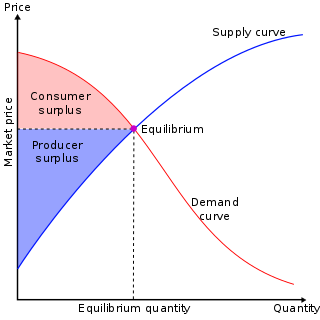

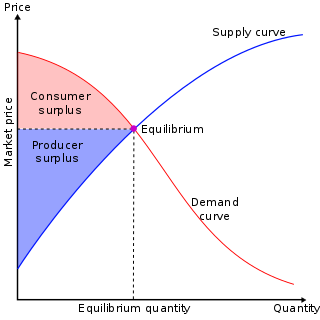

In microeconomics, supply and demand is an economic model of price determination in a market. It postulates that, holding all else equal, in a competitive market, the unit price for a particular good, or other traded item such as labor or liquid financial assets, will vary until it settles at a point where the quantity demanded will equal the quantity supplied, resulting in an economic equilibrium for price and quantity transacted. It forms the theoretical basis of modern economics.

In mainstream economics, economic surplus, also known as total welfare or Marshallian surplus, refers to two related quantities:

In economics, elasticity refers to the measurement of a percentage change of one economic variable in response to a change in another.

A good's price elasticity of demand is a measure of how sensitive the quantity demanded of it is to its price. When the price rises, quantity demanded falls for almost any good, but it falls more for some than for others. The price elasticity gives the percentage change in quantity demanded when there is a one percent increase in price, holding everything else constant. If the elasticity is -2, that means a one percent price rise leads to a two percent decline in quantity demanded. Other elasticities measure how the quantity demanded changes with other variables.

Marginalism is a theory of economics that attempts to explain the discrepancy in the value of goods and services by reference to their secondary, or marginal, utility. The reason why the price of diamonds is higher than that of water, for example, owes to the greater additional satisfaction of the diamonds over the water. Thus, while the water has greater total utility, the diamond has greater marginal utility.

In economics, economic equilibrium is a situation in which economic forces such as supply and demand are balanced and in the absence of external influences the (equilibrium) values of economic variables will not change. For example, in the standard text perfect competition, equilibrium occurs at the point at which quantity demanded and quantity supplied are equal. Market equilibrium in this case is a condition where a market price is established through competition such that the amount of goods or services sought by buyers is equal to the amount of goods or services produced by sellers. This price is often called the competitive price or market clearing price and will tend not to change unless demand or supply changes, and quantity is called the "competitive quantity" or market clearing quantity. But the concept of equilibrium in economics also applies to imperfectly competitive markets, where it takes the form of a Nash equilibrium.

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It specifies the amount of goods and services that will be purchased at all possible price levels. Consumer spending, investment, corporate and government expenditure, and net exports make up the aggregate demand.

In classical economics, Say's law, or the law of markets, is the claim that the production of a product creates demand for another product by providing something of value which can be exchanged for that other product. So, production is the source of demand. In his principal work, A Treatise on Political Economy, Jean-Baptiste Say wrote: "A product is no sooner created, than it, from that instant, affords a market for other products to the full extent of its own value." And also, "As each of us can only purchase the productions of others with his own productions – as the value we can buy is equal to the value we can produce, the more men can produce, the more they will purchase."

In economics, effective demand (ED) in a market is the demand for a product or service which occurs when purchasers are constrained in a different market. It contrasts with notional demand, which is the demand that occurs when purchasers are not constrained in any other market. In the aggregated market for goods in general, demand, notional or effective, is referred to as aggregate demand. The concept of effective supply parallels the concept of effective demand. The concept of effective demand or supply becomes relevant when markets do not continuously maintain equilibrium prices.

In economics, comparative statics is the comparison of two different economic outcomes, before and after a change in some underlying exogenous parameter.

In economics, market clearing is the process by which, in an economic market, the supply of whatever is traded is equated to the demand so that there is no leftover supply or demand. The new classical economics assumes that in any given market, assuming that all buyers and sellers have access to information and that there is not "friction" impeding price changes, prices always adjust up or down to ensure market clearing.

In economics, a demand curve is a graph depicting the relationship between the price of a certain commodity and the quantity of that commodity that is demanded at that price. Demand curves may be used to model the price-quantity relationship for an individual consumer, or more commonly for all consumers in a particular market.

The cobweb model or cobweb theory is an economic model that explains why prices might be subject to periodic fluctuations in certain types of markets. It describes cyclical supply and demand in a market where the amount produced must be chosen before prices are observed. Producers' expectations about prices are assumed to be based on observations of previous prices. Nicholas Kaldor analyzed the model in 1934, coining the term "cobweb theorem", citing previous analyses in German by Henry Schultz and Umberto Ricci.

A Walrasian auction, introduced by Léon Walras, is a type of simultaneous auction where each agent calculates its demand for the good at every possible price and submits this to an auctioneer. The price is then set so that the total demand across all agents equals the total amount of the good. Thus, a Walrasian auction perfectly matches the supply and the demand.

Walras's law is a principle in general equilibrium theory asserting that budget constraints imply that the values of excess demand must sum to zero regardless of whether the prices are general equilibrium prices. That is:

In monetary economics, the equation of exchange is the relation:

The Sonnenschein–Mantel–Debreu theorem is an important result in general equilibrium economics, proved by Gérard Debreu, Rolf Mantel, and Hugo F. Sonnenschein in the 1970s. It states that the excess demand curve for a market populated with utility-maximizing rational agents can take the shape of any function that is continuous, has homogeneity degree zero, and is in accordance with Walras's law. This implies that market processes will not necessarily reach a unique and stable equilibrium point.

Competitive equilibrium is a concept of economic equilibrium introduced by Kenneth Arrow and Gérard Debreu in 1951 appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated.

The Interspiro DCSC is a semi-closed circuit nitrox rebreather manufactured by Interspiro of Sweden for military applications. Interspiro was formerly a division of AGA and has been manufacturing self-contained breathing apparatus for diving, firefighting and rescue applications since the 1950s.

In microeconomics, an excess demand function is a function expressing excess demand for a product—the excess of quantity demanded over quantity supplied—in terms of the product's price and possibly other determinants. It is the product's demand function minus its supply function. In a pure exchange economy, the excess demand is the sum of all agents' demands minus the sum of all agents' initial endowments.