Administrative law is the body of law that governs the activities of administrative agencies of government. Government agency action can include rule making, adjudication, or the enforcement of a specific regulatory agenda. Administrative law is considered a branch of public law. As a body of law, administrative law deals with the decision-making of the administrative units of government that are part of a national regulatory scheme in such areas as police law, international trade, manufacturing, the environment, taxation, broadcasting, immigration and transport. Administrative law expanded greatly during the twentieth century, as legislative bodies worldwide created more government agencies to regulate the social, economic and political spheres of human interaction.

The Court of Cassation is one of the four courts of last resort in France. It has jurisdiction over all civil and criminal matters triable in the judicial system, and is the supreme court of appeal in these cases. It has jurisdiction to review the law, and to certify questions of law, to determine miscarriages of justice. The Court is located in the Palace of Justice in Paris.

A tribunal, generally, is any person or institution with authority to judge, adjudicate on, or determine claims or disputes—whether or not it is called a tribunal in its title. For example, an advocate who appears before a court with a single judge could describe that judge as 'their tribunal'. Many governmental bodies that are titled 'tribunals' are so described to emphasize that they are not courts of normal jurisdiction. For example, the International Criminal Tribunal for Rwanda is a body specially constituted under international law; in Great Britain, employment tribunals are bodies set up to hear specific employment disputes. In many cases, the word tribunal implies a judicial body with a lesser degree of formality than a court, to which the normal rules of evidence and procedure may not apply, and whose presiding officers are frequently neither judges nor magistrates. Private judicial bodies are also often styled 'tribunals'. However, the word tribunal is not conclusive of a body's function–for example, in Great Britain, the Employment Appeal Tribunal is a superior court of record.

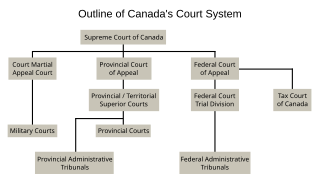

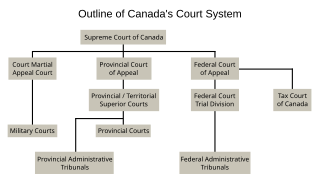

The court system of Canada forms the judicial branch of government, formally known as "The Queen on the Bench", which interprets the law and is made up of many courts differing in levels of legal superiority and separated by jurisdiction. Some of the courts are federal in nature, while others are provincial or territorial.

The courts of Scotland are responsible for administration of justice in Scotland, under statutory, common law and equitable provisions within Scots law. The courts are presided over by the judiciary of Scotland, who are the various judicial office holders responsible for issuing judgments, ensuring fair trials, and deciding on sentencing. The Court of Session is the supreme civil court of Scotland, subject to appeals to the Supreme Court of the United Kingdom, and the High Court of Justiciary is the supreme criminal court, which is only subject to the authority of the Supreme Court of the United Kingdom on devolution issues and human rights compatibility issues.

The United States Tax Court is a federal trial court of record established by Congress under Article I of the U.S. Constitution, section 8 of which provides that the Congress has the power to "constitute Tribunals inferior to the supreme Court". The Tax Court specializes in adjudicating disputes over federal income tax, generally prior to the time at which formal tax assessments are made by the Internal Revenue Service. Though taxpayers may choose to litigate tax matters in a variety of legal settings, outside of bankruptcy, the Tax Court is the only forum in which taxpayers may do so without having first paid the disputed tax in full. Parties who contest the imposition of a tax may also bring an action in any United States District Court, or in the United States Court of Federal Claims; however these venues require that the tax be paid first, and that the party then file a lawsuit to recover the contested amount paid. Tax Court judges are appointed for a term of 15 years, subject to presidential removal for "inefficiency, neglect of duty, or malfeasance in office...."

The judiciary of Australia comprises judges who sit in federal courts and courts of the States and Territories of Australia. The High Court of Australia sits at the apex of the Australian court hierarchy as the ultimate court of appeal on matters of both federal and State law.

The Combatant Status Review Tribunals (CSRT) were a set of tribunals for confirming whether detainees held by the United States at the Guantanamo Bay detention camp had been correctly designated as "enemy combatants". The CSRTs were established July 7, 2004 by order of U.S. Deputy Secretary of Defense Paul Wolfowitz after U.S. Supreme Court rulings in Hamdi v. Rumsfeld and Rasul v. Bush and were coordinated through the Office for the Administrative Review of the Detention of Enemy Combatants.

