Related Research Articles

NZ Post, shortened from New Zealand Post, is a state-owned enterprise responsible for providing postal service in New Zealand.

In finance, valuation is the process of determining the present value (PV) of an asset. In a business context, it is often the hypothetical price that a third party would pay for a given asset. Valuations can be done on assets or on liabilities. Valuations are needed for many reasons such as investment analysis, capital budgeting, merger and acquisition transactions, financial reporting, taxable events to determine the proper tax liability.

A property tax or millage rate is an ad valorem tax on the value of a property.

A joint venture (JV) is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance. Companies typically pursue joint ventures for one of four reasons: to access a new market, particularly Emerging market; to gain scale efficiencies by combining assets and operations; to share risk for major investments or projects; or to access skills and capabilities.

A sole proprietorship, also known as a sole tradership, individual entrepreneurship or proprietorship, is a type of enterprise owned and run by one person and in which there is no legal distinction between the owner and the business entity. A sole trader does not necessarily work alone and may employ other people.

Tranz Rail, formally Tranz Rail Holdings Limited, was the main rail operator in New Zealand from 1991 until it was purchased by Toll Holdings in 2003.

Rates are a type of property tax system in the United Kingdom, and in places with systems deriving from the British one, the proceeds of which are used to fund local government. Some other countries have taxes with a more or less comparable role, like France's taxe d'habitation.

Real estate appraisal, property valuation or land valuation is the process of developing an opinion of value for real property. Real estate transactions often require appraisals because they occur infrequently and every property is unique, unlike corporate stocks, which are traded daily and are identical. The location also plays a key role in valuation. However, since property cannot change location, it is often the upgrades or improvements to the home that can change its value. Appraisal reports form the basis for mortgage loans, settling estates and divorces, taxation, and so on. Sometimes an appraisal report is used to establish a sale price for a property.

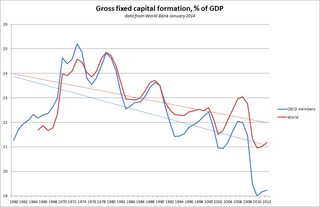

Capital formation is a concept used in macroeconomics, national accounts and financial economics. Occasionally it is also used in corporate accounts. It can be defined in three ways:

The Valuation Office Agency is a government body in England and Wales. It is an executive agency of His Majesty's Revenue and Customs.

Meteorological Service of New Zealand Limited is the national meteorological service of New Zealand. MetService was established as a state-owned enterprise in 1992. It employs about 300 staff, and its headquarters are in Wellington, New Zealand. Prior to becoming a state-owned enterprise, New Zealand's national meteorological service has existed in a number of forms since the appointment of the country's first Director of Meteorological Stations in August 1861.

Business rates in England, or non-domestic rates, are a tax on the occupation of non-domestic property. Rates are a property tax with ancient roots that was formerly used to fund local services that was formalised with the Poor Law 1572 and superseded by the Poor Law of 1601. The Local Government Finance Act 1988 introduced business rates in England and Wales from 1990, repealing its immediate predecessor, the General Rate Act 1967. The act also introduced business rates in Scotland but as an amendment to the existing system, which had evolved separately to that in the rest of Great Britain. Since the establishment in 1997 of a Welsh Assembly able to pass legislation, the English and Welsh systems have been able to diverge. In 2015, business rates for Wales were devolved.

Landcorp Farming Limited ("Landcorp") is a state-owned enterprise of the New Zealand government. Its brand name is Pāmu, the Te Reo Māori word 'to farm'. Its core business is pastoral farming including dairy, sheep, beef and deer, as well as a Foods business marketing milk and meat products globally under the Pāmu brand and as a supplier to other food processors. Pāmu manages 117 properties carrying over 1 million stock units on 3366,3426 hectares of property under management.

Most local governments in the United States impose a property tax, also known as a millage rate, as a principal source of revenue. This tax may be imposed on real estate or personal property. The tax is nearly always computed as the fair market value of the property times an assessment ratio times a tax rate, and is generally an obligation of the owner of the property. Values are determined by local officials, and may be disputed by property owners. For the taxing authority, one advantage of the property tax over the sales tax or income tax is that the revenue always equals the tax levy, unlike the other taxes. The property tax typically produces the required revenue for municipalities' tax levies. A disadvantage to the taxpayer is that the tax liability is fixed, while the taxpayer's income is not.

A property tax known as "rates" has been levied in Hong Kong since 1845. The tax applies to all domestic and commercial properties unless exempted, and is based upon the rental value of the property, re-assessed each year. Formerly part of the revenue went to the Urban Council and, from 1986, the Regional Council, but since 2000 the whole amount goes to the Hong Kong Government.

The Civil Aviation Authority of Fiji (CAAF) is the civil aviation authority in the Republic of Fiji and is responsible for discharging functions on behalf of the Government of Fiji under the States responsibility to the Convention on International Civil Aviation, also known as the Chicago Convention on International Civil Aviation Organization (ICAO). CAAF regulates the activities of airport operators, air traffic control and air navigation service providers, airline operators, pilots and air traffic controllers, aircraft engineers, technicians, airports, airline contracting organisations and international air cargo operators in Fiji.

Rates are a tax on property in the United Kingdom used to fund local government. Business rates are collected throughout the United Kingdom. Domestic rates are collected in Northern Ireland and were collected in England and Wales before 1990 and in Scotland before 1989.

The Local Government (Rating) Act 2002 of New Zealand is an Act of New Zealand's Parliament that empowers Local Government bodies to levy property taxes on property owners within their jurisdictions. These property taxes are called rates. They are assessed annually and usually paid in four equal instalments.

References

- ↑ "Quotable Value profit in maiden year | Scoop News".

- 1 2 "Company and entity performance advice".

- ↑ MacLeod, Scott (22 June 1999). "Law allows overseas firm to set values". The New Zealand Herald . Retrieved 4 November 2011.

- ↑ Statement of Corporate Intent (SCI) Archived 2008-10-14 at the Wayback Machine