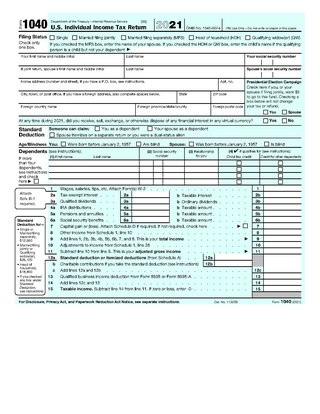

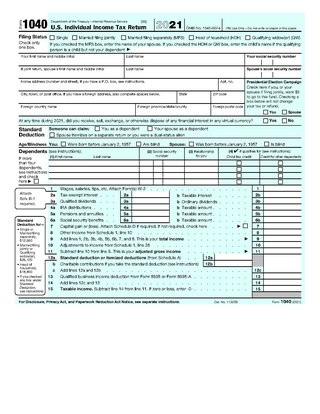

Form 1040, officially, the U.S. Individual Income Tax Return, is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government.

An accountant is a practitioner of accounting or accountancy. Accountants who have demonstrated competency through their professional associations' certification exams are certified to use titles such as Chartered Accountant, Chartered Certified Accountant or Certified Public Accountant, or Registered Public Accountant. Such professionals are granted certain responsibilities by statute, such as the ability to certify an organization's financial statements, and may be held liable for professional misconduct. Non-qualified accountants may be employed by a qualified accountant, or may work independently without statutory privileges and obligations.

Certified Public Accountant (CPA) is the title of qualified accountants in numerous countries in the English-speaking world. It is generally equivalent to the title of chartered accountant in other English-speaking countries. In the United States, the CPA is a license to provide accounting services to the public. It is awarded by each of the 50 states for practice in that state. Additionally, all states except Hawaii have passed mobility laws to allow CPAs from other states to practice in their state. State licensing requirements vary, but the minimum standard requirements include passing the Uniform Certified Public Accountant Examination, 150 semester units of college education, and one year of accounting-related experience.

In the United States of America, an Enrolled Agent (EA) is a tax advisor, who is a federally authorized tax practitioner which is empowered by the U.S. Department of the Treasury. Enrolled Agents represent taxpayers before the Internal Revenue Service (IRS) for tax issues that include audits, collections, and appeals.

A tax advisor or tax consultant is a person with advanced training and knowledge of tax law. The services of a tax advisor are usually retained in order to minimize taxation while remaining compliant with the law in complicated financial situations. Tax Advisors are also retained to represent clients before tax authorities and tax courts to resolve tax issues.

The Uniform Certified Public Accountant Examination is the examination administered to people who wish to become Certified Public Accountants in The United States of America. The CPA Exam is used by the regulatory bodies of all fifty states plus the District of Columbia, Guam, Puerto Rico, the U.S. Virgin Islands and the Northern Mariana Islands.

Tax preparation is the process of preparing tax returns, often income tax returns, often for a person other than the taxpayer, and generally for compensation. Tax preparation may be done by the taxpayer with or without the help of tax preparation software and online services. Tax preparation may also be done by a licensed professional such as an attorney, certified public accountant or enrolled agent, or by an unlicensed tax preparation business. Because United States income tax laws are considered to be complicated, many taxpayers seek outside assistance with taxes.

In order to be registered as a patent agent or patent attorney in the United States, one must pass the United States Patent and Trademark Office (USPTO) registration examination, officially called the Examination for Registration to Practice in Patent Cases Before the United States Patent and Trademark Office and known informally as the patent bar.

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

Circular 230 refers to Treasury Department Circular No. 230. This publication establishes the rules governing those who practice before the U.S. Internal Revenue Service (IRS), including attorneys, certified public accountants (CPAs) and enrolled agents (EAs).

The Special Enrollment Examination is a test that individuals can take to become an Enrolled Agent in the United States. The Enrolled Agent credential is conferred and regulated by the Internal Revenue Service (IRS). The exam consists of three parts:

The National Association of Enrolled Agents (NAEA) is an organization of enrolled agents (EAs) in the United States. Founded in 1972, it claims a membership of 11,000 EAs.

Tax protesters in the United States advance a number of administrative arguments asserting that the assessment and collection of the federal income tax violates regulations enacted by responsible agencies –primarily the Internal Revenue Service (IRS)– tasked with carrying out the statutes enacted by the United States Congress and signed into law by the President. Such arguments generally include claims that the administrative agency fails to create a duty to pay taxes, or that its operation conflicts with some other law, or that the agency is not authorized by statute to assess or collect income taxes, to seize assets to satisfy tax claims, or to penalize persons who fail to file a return or pay the tax.

The IRS Return Preparer Initiative was an effort by the Internal Revenue Service (IRS) to regulate the tax return preparation industry in the United States. The purpose of the initiative is to improve taxpayer compliance and service by setting professional standards for and providing support to the tax preparation industry. Starting January 1, 2011 and, until the program was suspended in January 2013, the initiative required all paid federal tax return preparers to register with the IRS and to obtain an identification number, called a Preparer Tax Identification Number (PTIN). The multi-year phase-in effort called for certain paid tax return preparers to pass a competency test and to take annual continuing education courses. The ethics provisions found in Treasury Department's Circular 230 were extended to all paid tax return preparers. Preparers who have their PTINs, pass the test and complete education credits were to have a new designation: Registered Tax Return Preparer.

The Preparer Tax Identification Number (PTIN) is an identification number that all paid tax return preparers must use on U.S. federal tax returns or claims for refund submitted to the Internal Revenue Service (IRS). Anyone who, for compensation, prepares all or substantially all of any federal tax return or claim for refund must obtain a PTIN issued by the IRS.

The National Society of Public Accountants (NSPA), later shortened to National Society of Accountants (NSA), is a professional association for tax and accounting professionals; NSA and its state affiliates represent more than 30,000 independent practitioners who provide accounting, tax, auditing, financial and estate planning, and management services to 19 million individuals and businesses. NSA's mission is to provide national leadership in the profession of accountancy and taxation through the advocacy of practice rights, and by the establishment and promotion of high standards in ethics, education, and professional excellence.

The California Tax Education Council (CTEC) is a private nonprofit quasi-public benefit organization that is mandated by the State of California. CTEC is responsible for providing a list of its approved tax education providers and verifying nonexempt tax preparers have met the state’s minimum requirements to prepare tax returns for a fee.

A Registered Tax Return Preparer is a former category of federal tax return preparers created by the U.S. Internal Revenue Service (IRS).

The Annual Filing Season Program is a voluntary Internal Revenue Service (IRS) program designed to incentivize non-credentialed tax return preparers to participate in continuing education (CE) courses. Participants receive an Annual Filing Season Program - Record of Completion, which may be displayed to prospective clients as a way to stand out in the marketplace and to demonstrate tax knowledge and filing competency. AFSP participants can also opt to be listed in The Directory of Federal Tax Return Preparers with Credentials and Select Qualifications, a public information database on the IRS website.

The Office of Professional Responsibility (OPR) at the U.S. Internal Revenue Service (IRS) is responsible for all matters related to "tax practitioner" misconduct, discipline and practice before the IRS under 31 CFR Subtitle A, Part 10. A tax practitioner, sometimes referred to as a tax professional, is generally an attorney, CPA or enrolled agent.