In law, the standard of review is the amount of deference given by one court in reviewing a decision of a lower court or tribunal. A low standard of review means that the decision under review will be varied or overturned if the reviewing court considers there is any error at all in the lower court's decision. A high standard of review means that deference is accorded to the decision under review, so that it will not be disturbed just because the reviewing court might have decided the matter differently; it will be varied only if the higher court considers the decision to have obvious error. The standard of review may be set by statute or precedent. In the United States, "standard of review" also has a separate meaning concerning the level of deference the judiciary gives to Congress when ruling on the constitutionality of legislation.

Australian administrative law defines the extent of the powers and responsibilities held by administrative agencies of Australian governments. It is basically a common law system, with an increasing statutory overlay that has shifted its focus toward codified judicial review and to tribunals with extensive jurisdiction.

The supreme court is the highest court within the hierarchy of courts in many legal jurisdictions. Other descriptions for such courts include court of last resort, apex court, and highcourt of appeal. Broadly speaking, the decisions of a supreme court are not subject to further review by any other court. Supreme courts typically function primarily as appellate courts, hearing appeals from decisions of lower trial courts, or from intermediate-level appellate courts.

The Federal Circuit Court of Australia, formerly known as the Federal Magistrates Court of Australia, is an Australian court with jurisdiction over matters broadly relating to family law and child support, administrative law, admiralty law, bankruptcy, copyright, human rights, industrial law, migration, privacy and trade practices.

The police tribunal is the traffic court and trial court which tries minor contraventions in the judicial system of Belgium. It is the lowest Belgian court with criminal jurisdiction. There is a police tribunal for each judicial arrondissement ("district"), except for Brussels-Halle-Vilvoorde, where there are multiple police tribunals due to the area's sensitive political situation. Most of them hear cases in multiple seats per arrondissement. As of 2018, there are 15 police tribunals in total, who hear cases in 38 seats. Further below, an overview is provided of all seats of the police tribunal per judicial arrondissement.

An administrative court is a type of court specializing in administrative law, particularly disputes concerning the exercise of public power. Their role is to ascertain that official acts are consistent with the law. Such courts are considered separate from general courts.

The tribunal system of the United Kingdom is part of the national system of administrative justice with tribunals classed as non-departmental public bodies (NDPBs).

Judicial review is a process under which executive or legislative actions are subject to review by the judiciary. A court with authority for judicial review may invalidate laws acts and governmental actions that are incompatible with a higher authority: an executive decision may be invalidated for being unlawful or a statute may be invalidated for violating the terms of a constitution. Judicial review is one of the checks and balances in the separation of powers: the power of the judiciary to supervise the legislative and executive branches when the latter exceed their authority. The doctrine varies between jurisdictions, so the procedure and scope of judicial review may differ between and within countries.

The Upper Tribunal is part of the administrative justice system of the United Kingdom. It was created in 2008 as part of a programme, set out in the Tribunals, Courts and Enforcement Act 2007, to rationalise the tribunal system, and to provide a common means of handling appeals against the decisions of lower tribunals. It is administered by Her Majesty's Courts and Tribunals Service.

An ouster clause or privative clause is, in countries with common law legal systems, a clause or provision included in a piece of legislation by a legislative body to exclude judicial review of acts and decisions of the executive by stripping the courts of their supervisory judicial function. According to the doctrine of the separation of powers, one of the important functions of the judiciary is to keep the executive in check by ensuring that its acts comply with the law, including, where applicable, the constitution. Ouster clauses prevent courts from carrying out this function, but may be justified on the ground that they preserve the powers of the executive and promote the finality of its acts and decisions.

Commissioner of Taxation v La Rosa was a 2003 decision of the Federal Court of Australia, sitting as the Full Court of the Federal Court. The court upheld two earlier rulings that Frank La Rosa, a convicted heroin dealer, was entitled to a tax deduction of $220,000 for money stolen from him during a drug deal. As a result of the decision, the federal government amended the Income Tax Assessment Act 1997 to prevent similar deductions being made.