Neoclassical economics is an approach to economics in which the production, consumption and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good or service is determined through a hypothetical maximization of utility by income-constrained individuals and of profits by firms facing production costs and employing available information and factors of production. This approach has often been justified by appealing to rational choice theory, a theory that has come under considerable question in recent years.

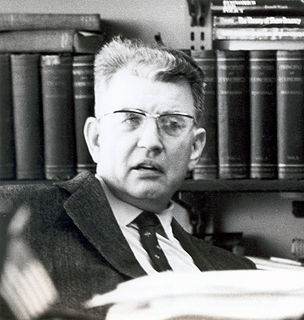

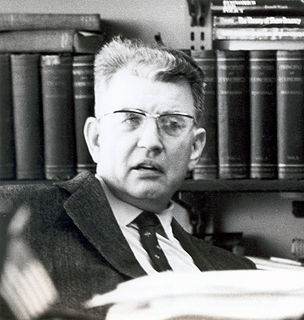

Ronald Harry Coase was a British economist and author. He was the Clifton R. Musser Professor of Economics at the University of Chicago Law School, where he arrived in 1964 and remained for the rest of his life. He received the Nobel Memorial Prize in Economic Sciences in 1991.

"The Nature of the Firm" (1937) is an article by Ronald Coase. It offered an economic explanation of why individuals choose to form partnerships, companies and other business entities rather than trading bilaterally through contracts on a market. The author was awarded the Nobel Memorial Prize in Economic Sciences in 1991 in part due to this paper. Despite the honor, the paper was written when Coase was an undergraduate and he described it later in life as "little more than an undergraduate essay."

In economics and related disciplines, a transaction cost is a cost in making any economic trade when participating in a market. Oliver E. Williamson defines transaction costs as the costs of running an economic system of companies, and unlike production costs, decision-makers determine strategies of companies by measuring transaction costs and production costs. Transaction costs are the total costs of making a transaction, including the cost of planning, deciding, changing plans, resolving disputes, and after-sales. Therefore, the transaction cost is one of the most significant factors in business operation and management.

Oliver Eaton Williamson was an American economist, a professor at the University of California, Berkeley, and recipient of the 2009 Nobel Memorial Prize in Economic Sciences, which he shared with Elinor Ostrom.

In economics, economic rent is any payment to an owner or factor of production in excess of the costs needed to bring that factor into production. In classical economics, economic rent is any payment made or benefit received for non-produced inputs such as location (land) and for assets formed by creating official privilege over natural opportunities. In the moral economy of neoclassical economics, economic rent includes income gained by labor or state beneficiaries of other "contrived" exclusivity, such as labor guilds and unofficial corruption.

Rent-seeking is the effort to increase one's share of existing wealth without creating new wealth. Rent-seeking results in reduced economic efficiency through misallocation of resources, reduced wealth creation, lost government revenue, heightened income inequality, and potential national decline.

In economics, aggregate supply (AS) or domestic final supply (DFS) is the total supply of goods and services that firms in a national economy plan on selling during a specific time period. It is the total amount of goods and services that firms are willing and able to sell at a given price level in an economy.

The theory of the firm consists of a number of economic theories that explain and predict the nature of the firm, company, or corporation, including its existence, behaviour, structure, and relationship to the market.

Government failure, in the context of public economics, is an economic inefficiency caused by a government intervention, if the inefficiency would not exist in a true free market. It can be viewed in contrast to a market failure, which is an economic inefficiency that results from the free market itself, and can potentially be corrected through government regulation. The idea of government failure is associated with the policy argument that, even if particular markets may not meet the standard conditions of perfect competition required to ensure social optimality, government intervention may make matters worse rather than better.

In economics, the hold-up problem is central to the theory of incomplete contracts, and shows the difficulty in writing complete contracts. A hold-up problem arises when two factors are present:

- Parties to a future transaction must make noncontractible relationship-specific investments before the transaction takes place.

- The specific form of the optimal transaction cannot be determined with certainty beforehand.

International economics is concerned with the effects upon economic activity from international differences in productive resources and consumer preferences and the international institutions that affect them. It seeks to explain the patterns and consequences of transactions and interactions between the inhabitants of different countries, including trade, investment and transaction.

New institutional economics (NIE) is an economic perspective that attempts to extend economics by focusing on the institutions that underlie economic activity and with analysis beyond earlier institutional economics and neoclassical economics. Unlike neoclassical economics, it also considers the role of culture and classical political economy in economic development.

In economics, the long-run is a theoretical concept in which all markets are in equilibrium, and all prices and quantities have fully adjusted and are in equilibrium. The long-run contrasts with the short-run, in which there are some constraints and markets are not fully in equilibrium. More specifically, in microeconomics there are no fixed factors of production in the long-run, and there is enough time for adjustment so that there are no constraints preventing changing the output level by changing the capital stock or by entering or leaving an industry. This contrasts with the short-run, where some factors are variable and others are fixed, constraining entry or exit from an industry. In macroeconomics, the long-run is the period when the general price level, contractual wage rates, and expectations adjust fully to the state of the economy, in contrast to the short-run when these variables may not fully adjust.

Asset specificity is a term related to the inter-party relationships of a transaction. It is usually defined as the extent to which the investments made to support a particular transaction have a higher value to that transaction than they would have if they were redeployed for any other purpose. Asset specificity has been extensively studied in a variety of management and economics areas such as marketing, accounting, organizational behavior and management information systems.

Optimal tax theory or the theory of optimal taxation is the study of designing and implementing a tax that maximises a social welfare function subject to economic constraints. The social welfare function used is typically a function of individuals' utilities, most commonly some form of utilitarian function, so the tax system is chosen to maximise the aggregate of individual utilities. Tax revenue is required to fund the provision of public goods and other government services, as well as for redistribution from rich to poor individuals. However, most taxes distort individual behavior, because the activity that is taxed becomes relatively less desirable; for instance, taxes on labour income reduce the incentive to work. The optimization problem involves minimizing the distortions caused by taxation, while achieving desired levels of redistribution and revenue. Some taxes are thought to be less distorting, such as lump-sum taxes and Pigouvian taxes, where the market consumption of a good is inefficient and a tax brings consumption closer to the efficient level.

Property rights have developed over ancient and modern history, from Abrahamic law to todays Universal Declaration of Human Rights article 17. Property rights can be understood as constructs in economics for determining how a resource or economic good is used and owned. Resources can be owned by individuals, associations, collectives, or governments. Property rights can be viewed as an attribute of an economic good. This attribute has three broad components and is often referred to as a bundle of rights in the United States:

- the right to use the good

- the right to earn income from the good

- the right to transfer the good to others, alter it, abandon it, or destroy it

The Brookings Papers on Economic Activity (BPEA) is a journal of macroeconomics published twice a year by the Brookings Institution Press.[1] Each issue of the journal comprises the proceedings of a conference held biannually by the Economic Studies program at the Brookings Institution in Washington D.C. The conference and journal both “emphasize innovative analysis that has an empirical orientation, take real-world institutions seriously, and is relevant to economic policy.”[2]

A global value chain (GVC) refers to the full range of activities that economic actors engaged in to bring a product to market. The global value chain does not only involve production processes, but preproduction and postproduction processes.

In economic theory, the field of contract theory can be subdivided in the theory of complete contracts and the theory of incomplete contracts.