Related Research Articles

Accounting, also known as accountancy, is the process of recording and processing information about economic entities, such as businesses and corporations. Accounting measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and "financial reporting" are often used interchangeably.

The Big Four are the four largest professional services networks in the world: Deloitte, EY, KPMG, and PwC. They are the four largest global accounting networks as measured by revenue. The four are often grouped because they are comparable in size relative to the rest of the market, both in terms of revenue and workforce; they are considered equal in their ability to provide a wide scope of professional services to their clients; and, among those looking to start a career in professional services, particularly accounting, they are considered equally attractive networks to work in, because of the frequency with which these firms engage with Fortune 500 companies.

The Register is a British technology news website co-founded in 1994 by Mike Magee and John Lettice. The online newspaper's masthead sublogo is "Biting the hand that feeds IT." The publication's primary focus is information technology news and opinions.

Ernst & Young Global Limited, trading as EY, is a multinational professional services partnership. EY is one of the largest professional services networks in the world. Along with Deloitte, KPMG and PwC, it is one of the Big Four accounting firms. It primarily provides assurance, tax, information technology services, consulting, and advisory services to its clients.

KPMG International Limited is a multinational professional services network, and one of the Big Four accounting organizations, along with Ernst & Young (EY), Deloitte, and PwC. The name "KPMG" stands for "Klynveld Peat Marwick Goerdeler". The initialism was chosen when KMG merged with Peat Marwick in 1987.

The ISO 9000 family is a set of international standards for quality management systems. It was developed in March 1987 by International Organization for Standardization. The goal of it is to help organizations ensure that they meet customer and other stakeholder needs within the statutory and regulatory requirements related to a product or service. The ISO refers to the set of standards as a "family", bringing together the standard for quality management systems and a set of "supporting standards", and their presentation as a family facilitates their integrated application within an organisation. ISO 9000 deals with the fundamentals and vocabulary of QMS, including the seven quality management principles that underlie the family of standards. ISO 9001 deals with the requirements that organizations wishing to meet the standard must fulfill. A companion document, ISO/TS 9002, provides guidelines for the application of ISO 9001. ISO 9004 gives guidance on achieving sustained organizational success.

PricewaterhouseCoopers International Limited is a multinational professional services brand of firms, operating as partnerships under the PwC brand. It is the second-largest professional services network in the world and is considered one of the Big Four accounting firms, along with Deloitte, EY, and KPMG.

An audit is an "independent examination of financial information of any entity, whether profit oriented or not, irrespective of its size or legal form when such an examination is conducted with a view to express an opinion thereon." Auditing also attempts to ensure that the books of accounts are properly maintained by the concern as required by law. Auditors consider the propositions before them, obtain evidence, roll forward prior year working papers, and evaluate the propositions in their auditing report.

Marketing management is the strategic organizational discipline that focuses on the practical application of marketing orientation, techniques and methods inside enterprises and organizations and on the management of marketing resources and activities. Compare marketology, which Aghazadeh defines in terms of "recognizing, generating and disseminating market insight to ensure better market-related decisions".

Due diligence is the investigation or exercise of care that a reasonable business or person is normally expected to take before entering into an agreement or contract with another party or an act with a certain standard of care.

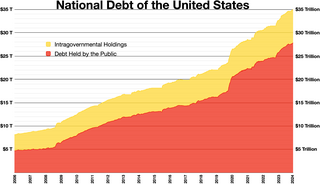

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

Deloitte Touche Tohmatsu Limited, commonly referred to as Deloitte, is a multinational professional services network based in London, England. Deloitte is the largest professional services network by revenue and number of employees in the world and is one of the Big Four accounting firms, along with EY, KPMG, and PwC.

Forensic accounting, forensic accountancy or financial forensics is the specialty practice area of accounting that investigates whether firms engage in financial reporting misconduct, or financial misconduct within the workplace by employees, officers or directors of the organization. Forensic accountants apply a range of skills and methods to determine whether there has been financial misconduct by the firm or its employees.

The Financial Reporting Council (FRC) is an independent regulator in the UK and Ireland based in London Wall in the City of London, responsible for regulating auditors, accountants and actuaries, and setting the UK's Corporate Governance and Stewardship Codes. The FRC seeks to promote transparency and integrity in business by aiming its work at investors and others who rely on company reports, audits and high-quality risk management.

Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organization's operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control and governance processes. Internal auditing might achieve this goal by providing insight and recommendations based on analyses and assessments of data and business processes. With commitment to integrity and accountability, internal auditing provides value to governing bodies and senior management as an objective source of independent advice. Professionals called internal auditors are employed by organizations to perform the internal auditing activity.

Grant Thornton is a multinational professional services company based in London, England. It is the world's seventh-largest by revenue and sixth-largest by number of employees professional services network of independent accounting and consulting member firms which provide assurance, tax and advisory services to privately held businesses, public interest entities, and public sector entities. Grant Thornton International Ltd. is a not-for-profit, non-practising, international umbrella membership entity organised as a private company limited by guarantee, and has no share capital.

Arabian Business (AB) is a weekly business magazine published in Dubai and focusing on global and regional news analysis. The brand is aimed at the English and Arabic-speaking communities and is published in both languages.

The United Arab Emirates is a federation of seven Emirates, with autonomous federal and local governments. The UAE has historically been a low-tax jurisdiction. The federal government and local governments are entitled to levy taxes on citizens and companies. The federal government currently levies a value added tax, corporate income tax, and excise taxes. Some emirates levy property, transfer, excise and tourism taxes. Some emirates also charge corporate taxes on oil companies and foreign banks.

In website governance, a content audit is the process of evaluating content elements and information assets on some part or all of a website.

Gamaliel Asis Cordoba is a Filipino lawyer who was the longest-serving Commissioner of the National Telecommunications Commission (NTC) from 2009 until 2022. He is currently the Chairperson of the Commission on Audit (COA) replacing former Solicitor General Jose Calida. His appointment was confirmed by the Commission on Appointments (CA) on November 29, 2022.

References

- ↑ "What Is Auditing?". ASQ. Retrieved 9 September 2024.

- ↑ Hammer, M (April 2007). "The process audit". Harvard Business Review. 85 (4): 111–9, 122–3, 142. PMID 17432158 . Retrieved 9 September 2024.

- ↑ Ramu, Govind (September 2024). "A Tailored Approach: A framework for thorough, value-add process auditing" . Quality Progress . 57 (9): 30–37. Retrieved 9 September 2024.