↑ Eatwell, John; Taylor, Lance (2000), Global Finance at Risk, The New York Press, pp. 2–5.