A fuel tax is an excise tax imposed on the sale of fuel. In most countries the fuel tax is imposed on fuels which are intended for transportation. Fuel tax receipts are often dedicated or hypothecated to transportation projects, in which case the fuel tax can be considered a user fee. In other countries, the fuel tax is a source of general revenue. Sometimes, a fuel tax is used as an ecotax, to promote ecological sustainability. Fuel taxes are often considered by government agencies such as the Internal Revenue Service as regressive taxes.

Health insurance or medical insurance is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses. As with other types of insurance, risk is shared among many individuals. By estimating the overall risk of health risk and health system expenses over the risk pool, an insurer can develop a routine finance structure, such as a monthly premium or payroll tax, to provide the money to pay for the health care benefits specified in the insurance agreement. The benefit is administered by a central organization, such as a government agency, private business, or not-for-profit entity.

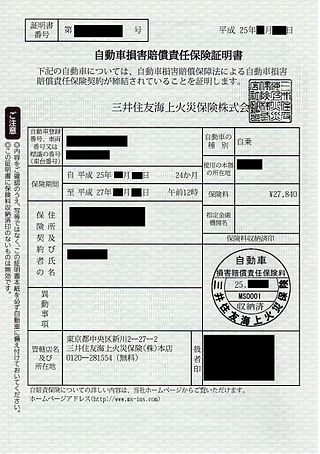

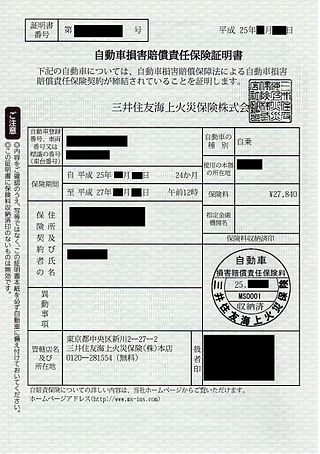

Vehicle insurance is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Vehicle insurance may additionally offer financial protection against theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as vandalism, weather or natural disasters, and damage sustained by colliding with stationary objects. The specific terms of vehicle insurance vary with legal regulations in each region.

Road tax, known by various names around the world, is a tax which has to be paid on, or included with, a motorised vehicle to use it on a public road.

In France, taxation is determined by the yearly budget vote by the French Parliament, which determines which kinds of taxes can be levied and which rates can be applied.

The Accident Compensation Corporation (ACC) is the New Zealand Crown entity responsible for administering the country's no-fault accidental injury compensation scheme, commonly referred to as the ACC scheme. The scheme provides financial compensation and support to citizens, residents, and temporary visitors who have suffered personal injuries.

The Insurance Corporation of British Columbia (ICBC) is a provincial Crown corporation in British Columbia providing vehicle insurance. ICBC was created in 1973 by the NDP government of Premier Dave Barrett.

Income taxes are the most significant form of taxation in Australia, and collected by the federal government through the Australian Taxation Office (ATO). Australian GST revenue is collected by the Federal government, and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission. There is no personal income tax in Tasmania.

Motoring taxation in the United Kingdom consists primarily of vehicle excise duty, which is levied on vehicles registered in the UK, and hydrocarbon oil duty, which is levied on the fuel used by motor vehicles. VED and fuel tax raised approximately £32 billion in 2009, a further £4 billion was raised from the value added tax on fuel purchases. Motoring-related taxes for fiscal year 2011/12, including fuel duties and VED, are estimated to amount to more than £38 billion, representing almost 7% of total UK taxation.

The Motor Insurers' Bureau (MIB) was founded in the UK in 1946 as a private company limited by guarantee and is the mechanism in the UK through which compensation is provided for victims of accidents caused by uninsured and untraced drivers, which is funded by an estimated £30 a year from every insured driver's premiums.

Australia's insurance market can be divided into roughly three components: life insurance, general insurance and health insurance. These markets are fairly distinct, with most larger insurers focusing on only one type, although in recent times several of these companies have broadened their scope into more general financial services, and have faced competition from banks and subsidiaries of foreign financial conglomerates. With services such as disability insurance, income protection and even funeral insurance, these insurance giants are stepping in to fill the gap where people may have otherwise been in need of a personal or signature loan from their financial institution.

An excise, or excise tax, is any duty on manufactured goods that is normally levied at the moment of manufacture for internal consumption rather than at sale. It is therefore a fee that must be paid in order to consume certain products. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the border, while excise is levied on goods that came into existence inland.

The Salter Report was named after Arthur Salter, who chaired an influential conference of road and rail experts in 1932 which reported in 1933. The report directed British government policy for transport funding for decades to follow.

The Road Fund was a British Government fund designated to pay for the building and maintenance of the United Kingdom road network. Its income came originally from Vehicle Excise Duty, until that ceased to be hypothecated for roads use in 1936, and then from government grants. It was created by the Roads Act 1920 and Finance Act 1920, and was wound up in the Miscellaneous Financial Provisions Act 1955.

Taxes in Germany are levied at various government levels: the federal government, the 16 states (Länder), and numerous municipalities (Städte/Gemeinden). The structured tax system has evolved significantly, since the reunification of Germany in 1990 and the integration within the European Union, which has influenced tax policies. Today, income tax and Value-Added Tax (VAT) are the primary sources of tax revenue. These taxes reflect Germany's commitment to a balanced approach between direct and indirect taxation, essential for funding extensive social welfare programs and public infrastructure. The modern German tax system accentuate on fairness and efficiency, adapting to global economic trends and domestic fiscal needs.

Taxation may involve payments to a minimum of two different levels of government: central government through SARS or to local government. Prior to 2001 the South African tax system was "source-based", where in income is taxed in the country where it originates. Since January 2001, the tax system was changed to "residence-based" wherein taxpayers residing in South Africa are taxed on their income irrespective of its source. Non residents are only subject to domestic taxes.

The Ministry of Finance, abbreviated MOF, is a ministry of the Government of Malaysia that is charged with the responsibility for government expenditure and revenue raising. The ministry's role is to develop economic policy and prepare the Malaysian federal budget. The Ministry of Finance also oversees financial legislation and regulation. Each year in October, the Minister of Finance presents the Malaysian federal budget to the Parliament.

Taxation in Oklahoma takes many forms. Individuals and corporations in Oklahoma are required to pay taxes or fee charges to both levels of government: state and local. Taxes are collected by the government to support the provisions of public services. The Oklahoma Constitution vested the authority to levy taxes with the Oklahoma Legislature while the Oklahoma Tax Commission is the primary Executive agency responsible for collecting taxes.

Minister of Safety and Security v Road Accident Fund and Another is an important case in the South African law of delict. It was heard in the Natal Provincial Division on November 17, 2000, with judgment handed down the same day. GM MacKenzie was counsel, as State Attorney, for the plaintiff; CJ Hartzenberg SC appeared for the first defendant. There was no appearance for the second defendant. The presiding officer was Combrinck J, to whom fell the adjudication of a stated case in an action for damages arising from a motor vehicle accident.

Taxes in Lithuania are levied by the central and the local governments. Most important revenue sources include the value added tax, personal income tax, excise tax and corporate income tax, which are all applied on the central level. In addition, social security contributions are collected in a social security fund, outside the national budget. Taxes in Lithuania are administered by the State Tax Inspectorate, the Customs Department and the State Social Insurance Fund Board. In 2019, the total government revenue in Lithuania was 30.3% of GDP.