Smuggling is the illegal transportation of objects, substances, information or people, such as out of a house or buildings, into a prison, or across an international border, in violation of applicable laws or other regulations.

“Customs” means the Government Service which is responsible for the administration of Customs law and the collection of duties and taxes and which also has the responsibility for the application of other laws and regulations relating to the importation, exportation, movement or storage of goods.

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the exemption of certain goods or services from sales and use tax.

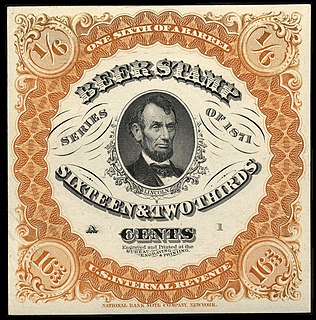

An ad valorem tax is a tax whose amount is based on the value of a transaction or of property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ad valorem tax may also be imposed annually, as in the case of a real or personal property tax, or in connection with another significant event. In some countries a stamp duty is imposed as an ad valorem tax.

A secondhand or used good is a piece of personal property that is being purchased by or otherwise transferred to a second or later end user. A used good can also simply mean it is no longer in the same condition as it was when transferred to the current owner. When the term used means that an item has expended its purpose, it is typically called garbage, instead.

Border trade, in general, refers to the flow of goods and services across the international borders between jurisdictions. In this sense, it is a part of normal legal trade that flows through standard export/import frameworks of nations. However border trade specifically refers to the increase in trade in areas where crossing borders is relatively easy and where products are significantly cheaper in one place than another, often because of significant variations in taxation levels on goods such as alcohol and tobacco.

A parallel import is a non-counterfeit product imported from another country without the permission of the intellectual property owner. Parallel imports are often referred to as grey product and are implicated in issues of international trade, and intellectual property.

Duty-free shops are retail outlets that are exempt from the payment of certain local or national taxes and duties, on the requirement that the goods sold will be sold to travelers who will take them out of the country. Which products can be sold duty-free vary by jurisdiction, as well as how they can be sold, and the process of calculating the duty or refunding the duty component.

Re-exportation, also called entrepot trade, may occur when one member of a free trade agreement charges lower tariffs to external nations to win trade, and then re-exports the same product to another partner in the trade agreement, but tariff-free. Re-exportation can be used to avoid sanctions by other nations.

Export subsidy is a government policy to encourage export of goods and discourage sale of goods on the domestic market through direct payments, low-cost loans, tax relief for exporters, or government-financed international advertising. An export subsidy reduces the price paid by foreign importers, which means domestic consumers pay more than foreign consumers. The World Trade Organization (WTO) prohibits most subsidies directly linked to the volume of exports, except for LDCs. Incentives are given by the government of a country to exporters to encourage export of goods.

A bonded warehouse, or bond, is a building or other secured area in which dutiable goods may be stored, manipulated, or undergo manufacturing operations without payment of duty. It may be managed by the state or by private enterprise. In the latter case a customs bond must be posted with the government. This system exists in all developed countries of the world.

Missing trader fraud and the related carousel fraud is the theft of Value Added Tax (VAT) from a government by organised crime gangs who exploit the way VAT is treated within multi-jurisdictional trading where the movement of goods between jurisdictions is VAT-free. This allows the fraudster to charge VAT on the sale of goods, and then instead of paying this over to the government's collection authority, to abscond, taking the VAT with them. This is termed "missing trader" as the trader goes missing with the VAT. "Carousel" refers to a more complex type of fraud in which VAT and goods are passed around between companies and jurisdictions, similar to how a carousel goes round and round.

The Royal Malaysian Customs Department, abbreviated RMC or JKDM, is the government agency responsible for administrating the nation's indirect tax policy, border enforcement and narcotic offences. In other words, KDRM administers seven main and thirty-nine subsidiary laws. Apart from this,KDRM implements eighteen laws for other government agencies. KDRM is now known as JKDM when Dato' Sri Hj. Ibrahim bin Jaapar takes over as Director General of Customs in 2009.

Article I, § 10, clause 2 of the United States Constitution, known as the Import-Export Clause, prevents the states and the federal government, without the consent of Congress, from imposing tariffs on imports and exports above what is necessary for their inspection laws and secures for the federal government the revenues from all tariffs on imports and exports. Several nineteenth century Supreme Court cases applied this clause to duties and imposts on interstate imports and exports. In 1869, the United States Supreme Court ruled that the Import-Export Clause only applied to imports and exports with foreign nations and did not apply to imports and exports with other states, although this interpretation has been questioned by modern legal scholars.

A Customs declaration is a form that lists the details of goods that are being imported or exported when a citizen or visitor enters a customs territory . Most countries require travellers to complete a customs declaration form when bringing notified goods across international borders. Posting items via international mail also requires the sending party to complete a customs declaration form.

Brown v. Maryland, 25 U.S. 419 (1827), was a significant United States Supreme Court case which interpreted the Import-Export and Commerce Clauses of the U.S. Constitution to prohibit discriminatory taxation by states against imported items after importation, rather than only at the time of importation. The state of Maryland passed a law requiring importers of foreign goods to obtain a license for selling their products. Brown was charged under this law and appealed. It was the first case in which the U.S. Supreme Court construed the Import-Export Clause. Chief Justice John Marshall delivered the opinion of the court, ruling that Maryland's statute violated the Import-Export and Commerce Clauses and the federal law was supreme. He alleged that the power of a state to tax goods did not apply if they remained in their "original package". A license tax on the importer was essentially the same as a tax on an import itself. Despite arguing the case for Maryland, future chief justice Roger Taney admitted that the case was correctly decided.

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally, based on the increase in value of a product or service at each stage of production or distribution. VAT essentially compensates for the shared services and infrastructure provided in a certain locality by a state and funded by its taxpayers that were used in the elaboration of that product or service. Not all localities require VAT to be charged and goods and services for export may be exempted. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. Confusingly, the terms VAT, GST, consumption tax and sales tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues both worldwide and among the members of the Organisation for Economic Co-operation and Development (OECD). As of 2018, 166 of the 193 countries with full UN membership employ a VAT, including all OECD members except the United States, which uses a sales tax system instead.