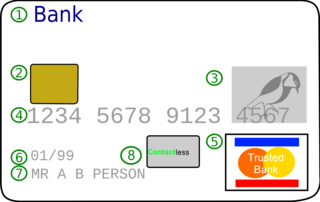

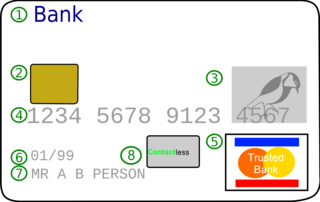

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many of the new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. These are similar to a credit card, but unlike a credit card, the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

A stored-value card (SVC) is a payment card with a monetary value stored on the card itself, not in an external account maintained by a financial institution. This means no network access is required by the payment collection terminals as funds can be withdrawn and deposited straight from the card. Like cash, payment cards can be used anonymously as the person holding the card can use the funds. They are an electronic development of token coins and are typically used in low-value payment systems or where network access is difficult or expensive to implement, such as parking machines, public transport systems, closed payment systems in locations such as ships or within companies.

A transaction account, also called a checking account, chequing account, current account, demand deposit account, or share draft account at credit unions, is a deposit account or bank account held at a bank or other financial institution. It is available to the account owner "on demand" and is available for frequent and immediate access by the account owner or to others as the account owner may direct. Access may be in a variety of ways, such as cash withdrawals, use of debit cards, cheques and electronic transfer. In economic terms, the funds held in a transaction account are regarded as liquid funds. In accounting terms, they are considered as cash.

Interac is a Canadian interbank network that links financial institutions and other enterprises for the purpose of exchanging electronic financial transactions. Interac serves as the Canadian debit card system and the predominant funds transfer network via its e-Transfer service. There are over 59,000 automated teller machines that can be accessed through the Interac network in Canada, and over 450,000 merchant locations accepting Interac debit payments.

A gift card also known as gift certificate in North America, or gift voucher or gift token in the UK is a prepaid stored-value money card, usually issued by a retailer or bank, to be used as an alternative to cash for purchases within a particular store or related businesses. Gift cards are also given out by employers or organizations as rewards or gifts. They may also be distributed by retailers and marketers as part of a promotion strategy, to entice the recipient to come in or return to the store, and at times such cards are called cash cards. Gift cards are generally redeemable only for purchases at the relevant retail premises and cannot be cashed out, and in some situations may be subject to an expiry date or fees. American Express, MasterCard, and Visa offer generic gift cards which need not be redeemed at particular stores, and which are widely used for cashback marketing strategies. A feature of these cards is that they are generally anonymous and are disposed of when the stored value on a card is exhausted.

Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account, or through a transfer of cash at a cash office.

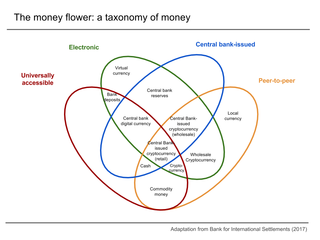

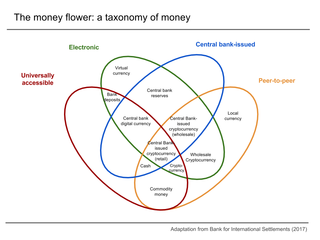

Digital currency is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed database on the internet, a centralized electronic computer database owned by a company or bank, within digital files or even on a stored-value card.

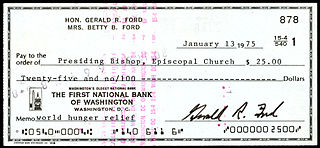

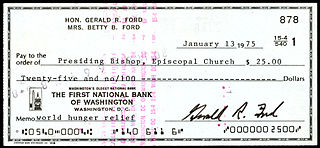

A cheque, or check, is a document that orders a bank to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

An e-commerce payment system facilitates the acceptance of electronic payment for offline transfer, also known as a subcomponent of electronic data interchange (EDI), e-commerce payment systems have become increasingly popular due to the widespread use of the internet-based shopping and banking.

A direct debit or direct withdrawal is a financial transaction in which one organisation withdraws funds from a payer's bank account. Formally, the organisation that calls for the funds instructs their bank to collect an amount directly from another's bank account designated by the payer and pay those funds into a bank account designated by the payee. Before the payer's banker will allow the transaction to take place, the payer must have advised the bank that they have authorized the payee to directly draw the funds. It is also called pre-authorized debit (PAD) or pre-authorized payment (PAP). After the authorities are set up, the direct debit transactions are usually processed electronically.

A payment is the voluntary tender of money or its equivalent or of things of value by one party to another in exchange for goods or services provided by them, or to fulfill a legal obligation/philanthropy desire. The party making the payment is commonly called the payer, while the payee is the party receiving the payment.

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer with a payment terminal and access automated teller machines (ATMs). Such cards are known by a variety of names including bank cards, ATM cards, client cards, key cards or cash cards.

An ATM card is a dedicated payment card card issued by a financial institution which enables a customer to access their financial accounts via its and others' automated teller machines (ATMs) and, in some countries, to make approved point of purchase retail transactions. ATM cards are not credit cards or debit cards, however most credit and debit cards can also act as ATM cards and that is the most common way that banks issue cards since the 2010s.

Interchange fee is a term used in the payment card industry to describe a fee paid between banks for the acceptance of card-based transactions. Usually for sales/services transactions it is a fee that a merchant's bank pays a customer's bank.

Discover Financial Services is an American financial services company that owns and operates Discover Bank, an online bank that offers checking and savings accounts, personal loans, home equity loans, student loans and credit cards. It also owns and operates the Discover and Pulse networks, and owns Diners Club International. Discover Card is the third largest credit card brand in the United States, when measured by cards in force, with nearly 50 million cardholders. Discover is currently headquartered in the Chicago suburb of Riverwoods, Illinois.

EagleCash and its sister programs EZpay and Navy Cash are cash management applications that use stored-value card technology to process financial transactions in "closed-loop" operating environments. The United States Department of the Treasury sponsors the programs for the United States Armed Forces. The Federal Reserve Bank of Boston administers the programs for the Treasury, and they are in use at approved U.S. military facilities inside and outside the continental United States. The systems use a plastic payment card, similar to a credit or debit card, which has an embedded microchip that tracks the card's balance and interfaces with encrypted card readers. This method allows soldiers to purchase goods and services at U.S. military posts and canteens, without carrying cash, or manage their personal bank accounts while on deployment or in training. The program reduces the amount of American currency required overseas, reduces theft, saves thousands of man-hours in labor, helps reduce the risk of transporting cash in combat environments, and increases security and convenience for service members. It helped reduce or eliminate the need for cash and money orders.

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt. The card issuer creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards, and a few gemstone-encrusted metal cards.

Neteller is an e-money transfer service used to transfer money to and from merchants, such as forex trading firms, social networks firms. Users in some locations can withdraw funds directly using the Net+ card or transfer the balance to their own bank accounts, others are restricted.

Paysafe Limited is a multinational online payments company. Paysafe offers payment processing, digital wallet and online cash solutions to businesses and consumers, with particular experience of serving the global entertainment sectors. The group offers services both under the Paysafe brand and subsidiary brands that have become part of the group through several mergers and acquisitions, most notably Neteller, Skrill, SafetyPay, PagoEfectivo, Paysafecash and paysafecard.

Cash App is a mobile payment service available in the United States and the United Kingdom that allows users to transfer money to one another using a mobile phone app. In September 2021, the service reported 70 million annual transacting users and US$1.8 billion in gross profit.