Related Research Articles

Economics is the social science that studies the production, distribution, and consumption of goods and services.

In economics, factors of production, resources, or inputs are what is used in the production process to produce output—that is, finished goods and services. The utilized amounts of the various inputs determine the quantity of output according to the relationship called the production function. There are three basic resources or factors of production: land, labour and capital. The factors are also frequently labeled "producer goods or services" to distinguish them from the goods or services purchased by consumers, which are frequently labeled "consumer goods".

Public choice, or public choice theory, is "the use of economic tools to deal with traditional problems of political science". Its content includes the study of political behavior. In political science, it is the subset of positive political theory that studies self-interested agents and their interactions, which can be represented in a number of ways – using standard constrained utility maximization, game theory, or decision theory.

This aims to be a complete article list of economics topics:

Classical economics or classical political economy is a school of thought in economics that flourished, primarily in Britain, in the late 18th and early-to-mid 19th century. Its main thinkers are held to be Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Robert Malthus, and John Stuart Mill. These economists produced a theory of market economies as largely self-regulating systems, governed by natural laws of production and exchange.

In economics, contract theory studies how economic actors can and do construct contractual arrangements, generally in the presence of asymmetric information. Because of its connections with both agency and incentives, contract theory is often categorized within a field known as Law and economics. One prominent application of it is the design of optimal schemes of managerial compensation. In the field of economics, the first formal treatment of this topic was given by Kenneth Arrow in the 1960s. In 2016, Oliver Hart and Bengt R. Holmström both received the Nobel Memorial Prize in Economic Sciences for their work on contract theory, covering many topics from CEO pay to privatizations.

In public-choice theory, as well as in economics, rent-seeking means seeking to increase one's share of existing wealth without creating new wealth. Rent-seeking results in reduced economic efficiency through misallocation of resources, reduced wealth-creation, lost government revenue, heightened income inequality, and potential national decline.

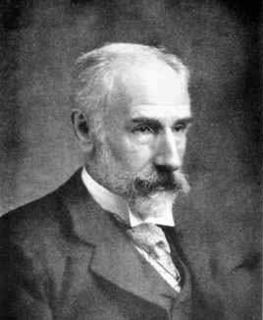

Francis Ysidro Edgeworth was an Anglo-Irish philosopher and political economist who made significant contributions to the methods of statistics during the 1880s. From 1891 onward, he was appointed the founding editor of The Economic Journal.

The principal–agent problem, in political science and economics occurs when one person or entity, is able to make decisions and/or take actions on behalf of, or that impact, another person or entity: the "principal". This dilemma exists in circumstances where agents are motivated to act in their own best interests, which are contrary to those of their principals, and is an example of moral hazard.

In finance and economics, systematic risk is vulnerability to events which affect aggregate outcomes such as broad market returns, total economy-wide resource holdings, or aggregate income. In many contexts, events like earthquakes, epidemics and major weather catastrophes pose aggregate risks that affect not only the distribution but also the total amount of resources. That is why it is also known as contingent risk, unplanned risk or risk events. If every possible outcome of a stochastic economic process is characterized by the same aggregate result, the process then has no aggregate risk.

John Bates Clark was an American neoclassical economist. He was one of the pioneers of the marginalist revolution and opponent to the Institutionalist school of economics, and spent most of his career as professor at Columbia University.

Personnel economics has been defined as "the application of economic and mathematical approaches and econometric and statistical methods to traditional questions in human resources management". It is an area of applied micro labor economics, but there are a few key distinctions. One distinction, not always clearcut, is that studies in personnel economics deal with the personnel management within firms, and thus internal labor markets, while those in labor economics deal with labor markets as such, whether external or internal. In addition, personnel economics deals with issues related to both managerial-supervisory and non-supervisory workers.

An agency cost is an economic concept concerning the fee to a "principal", when the principal chooses or hires an "agent" to act on its behalf. Because the two parties have different interests and the agent has more information, the principal cannot directly ensure that its agent is always acting in its best interests.

The Quarterly Journal of Economics is a peer-reviewed academic journal published by the Oxford University Press. Its current editors-in-chief are Pol Antràs, Robert J. Barro, Lawrence F. Katz, and Andrei Shleifer. It is the oldest professional journal of economics in the English language, and covers all aspects of the field—from the journal's traditional emphasis on microtheory, to both empirical and theoretical macroeconomics. According to the Journal Citation Reports, the journal has a 2015 impact factor of 6.662, ranking it first out of 347 journals in the category "Economics". It is generally regarded as one of the top 5 journals in economics, together with the American Economic Review, Econometrica, the Journal of Political Economy, and the Review of Economic Studies.

Returns, in economics and political economy, are the distributions or payments awarded to the various suppliers of a good or service

In economics, distribution is the way total output, income, or wealth is distributed among individuals or among the factors of production. In general theory and the national income and product accounts, each unit of output corresponds to a unit of income. One use of national accounts is for classifying factor incomes and measuring their respective shares, as in national Income. But, where focus is on income of persons or households, adjustments to the national accounts or other data sources are frequently used. Here, interest is often on the fraction of income going to the top x percent of households, the next x percent, and so forth, and on the factors that might affect them.

Principles of Economics is a leading political economy or economics textbook of Alfred Marshall (1842–1924), first published in 1890. It ran into many editions and was the standard text for generations of economics students.

Luigi L. Pasinetti is an Italian economist of the post-Keynesian school. Pasinetti is considered the heir of the "Cambridge Keynesians" and a student of Piero Sraffa and Richard Kahn. Along with them, as well as Joan Robinson, he was one of the prominent members on the "Cambridge, UK" side of the Cambridge capital controversy. His contributions to economics include developing the analytical foundations of neo-Ricardian economics, including the theory of value and distribution, as well as work in the line of Kaldorian theory of growth and income distribution. He has also developed the theory of structural change and economic growth, structural economic dynamics and uneven sectoral development.

The Tableau économique or Economic Table is an economic model first described by French economist François Quesnay in 1758, which laid the foundation of the Physiocratic school of economics.

Thomas Nixon Carver was an American economics professor.

References

- ↑ Fama, E.F., Jensen, M.C. (1983). Separation of Ownership and Control. Journal of Law and Economics, 26(2), p. 302.

- ↑ A search for "residual claimant" on Google Scholar in January 2015 yielded approximately 8,430 results.

- ↑ Walker, F.A. (1883). Political Economy. American Science Series (Vol. 5): New York & London.

- ↑ Patten, S.N. (1889). President Walker's Theory of Distribution. The Quarterly Journal of Economics, 4(1), pp. 34-49; Bonar, J. (1891). The Residual Theory of Distribution. The Quarterly Journal of Economics, 6(1), pp. 105-107; Walker, F.A. (1891). The Doctrine of Rent, and the Residual Claimant Theory of Wages. The Quarterly Journal of Economics, 5(4), pp. 417-437; and Hollander, J.H. (1903). The Residual Claimant Theory of Distribution. The Quarterly Journal of Economics, 17(2), pp. 261-279.

- ↑ Bowles, Samuel (2004) Microeconomics: Behavior, Institutions and Evolution, Russell Sage Foundation, New York

- ↑ Samuel Bowles and Herbert Gintis, Mutual Monitoring in Teams: The Effects of Residual Claimancy and Reciprocity.

| This article about wealth, income, or other related issues is a stub. You can help Wikipedia by expanding it. |